Bitcoin (BTC) is likely ready to outshine gold, according to Bloomberg’s lead commodity strategist Mike McGlone.

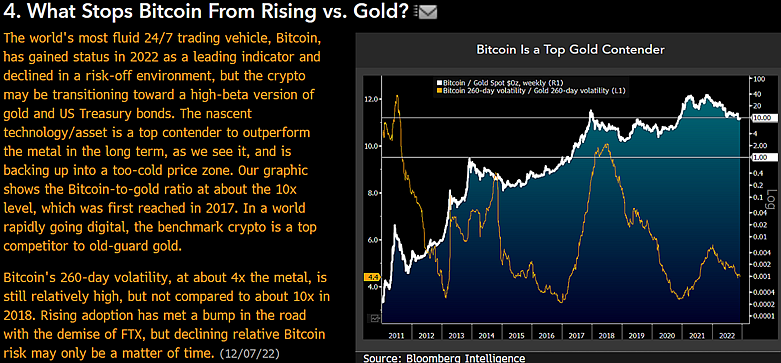

The popular analyst says that the flagship cryptocurrency is currently four times more volatile than the yellow metal, which is minuscule compared to where it was in 2018.

According to McGlone, Bitcoin is a “top contender” to gold and could be transitioning to a higher-beta version of it and bonds.

“What Stops Bitcoin From Rising vs. Gold? The world’s most fluid 24/7 trading vehicle, Bitcoin, has gained status in 2022 as a leading indicator and declined in a risk-off environment, but the crypto may be transitioning toward a high-beta version of gold and US Treasury.”

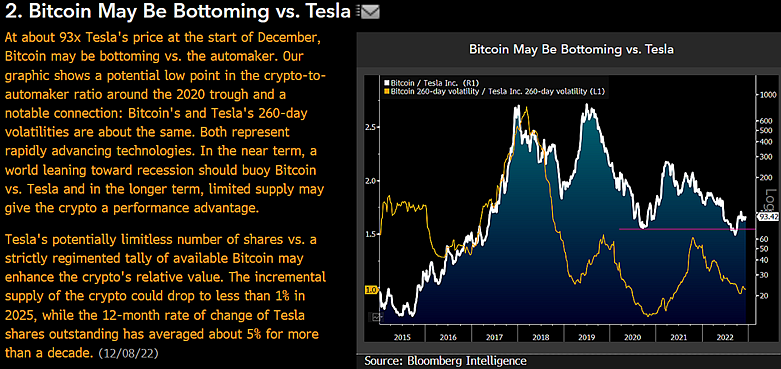

The strategist also compares BTC to Tesla stock, as the two assets often get grouped together by analysts as similar plays on innovative technology.

According to McGlone, Bitcoin’s price relative to TSLA may be in the process of forming a bottom.

“Bitcoin May Be Bottoming vs. Tesla – At about 93x Tesla’s price at the start of December, Bitcoin may be bottoming vs. the automaker. The graphic shows a potential low in the crypto-to-automaker ratio around the 2020 trough and a notable connection: risk measures about the same.”

The closely followed commodities strategist has previously called for next year to be Bitcoin and the crypto market’s time to shine after over a year of straight downtrends.

“The most aggressive Fed tightening in 40 years is a good reason for the macroeconomic ebbing tide, but 2023 may be about which assets come out ahead as central banks pivot. If they don’t flip to easing, the world may tilt more deeply into recession, with repercussions for all risk assets. Our base case is for an elongated deflationary period, with the crypto market, as measured by the Bloomberg Galaxy Crypto Index, coming out ahead.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Alberto Andrei Rosu/PurpleRender