Leon Neal/Getty Images News

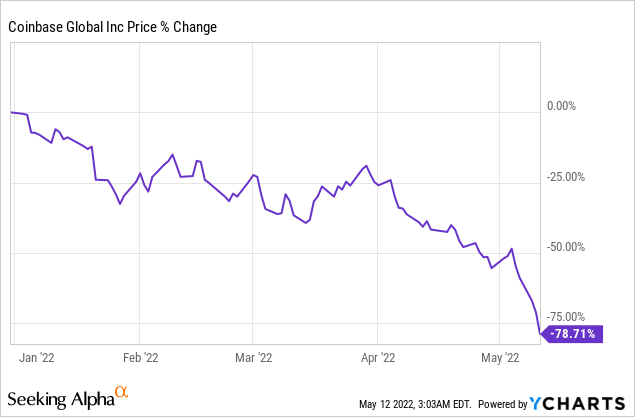

Coinbase (NASDAQ:COIN) is one of the largest holdings in my growth portfolio but it hasn’t been easy to hold the stock over the last 6 months.

The company posted an awful Q1 2022 due to the crypto bear market and investors started fleeing for the exits. COIN stock is down 78% YTD due to the current crypto bear market.

However, I’ve been a passionate user of Coinbase since 2018 and won’t sell a single share during this current market crash.

Crypto trades in cycles and right now investors are experiencing how it a crypto winter feels. It doesn’t feel good at all but history shows patient holders get rewarded with much higher valuations if they simply HODL and do nothing.

In this article, I’ll answer many of the common questions I’ve received surrounding the latest quarterly report and explain my personal strategy for Coinbase back.

Q1 2022 Was Brutal Because The Crypto Market Has Crashed

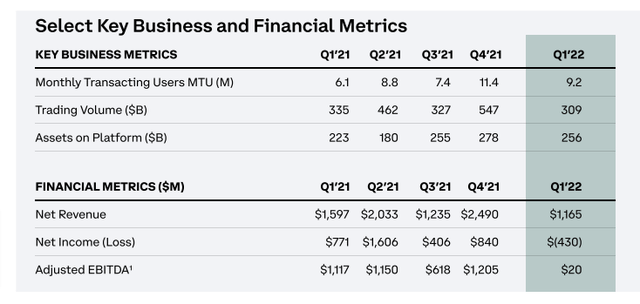

Coinbase suffered a big dip in monthly transacting users, trading value, and assets on the platform in comparison to Q4 2021, triggering a massive 25% selloff after Q1 2022 earnings release.

Q1 2022 revenue was a huge let-down and the company lost $430 million during the quarter. Both retail and institutional revenue was down over 50% from Q4 2021.

Coinbase Q1 2022 Key Metric (coinbase.com)

Lower crypto prices caused a $258 million impairment charge because the SEC requires all companies holding crypto assets to include any losses when they fall below their cost basis. Removing impairment charges, Coinbase lost around $172 million per quarter.

Coinbase lowered its Q2 2022 guidance with the expectation of lower active users and trading volume.

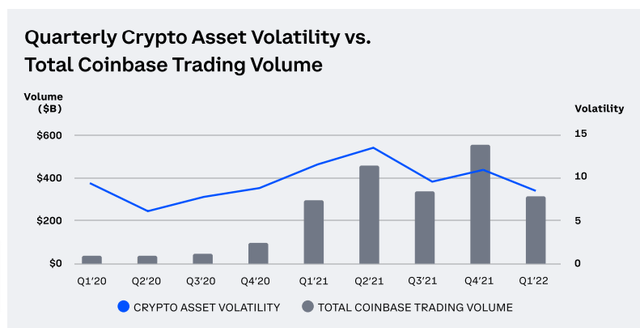

Coinbase Q1 2022 Trading Volumes (coinbase.com)

Bitcoin prices have fallen substantially since the beginning of 2021, which has caused COIN shares to fall. This is completely normal as Bitcoin enters the 2nd half of its current halving cycle. In fact, Bitcoin has historically fallen as much as 80% during the bottom of its bearish cycle. That means COIN stock could trade much lower as we head towards the 2nd half of 2022.

However, I want to address several reasons why this selloff is unwarranted and how investors can profit once things turn around.

Coinbase Is Diversifying Into NFTs, Staking, And Derivatives

Coinbase turned 10 years old this year and is no longer just a cryptocurrency broker and exchange.

In April, Coinbase launched its NFT marketplace to compete with Opensea and generate revenue from the growing NFT industry but initial activity has been slow.

Secondly, 5.8 million Coinbase users staked their crypto on Coinbase to generate yield with their assets in Q1 2022. The company added Cardano, the 9th most popular cryptocurrency, to its platform and should increase user activity with more staking products in the future.

Thirdly, Coinbase plans to launch crypto derivatives products similar to options trading that allow users to profit from short and long-term crypto price movements. In February, Coinbase acquired FairX to help ease its transition into derivatives.

This could be a massive game-changer for Coinbase because derivatives will generate a ton of extra trading revenue for the company.

Coinbase Fair Cash Value Is Around $43

COIN stock is currently sitting at some attractive valuations based on the recent selloff. The P/E ratio is just 3 while the cash value per share is $43.

Right now, Coinbase is being valued at basically its cash balance with zero regard for its revenue growth prospects.

We are currently more than halfway through the current Bitcoin halving cycle at block #736,000. That means crypto prices will continue to trade lower so be prepared for future losses if you hold Coinbase stock.

COIN stock has traded alongside Bitcoin and crypto prices so we could see Coinbase stock near $40 or below by the end of the summer. At this point, I want to build a large position in Coinbase so I welcome lower prices in the short term to profit massively over the long run.

It’s All About The User Growth

Coinbase has 98 million verified users and those users will spend a lot of money buying crypto once the market picks back up.

Coinbase user growth grew at a 75% CAGR over the last year as the company continues to rack up more user growth despite falling crypto prices.

| Quarter | Coinbase Verified Users |

| Q1 2021 | 56 million |

| Q2 2021 | 68 million |

| Q3 2021 | 73 million |

| Q4 2021 | 89 million |

| Q1 2022 | 98 million |

It’s likely that Coinbase will cross the 100 million user mark in Q2 2022 while the stock price continues crashing.

Long-term investors have a wonderful opportunity to acquire an industry-leading company with a growing user base at rock bottom prices.

At the end of the day, users make fintech companies such as Coinbase valuable. As long as the userbase increases, I will remain bullish on the stock.

Of course, there are several risk factors that investors need to take note of.

Risk Factors

Competition is my main concern when it comes to Coinbase. Robinhood (HOOD) launched its crypto wallet and other competitors such as Binance and Kraken could steal market share from Coinbase.

The initial Coinbase NFT marketplace hasn’t performed well and it’s a possibility that Opensea leads the industry well into the future.

Many investors have expressed concerns about Coinbase filing for bankruptcy due to running out of cash. The company held $6.1 billion in cash on its balance sheet at the end of Q1 (including $180 million in USC and $1 billion in various crypto assets).

Also, Coinbase filed a shelf registration with the SEC and may need to sell stock in order to stay afloat. Coinbase CEO Brian Armstrong denied that the company is at risk of bankruptcy on Twitter so hopefully the company has plenty of cash to make it through the crypto bear market.

Lastly, I’ve read several concerns about Coinbase’s policy on crypto assets in the event of bankruptcy. It’s true that assets held on Coinbase are technically owned by Coinbase since the company must report customer assets on its balance.

Coinbase wrote in its latest 10-Q:

Because custodially [sic] held crypto assets may be considered to be the property of a bankruptcy estate, in the event of a bankruptcy, the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings and such customers could be treated as our general unsecured creditors. (Source: Coinbase 10-Q)

Brian Armstrong tweeted that this is standard SEC practice and your assets are safe.

This is not a new rule but it’s important to understand the risks of holding crypto assets. If you are worried about a hack or bankruptcy then simply move your assets off Coinbase into your own hardware or digital mobile wallet where you control your private keys.

Conclusion

Coinbase will struggle in Q2 2022 but I expect things to get better as we head towards Q3. The crypto market could bottom and crypto stocks like Coinbase will be prepared for a bullish turnaround.

Coinbase has added several new products to keep its users happy and remains a dominant force in the North American crypto industry.

COIN stock remains attractive at under $50 even though the risks are piling up. I truly believe long-term holders will be rewarded but it’s important to remain calm and see the big picture.

Cryptocurrency is the future of finance and isn’t going anywhere. I expect Coinbase to remain a leader in the industry for years to come.