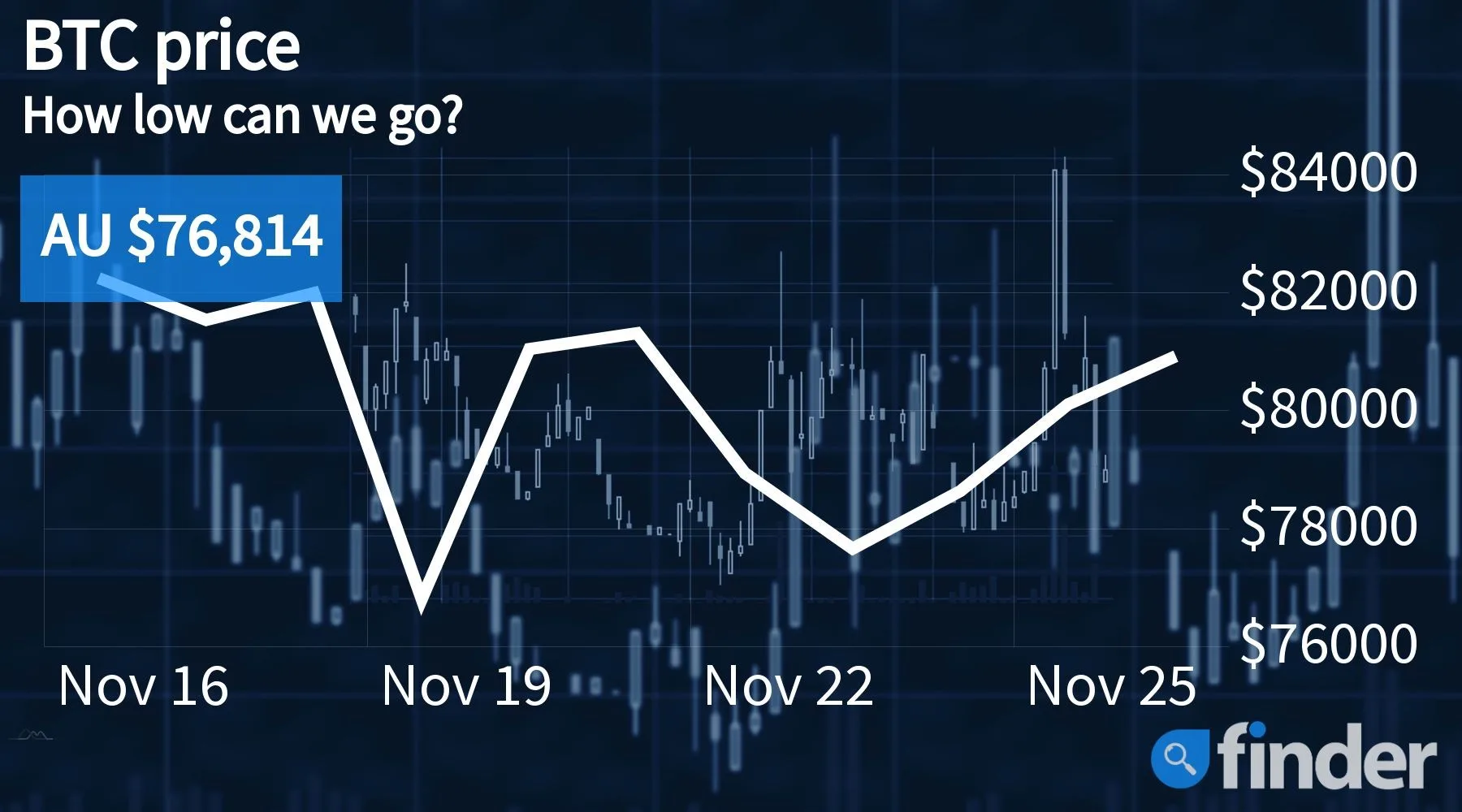

BTC is currently in the red over the last 14-day stretch, registering losses of 14.6%, but this pales in comparison to the rest of the market

- Experts believe that BTCs ongoing consolidation trend could see the currency make a major upward push over the coming few days or weeks.

- Bitcoin’s total quarterly transaction volume has surged past that of PayPal’s over the course of 2021.

- BTCs market dominance index (DI) is currently limping around the 39.6% zone.

After having tried to reclaim support near the AU $83k (US $59,500) range yesterday, Bitcoin, the world’s largest cryptocurrency by total market capitalization, has continued to showcase small corrections, finding support around the AU $81.5k (US $58,000) mark seemingly. At press time, BTC is trading at a price point of AU $81,346.

Pseudonymous independent analyst Rekt Capital is of the view that if Bitcoin is able to maintain its ongoing price action, a convincing trend reversal may be on the cards, spurring the flagship crypto’s value in an upward trajectory quite strongly over the coming few days. A similar sentiment was also echoed by crypto trading firm QCP Capital, whose crypto analysis team believes that the recent selling pressure has been “capped” and that the market seems to be consolidating rather than showing further signs of dropping.

While large inflow and outflow BTC volumes have been witnessed across all exchanges — signifying an active market — data suggests that the digital currency is currently showcasing its lowest levels of volatility over the last six months.

Bitcoin network activity continues to rise

According to information made available by market intelligence firm Blockdata, the total volume of dollar-denominated transactions facilitated by the Bitcoin network has already exceeded that of PayPal. Not only that, the firm also noted that BTC could also overtake payments giant Mastercard as early as 2026.

Technically speaking, over the course of 2021, the Bitcoin network processed about US $489 billion worth of transactions every quarter, which is substantially larger than PayPal’s volume of around US $302 billion. Furthermore, after just a decade of action, Bitcoin’s total transaction throughput rate has already scaled up to 27% of Mastercard’s per quarter volume of around US $1.8 trillion and about 15% of Visa’s US $3.2 trillion.

Looking ahead

As the Indian government gets ready to table a bill looking to possibly ban “private cryptocurrencies” during its upcoming winter parliament session, it will be interesting to see how the market continues to respond to these developments. Since hinting at the ban recently, the Asian nation’s local crypto market has suffered heavy losses, with most major cryptos — including BTC, ETH — losing over 15% of their value.

Interested in cryptocurrency? Learn more about the basics with our beginner’s guide to Bitcoin, dive deeper by learning about Ethereum and see what blockchain can do with our simple guide to DeFi.

Disclosure: The author owns a range of cryptocurrencies at the time of writing

Disclaimer:

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider,

service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and

involve significant risks – they are highly volatile and sensitive to secondary activity. Performance

is unpredictable and past performance is no guarantee of future performance. Consider your own

circumstances, and obtain your own advice, before relying on this information. You should also verify

the nature of any product or service (including its legal status and relevant regulatory requirements)

and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.