MittGroup CEO Grant Mitterlehner tells Neil Cavuto Bitcoin is ‘the brand new gold.’

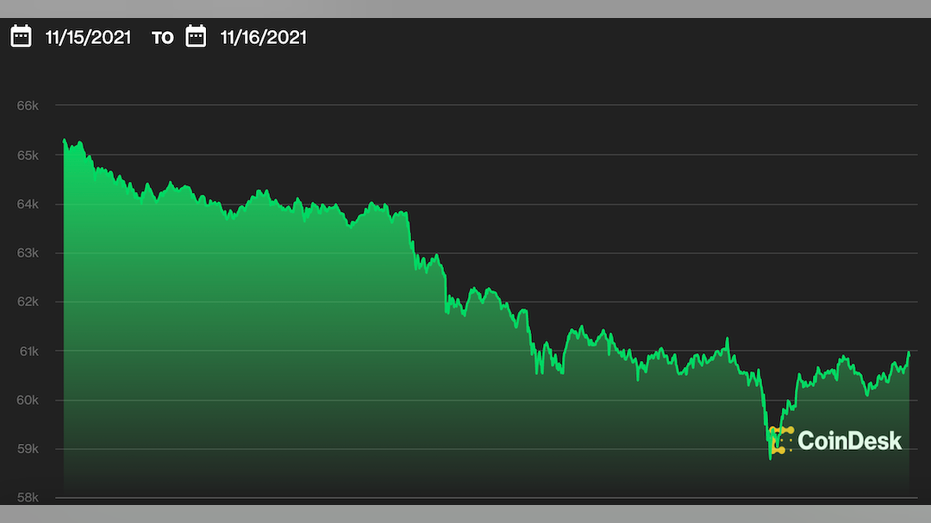

Bitcoin is buying and selling above the $60,000 per coin mark on Tuesday after briefly tumbling under that stage earlier within the day.

The world’s largest cryptocurrency has dropped greater than 5% up to now 24 hours as of the time of publication, nevertheless it’s year-to-date returns are nonetheless up roughly 110%, in response to CoinDesk. In the meantime, Ethereum has dropped greater than 7% to round $4,300 per coin.

Though the explanation behind the drop is unclear, the transfer coincided with a press convention by China’s state planner, the Nationwide Improvement and Reform Fee and comes a day after President Biden signed the $1.2 trillion infrastructure invoice into legislation.

WHAT’S IN THE 1.2T BIPARTISAN INFRASTRUCTURE BILL?

NDRC spokesperson, Meng Wei, blasted virtual currency mining as “extraordinarily dangerous,” arguing it “consumes plenty of vitality and carbon emissions, and doesn’t have a optimistic driving impact on industrial growth and technological progress.” She added that dangers derived from digital foreign money manufacturing and transactions have change into extra outstanding and that the cryptocurrency trade is “blind and disorderly.”

China’s electrical energy consumption jumped 12.2% year-over-year from January to October and 6.1% year-over-year in October alone, in response to the NDRC.

Wei emphasised that the NDRC would “clear up and rectify” digital foreign money mining actions within the area and “punish” the mining actions of state-owned companies by imposing punitive electrical energy costs on them. The transfer comes after China declared in September that cryptocurrency buying and selling and mining actions within the nation are unlawful and strictly prohibited.

Reuters reported on the time that the Individuals’s Financial institution of China was planning to ban abroad exchanges from offering providers to clients within the nation and prohibit monetary firms and different abroad corporations from facilitating the offers the place cryptocurrency buying and selling could be in any other case authorized.

“Remediation of digital foreign money “mining” actions is of nice significance to advertise the optimization of my nation’s industrial construction, promote vitality conservation and emission discount, and obtain the purpose of carbon peak and carbon neutrality on schedule,” Wei mentioned.

China’s president Xi Jinping has set a goal to reach net-zero carbon emissions by 2060, 10 years later than the United Nations’ goal.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

As well as, the USA’ accredited infrastructure bundle will strengthen tax enforcement on cryptocurrencies.

One provision within the invoice requires brokers to report digital asset transactions, corresponding to bitcoin or ether, to the IRS within the form of a 1099 type. Brokers can even be required to reveal the names and addresses of consumers.

Proponents of the measure have argued that exempting decentralized exchanges or cryptocurrency miners from reporting necessities may create a “two-tiered cryptocurrency market” and encourage an “unregulated shadow monetary market.” The non-partisan Joint Committee on Taxation estimated the coverage would generate about $28 billion in new income over the following decade.

Nevertheless, crypto advocates and different critics have argued that the invoice’s definition of who qualifies as a “dealer” is simply too broad, noting the language may probably goal these with out clients who wouldn’t have entry to the data wanted to conform. In response to those fears, the U.S. Treasury Division mentioned in August that it’s going to not goal non-brokers, corresponding to miners, {hardware} builders and others.

One other provision requires companies and exchanges to report after they obtain greater than $10,000 in cryptocurrency.

CLICK HERE TO READ MORE FROM FOX BUSINESS

The provisions aren’t slated to take impact till January 2024, that means that cryptocurrency lobbyists will probably push for various legislative avenues to water down the regulation.

Cash generated from the stricter regulation will assist pay for about $550 billion in new funding over the following decade for roads, bridges, rail, transit, water and different “conventional” infrastructure packages. Different pay-fors within the infrastructure invoice embrace repurposing unspent coronavirus aid funds, together with recouping fraudulently paid unemployment cash, unemployment cash returned by states that prematurely ended a federal $300-a-week profit, focused company customers charges and financial progress created by the investments.

FOX Enterprise’ Megan Henney contributed to this report