COIN Likely to Suffer From Crypto Collapse

CreativaImages/iStock via Getty Images

FTX Collapse Drags All Cryptos Down With It

As I write this, the crypto world has been rocked by the political and financial scandal around the FTX (FTT-USD) bankruptcy. My purpose today is not to discuss that scandal (a previous article covers that), but to look at how it will impact Coinbase Global (NASDAQ:COIN) going forward.

Coinbase is a digital currency exchange company that was founded in San Francisco, California in 2012. Founded by Brian Armstrong in 2012, Coinbase Global is the 800-pound gorilla in the American crypto space. Since that time, COIN quickly grew to become the dominant US crypto exchange by volume and user base.

The effects of the FTX collapse and alleged monumental fraud are disastrous for the crypto space.

- They have led to severe drops in the value of almost all cryptocurrencies, with even stalwart frontrunners like Solana losing about two-thirds of its value since the FTX revelations.

- The vast majority of crypto investors have been severely hurt by the bear markets. Many crypto investors were highly leverage and have suffered life-changing losses.

- One consequence of the scandal is the erosion of trust in any centrally run crypto brokerages. The crypto world is awash with discussions of which big brokerage or crypto currency will be the next domino to fall.

- Many pundits have emerged announcing the death knell for all cryptocurrencies. (I don’t agree, but I acknowledge the overwhelming negative sentiment.)

As the leading crypto brokerage in the space, Coinbase is obviously enormously impacted by the overall whirlwinds buffeting the crypto industry.

The Winds Buffeting Crypto in 2023

In discussing the impact on Coinbase, I’d like to begin with a macroeconomic picture of the crypto world recently painted by one of my favorite analysts: the pseudonymous “Guy” of Coin Bureau. In a recent video titled “Coin Bureau Crypto Predictions 2023: My TOP 10 LIST!”, Guy made the following 10 predictions for the impacts of the FTX scandal and other large crypto meltdowns that occurred during 2022 and how these would change crypto markets permanently.

- Crypto market bottom out in late 2023. The lows will occur early in quarter 2, coinciding with cessation of Fed interest rate hikes. Bitcoin (BTC-USD) will drop to $10k and possibly even $3k. Most cryptos will lose another 60%-80%, correlating with 20%-30% drops he expects for US equities.

- Securities Exchange Commission will crack down on another big crypto company. This could be any crypto other than Bitcoin.

- There will be a flood of new regulations imposed on the crypto industry. These will vary by country. After causing lots of headaches and the disappearance of many altcoins unable to comply with tem, this will eventually bring regulatory clarity to the crypto industry. As a result, more institutional investors will be willing to invest in the cryptospace, leading to a recovery of the sector later in the year. It will also force more decentralization of crypto governance.

- Decentralized Finance (“Defi”) will go mainstream, as they step up with better interfaces, more proof of resiliency, and known conformance with now clarified legal statutes. More crypto investors will abandon centralized exchanges (like COIN) in favor of self-custody and decentralized programmatic solutions less susceptible to out-and-out fraud. The best Defi protocols, such as AAVE, have not been and will not be targeted by the legislation. Big tradfi financial institutions, such as JP Morgan or Fidelity, will attempt to buy their way into control of those protocols.

- Crypto payments will become more easier, cheaper and more common, due to increase in scalability, better front ends, and the increasing liquidity resulting from institutional adoption. Layer-2 crypto solutions will increase their scalability by 10 to 100 times and will rival the speed and power of VISA credit card transactions.

- The number of crypto holders will grow from 4% of the population to multiples of that in 2023 , as companies such as Facebook, META, Twitter, Telegram, Instagram and TikTok roll out crypto based solutions.

- At least one additional country will adopt BTC as legal tender, probably Tonga, following the countries of El Salvador and the Central African Republic in 2022.

- Big tech companies will announce crypto integrations. They’ll do so in order to create new product streams, with Twitter the most likely. The

- Big Wall Street wolves, such as Goldman Sachs (GS) or others, are likely to snap up the distressed assets emerging from the FTX debacle and the collapse of LUNA (LUNC-USD), Celsius (CEL-USD), Three Arrows Capital and other big crypto entities. Guy specifically singled out Coinbase as an asset that is likely to suffer under SEC scrutiny and policy tightening, which could force Coinbase to sell itself to a bigger player in the world of traditional finance, such as JP Morgan (JPM).

- Bitcoin will start being used for international trade, by countries such as Iran, Russia, India, Russia South Africa, or Saudi Arabia.

Scenarios for A Takeover of COIN?

His ninth prediction, as it concerns Coinbase, is of particular relevance here. Frankly, this is the first rumor I’ve heard about a JP Morgan takeover of Coinbase, but I would not be at all shocked by such a development. JP Morgan CEO Jamie Dimon despite at first notoriously dismissed all cryptos and Bitcoin starting in 2017 as “fraud” and “fool’s gold”. But in more recent comments, he’s stated that some stablecoins may have real value and he’s begun to warm to the sector.

Dimon’s a smart man and eminently aware that if DEFI succeeds, it puts the banking sector out of business over the long term. Better to embrace and coopt the possible competitor before it is too late. His competitors, Morgan Stanley (MS) and Goldman Sachs have already succumbed to the lure of cryptos, by offering it to their clients for the first time in 2022.

Dimon has not yet retracted his earlier comments about Bitcoin or other cryptos, but he has allowed the company to cautiously begin treading down the crypto path. In February 2019, JPMorgan announced that it would roll out a digital currency called JPM Coin, and in October 2020, the firm created a new unit for blockchain projects.

Last August, Coinbase announced a major new agreement by which it would service institutional clients of Blackrock’s Aladdin software. This was a significant step forward toward the institutionalization of cryptos. So it would not be surprising if JP Morgan were to preempt Blackrock from gaining a controlling interest in the crown jewel of crypto brokerages.

However, I do not see any big traditional bank or financial institution taking a controlling interest in Coinbase until the stock price drops a lot more.

The Disastrous Earnings Report

In their quarterly statement ending Sept 30, 2022, issued last November, Coinbase announced both a drop in earnings and a considerable drop in revenues. Revenues dropped 53% from $1.23 billion to $576 million compared to the previous year’s quarter.

Meanwhile, total expenses rose 12% from $ 1,020.1 to $1,146.8 billion. The net result was that Coinbase went from profits of $406 million for the third quarter of 2021 to losses of $545 million in 2022.

The company ended the quarter with $5.006 billion in cash, enough to sustain 10 such quarters of losses.

Investors should note that these trends were already in place even before the considerable negative fallout resulting from the FTX collapse.

My Prognosis for COIN’s Next Few Months

I predict we will see an accelerated decline in revenues. Many crypto investors have seen life-altering drops in their portfolios. Many investors used leverage and have seen their entire crypto portfolios go to zero. A minority will hold on to their remaining positions tightly and maintain their activities in these markets. But a large number of investors who where following the momentum trade up have been burned too severely and will never return.

I have no doubt that Coinbase will benefit from the flow of crypto investors from weaker brokerages to better capitalized ones, of which Coinbase is among the best. But this will not be sufficient to offset the dropoff in overall market size that I foresee over at least the next four quarters.

More importantly, presumably as a result of SEC pressures, Coinbase, along with other US-based crypto exchanges have radically tightened their trading policies. In early 2021 it was trivially easy to short a crypto through US exchanges. Policy changes have made it virtually impossible to bet to the downside on cryptos today. Coinbase has suspended users’ ability to use margin to take a short position in a cryptocurrency.

I have no doubt that this is due to regulatory pressures, not to Coinbase management’s preferences. But the consequence is that if any trader wants to stay active in the crypto space but is not currently bullish, that trader cannot put on bearish bets. This effectively means that until the bear market reverses, Coinbase’s revenues from trading will dramatically shrink.

Sophisticated traders, will be able to execute bearish bets by moving off of centralized exchanges and into decentralized ones, but this is not a positive development for Coinbase. The percentage of traders who are comfortable taking short positions is admittedly small, but this is the group of traders that is the most active, often placing 100 times more trades than other crypto investors. So the hit to Coinbase’s trading revenues will be quite severe, I esteem.

The real question is how successful the company can be in shrinking their expenses. A shrinkage of costs by 50% to 75% will be difficult to pull off. Management may take a lesson from Twitter’s recent radical cuts of staffing while maintaining and even arguably improving Twitter’s software features. But Coinbase, unlike Twitter, is not a private corporation. CEO Brian Armstrong must respond to a board of directors, and even if he were to favor drastic cuts he would first have to convince all others.

As a result, I expect numerous quarters of rising losses until the crypto market turns around. If Coin Bureau is right in their 2023 projections, this will be in late 2023. That means a big continued drop in the stock price.

Coinbase: Survival or Bankruptcy?

Do I expect Coinbase to survive? Yes. They are the leading US crypto company in a shrinking market. While the bear market will be extremely painful, it will allow them to acquire talent and technologies at bargain basement prices.

If management is smart, it can facilitate the desire of crypto investors to manage their own wallets and maintain their own sets of keys. If done property this can even provide a new source of revenues, to replace the lost trading fees.

For example, a smoother interface allowing for easy deployment from hard wallets to Coinbase’s trading exchange would go a long way to attracting new users. A potential new insurance fund from a well-viewed company like Lloyd’s of London backing all assets held on the Coinbase exchange – similar to FDIC or SIPC protection – would also be a huge attraction that most crypto users would be willing to pay for.

As mentioned above, Coinbase has enough cash on hand to sustain about 10 quarters of losses at present negative cash flows. The time will be reduced if Coinbase’s revenues shrink faster than management can reduce costs.

My Price Prognosis: Another 29% Dip Before Recovery

Trying to gauge Coinbase’s fair market value based on fundamental factors is extremely difficult, given the unpredictability of its earnings stream and the wide variation in its potential future earnings sources. To that you must add the enormous risk inherent from possible government regulatory crackdowns.

A good estimate for this was done on Seeking Alpha pages 1 year ago by Michel Sanguanini. The author’s estimate was for a fair value of $185. The fact that the price today is 80% lower does not invalidate that analysis. It just underlines how schizophrenic Mr Market can be.

In my 15 years of investing experience, I’ve found technical analysis to be a much better guide to predicting those schizophrenic ups and downs, because technical analysis inherently accounts for the psychology of the market.

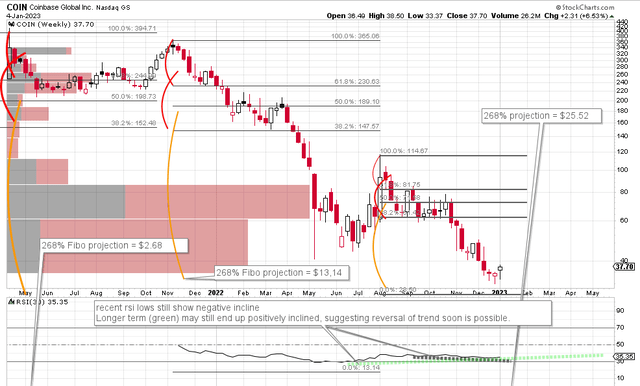

That analysis is shown on the graph below.

Coinbase LongTerm Chart Weekly Candles (stockcharts.com)

I use Fibonacci intervals along with Elliott wave analysis to project my expected price pivots. My rule of thumb is this. If a wave is formed (minimum 27 to 38% retracement or gap up or down0 and then breached, then a subsequent “mirrored” wave occurs with 70% probability. A third (Elliott wave 4->5 wave) is possible, but less likely, with approximately a 30% probabililty.

That’s why, in the graph above, I’ve colored some of the waves yellow (less likely), versus red (highly likely).

As you can see, all of the “required” mirroring patterns have already occurred, and COIN does not “need” to go lower for it to correspond to Elliott cycles.

That said, the most recent fractal pattern which began forming in August 2022, has already almost completed its 268% expected drop to a wave V. Note that the 30 day RSI is still negatively sloped (dark grey tracing). This suggests the fifth wave will reach its expected fibo projection down to a price of $25.52. That’s about 29% lower than today’s price of $37.70.

I’ve found predicting cycles – the time it takes for a price to be reached – to be much less reliable in my technical toolset. But time cycles suggest that that drop should happen by amount mid March 2023. I will be preparing some option trades based on that assumption.

At that low of $25, a retracement of 38% is very likely, back up to the pivot point around $62.

It’s still too early to say if the other larger fractal that began in November of 2021 will then come into play, fully extending COIN down 268% to the price of $13.14. Because COIN is a relatively recent stock, we don’t have price/rsi history going back 50 and 100 months to give us better color on that issue.

If Coin Bureau’s analysis of the overall crypto market is correct – and I largely concur with it – I think the $25 price will likely mark the all time low. I give that a better chance than the drop to $13.

That said, anybody expecting a quick recovery back to the IPO highs will have to be very very patient. I think it will be a long two to three year slog under the best of circumstances.

The reader should note my overall bias though. I believe the Fed will raise rates a bit more, than pause for longer than bulls expect. The economy will not suffer a mild recession, but a large one, and this will propel equities in general down another 50%. Until equities recover, crypto will not.

But as my wise father used to say: “Anything can happen and probably will”.

How Can I Benefit from The Bad Prospects?

If you concur with this analysis, you have several ways to play this:

For one thing, if you own COIN already, but believe in its long term prospects, you could sell today, take your losses, and use the money to buy more shares at the lower value later on.

Alternatively, if you own at least 100 shares of COIN, you could sell covered call options against your position to generate premium income until COIN recovers. As I write this, a one year call option on COIN at a strike above today’s price, at $35, yields $7.30. That’s a 20% yearly return, and goes a long ways to mitigating further losses on the stock.

A speculative investment would be to take a short position of COIN stock. That means borrowing the stock from your brokerage in order to immediately sell at today’s perceived high value. You hope to gain by buying the shares back at the lower price and pocketing the gain after paying back any related interest costs.

If you intend to do this you should be knowledgeable about the risks of shorting a stock. When you short a stock you don’t own, you can theoretically lose more money than the original margin required to take on the position That’s because a stock price has no upper bound on how high it can go, at least in theory. Before you short a stock like COIN, make sure you fully understand the increased risks. Consider using stops and stop limits but you must weigh the pros and cons of these (see Seeking Alpha’s guide).

Some people think they can use stop losses to protect against a sudden rise. These will not always work, as stocks can jump up 30% to 50% overnight on unexpected news or an unanticipated merger.

An alternative approach is to bet on the downside using options. Options can be very risky, if you don’t have years of hands-on experience. Make sure you are an expert, or hire a financial advisor for expert guidance.

That said, that is the methodology that I prefer. If constructed properly strategies like simple puts, put spreads, calendar calls and broken wing butterfly trades can provide you with trades that limit your loss to a predefined maximum you are willing to risk. That loss occurs if the bearish prediction does not occur in the time or to the extent that you expect. The upside if you are right can be very attractive. I like to put on those trades when I can achieve three to ten times the reward for my money at risk, and when I believe I have a better than 50% chance of being right.

Conclusion

Investors with a short-term time horizon will want to exit COIN to avoid further pain. More experienced investors should consider short positions or even better, option trades that benefit from a drop. Those deeply underwater but believing in the company will need to wait 3 to 4 years to be rewarded for their patience.