A leading crypto asset manager says that institutional investment products stemmed outflows last week thanks to continued investment in altcoin-focused products.

In the most recent Digital Asset Fund Flows Weekly report, CoinShares finds that crypto investment products suffered minor outflows last week.

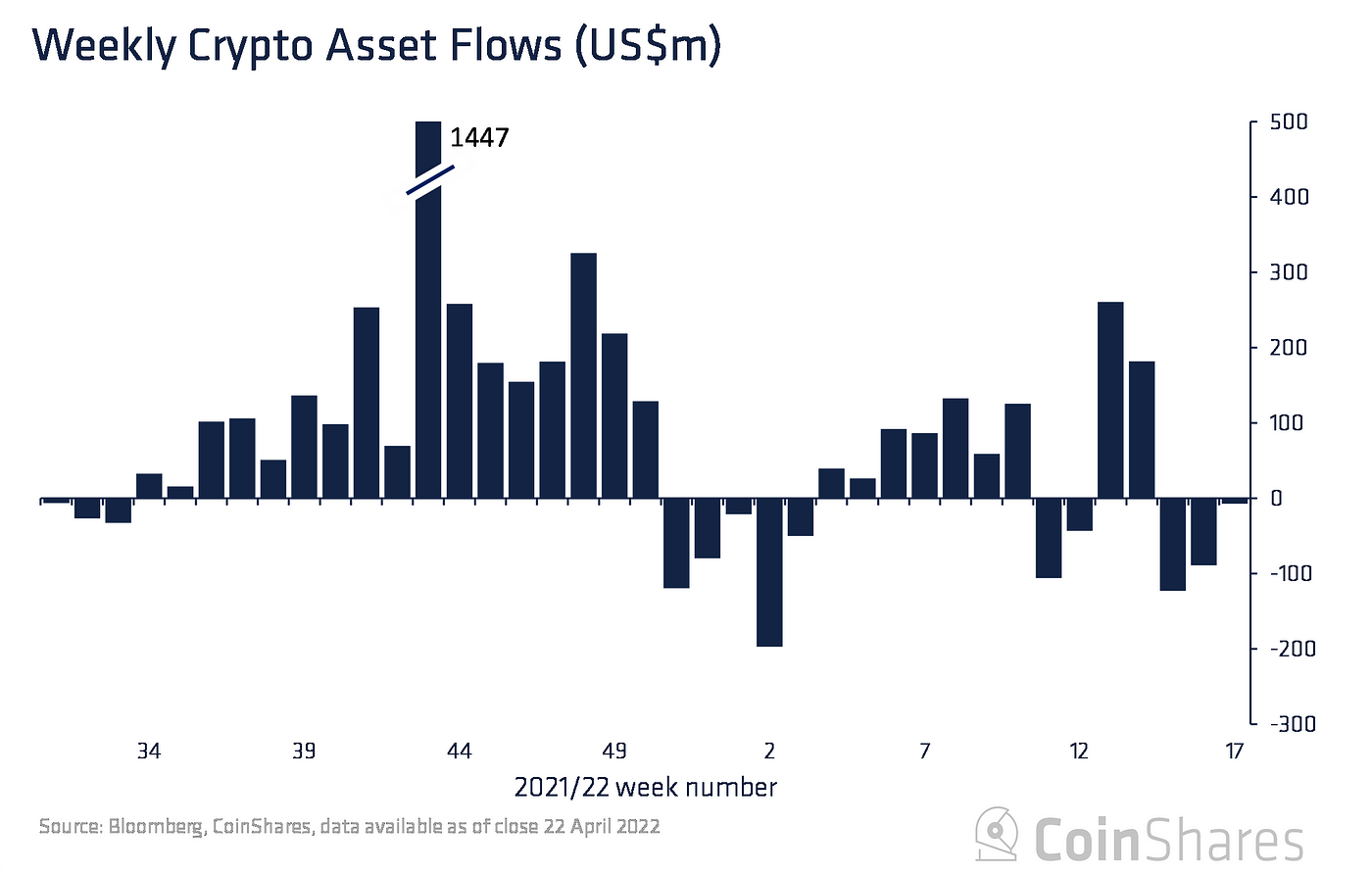

“Digital asset investment products saw outflows cool last week, totaling US$7.2m, bringing total outflows in this 3-week run to US$219m.”

CoinShares notes that yearly inflows still remain positive at $389 million despite the three-week stretch of outflows.

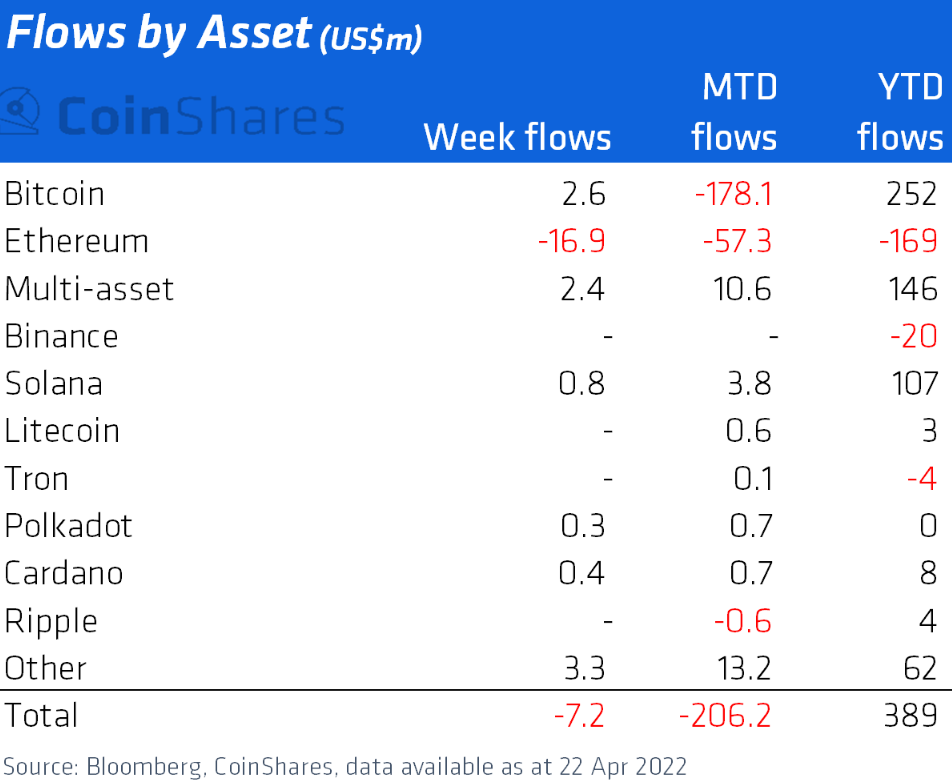

While Bitcoin (BTC) and Ethereum (ETH)-focused investment products suffered outflows totaling $178 million and $16.9 million respectively, investment products focused on altcoins such as Avalanche (AVAX), Solana (SOL), Terra (LUNA) and Algorand (ALGO) enjoyed modest inflows.

“Altcoins remain the focus amongst investors, with notable inflows into Avalanche, Solana, Terra and Algorand of US$1.8m, US$0.8m, US$0.7m and US$0.2m respectively.”

CoinShares also notes that the number of investment products launching has slowed over the last four months compared to Q4 of 2021.

“The total number of investment product launches has cooled, with only 11 in Q1 2022 versus 24 in Q4 2021. Of the 23 different investment products by asset type, 10 were launched this year. There has been a focus on altcoins, most notable of which were Avalanche, Tezos and Terra with US$49m, US$30m and US$16m of assets under management respectively.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Check Latest News Headlines

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Supawat Eurthanaboon