Online merchants will soon need to offer crypto as a standard. It makes sense to choose a platform with multiple features that can smooth the process.

Online merchants will soon need to offer crypto as a standard. It makes sense to choose a platform with multiple features that can smooth the process.

Where will be the biggest demand for B2B crypto payments?

E-commerce, Software-as-a-Service (SaaS) companies, subscription-based businesses, NFT vendors, content producers, online gaming etc.

Literally any kind of business that has an online checkout process and already accepts other payment methods like credit cards – or are pure crypto companies.

- Payment infrastructure providers

Payment service providers with existing payment infrastructure and clients for traditional payment methods like credit cards, direct debit etc.

This can be traditional payment gateways, money remittance services, mobile payment apps, loyalty apps, and so on.

Crypto payments are starting to enter the realm of the norm and will be much in demand within the e-commerce world in the months and years to come. A versatile platform, a one-stop-shop, that can leverage hosted checkouts, APIs, and plugins to accept multiple cryptocurrencies and auto converting to fiat currencies in seconds is highly desirable for merchants who now need to think about fulfilling the payments expectations of their customers.

A platform with a host of additional administrative features can also make life easier for merchants, leaving them free to focus on building their offering.

What to look out for if you want to accept crypto payments?

- Protection from currency volatility – if a merchant sells a product for €100 and a customer pays in Bitcoin, the merchant must receive €100 EUR in their account. COINQVEST protects merchants from that business risk.

- Direct withdrawal to bank account.

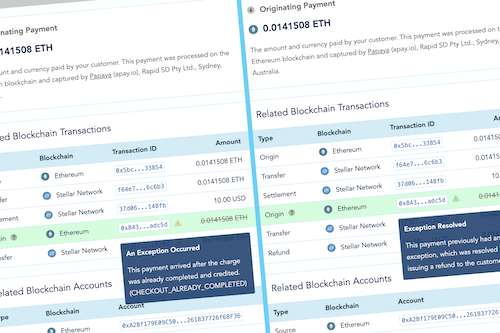

- Automated payment exception handling (does your provider detect and mitigate over/under/multiple payments?)

- Tax and regulatory compliant crypto payments, i.e. normally anonymous crypto payments get de-anonymised by adding sender and receiver data and order information to a payment.

Indeed, crypto as a payment mechanism is seeing growing demand, particularly in Europe where consumers and investors alike have a good awareness of how crypto works and the advantages of using it as a payment mechanism.

Indeed, crypto as a payment mechanism is seeing growing demand, particularly in Europe where consumers and investors alike have a good awareness of how crypto works and the advantages of using it as a payment mechanism.

Being able to offer payment in cryptos allows merchants to have an offering that appeals to the broadest possible audience and thus makes business sense. Major companies know this. Firms like Mastercard, Microsoft, Starbucks, Amazon, and many other successful companies accept cryptocurrency and there is no reason why e-commerce merchants should not offer it too.

Aside from meeting customer demand, there are benefits to the merchant in accepting crypto payments such as lower fees, fast payments, and high levels of security.

In theory, setting up to accept crypto is simple and straightforward – simply sign up for a crypto payment gateway, and connect it to your website through plugins or create invoices.

In theory, setting up to accept crypto is simple and straightforward – simply sign up for a crypto payment gateway, and connect it to your website through plugins or create invoices.

But choosing the right company to keep is crucial. Having the right partnership can have a positive impact in terms of the payment itself as well as all the administrative elements that surround it.

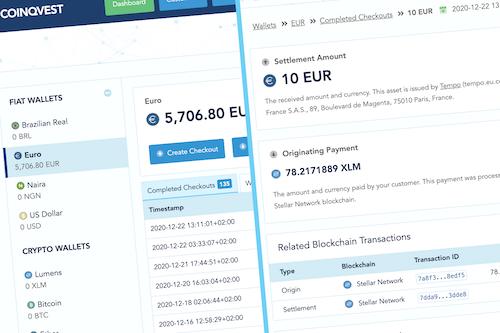

COINQVEST is a leading enterprise cryptocurrency payment gateway designed to provide an all-in-one experience. It helps online merchants and e-commerce shops programmatically accept and settle payments in new digital currencies.

For starters, merchants use can use COINQVEST’s hosted checkouts, APIs, and plugins to flow seamlessly through the payment process. It automatically calculates the payment price in each supported cryptocurrency; Bitcoin, Ethereum, Litecoin, and Stellar Lumens. COINQVEST also supports fiat currencies such as USD, NGN, EUR, and is in the process of adding an additional 45 currencies to its proposition.

For starters, merchants use can use COINQVEST’s hosted checkouts, APIs, and plugins to flow seamlessly through the payment process. It automatically calculates the payment price in each supported cryptocurrency; Bitcoin, Ethereum, Litecoin, and Stellar Lumens. COINQVEST also supports fiat currencies such as USD, NGN, EUR, and is in the process of adding an additional 45 currencies to its proposition.

The platform is fully customisable and can be white-labelled. Developers like the fact that it is easy to set up, and has ready-made e-commerce extensions and plugins, such as WordPress, WooCommerce, Shopify, and Magento.

The platform also features to help with compliance and tax. It automates invoicing, accounting and will keep a record of all customers’ payments and transactions. And to get optimal viability merchants can view APIs in real-time so to enable instant identification of errors when they occur and keep an audit of the interactions between the merchant’s system and COINQVEST.

And unlike many payments platforms, COINQVEST will also offer refunds and rectify overpaid, underpaid, or invalid payments to provide maximum flexibility and functionality to merchants – making it easier for them to do business.

And unlike many payments platforms, COINQVEST will also offer refunds and rectify overpaid, underpaid, or invalid payments to provide maximum flexibility and functionality to merchants – making it easier for them to do business.

The platform is easy to set up and, unlike other platforms, offers the first 50 transactions for free, allowing merchants to get used to it. There is a charge of 0.5% thereafter.

All of this is bundled together is important because it takes the hassle away from merchants. It offers a one-stop platform that not only fulfils the expectations of end customers in terms of the transaction itself but makes life easier for the merchant because it is fully customisable and also takes care of administrative tasks. This adds up and leaves the merchant free to focus on the business itself.

In short, COINQVEST offers a comprehensive and easy solution for a fast-growing market that will be in high demand.

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘303108721294352’);

fbq(‘track’, ‘PageView’);

window.fbAsyncInit = function() {

FB.init({

appId : ‘217185300307154’,

xfbml : true,

version : ‘v2.11’

});

FB.AppEvents.logPageView();

};

(function(d, s, id){

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) {return;}

js = d.createElement(s); js.id = id;

js.src = “https://connect.facebook.net/en_US/sdk.js”;

fjs.parentNode.insertBefore(js, fjs);

}(document, ‘script’, ‘facebook-jssdk’));