The U.K. formally unveiled its plans to bring the regulation of digital assets and digital asset businesses in line with traditional financial firms, as the government kicked off its long-awaited consultation on the topic on Tuesday.

The plans are a continuation of a regulatory overhaul that has been in the offing since April 2022 and has seen the U.K. introduce several proposals aimed at shoring up the country’s digital asset regulatory regime. A paper published by the Treasury in starting the consultation period says this:

“Our objective is to establish a proportionate, clear regulatory framework which enables firms to innovate at pace, while maintaining financial stability and clear regulatory standards. This includes a proposal to bring centralised cryptoasset exchanges into financial services regulation for the first time, as well as other core activities like custody and lending.”

The moves are intended to make the U.K. a digital asset hub while giving due recognition to the risk they pose to investors and the wider financial system. The turbulence of the past 12 months has only highlighted that risk further, according to the initial consultation paper.

“Our view is that this reinforces the case for clear, effective, timely regulation and proactive engagement with industry. Effective regulation will create the conditions for cryptoasset service providers to thrive in the UK, and give people and businesses the confidence to invest with an understanding of the often high risks involved.”

Previously, significant digital asset-related clauses have been included in the Treasury’s Financial Services and Markets Bill (FSMB), which would, among other things, regulate stablecoins and prohibit the advertising of digital asset products in the U.K. without authorization from the Financial Conduct Authority (FCA). That Bill is currently being scrutinized by the House of Lords and is expected to pass into law sometime in the summer.

The latest proposals go beyond that, however.

What’s in the consultation paper?

The paper again spells out the Treasury’s guiding principles in approaching the subject of digital assets, which prove illuminating.

- A “same risk, same regulatory outcome” approach: in other words, a focus on the risk posed by an asset independent of its technology. Assets and businesses which pose the same risk should result in the same tech-agnostic regulatory outcome, even if the exact form of the regulation is not exactly the same.

- Proportionate and focused: regulators should avoid applying disproportionate regulation to entities, especially where investors are sophisticated or where risks to financial stability are low.

- Agile and flexible: any incoming regulatory framework should accommodate evolving markets and products. This also means being responsive to changing conditions in the digital asset market which might pose a greater risk to financial stability.

The paper highlights that the U.K. government’s intention is to focus its regulatory efforts on activity rather than assets. However, it provides a list of digital asset classes which the regulations are intended to capture when those assets are being used for financial activities:

- Exchange tokens

- Utility tokens

- Security tokens

- Non-fungible tokens

- Stablecoins

- Asset-referenced tokens

- Commodity-linked tokens

- Crypto-backed tokens

- Algorithmic tokens

- Governance tokens

- Fan tokens

In other words, any digital asset being used for financial activity will be regulated in the country.

As for what constitutes financial activity, the paper provides the following list:

- Issuance activities

- Payment activities

- Exchange activities

- Investment and risk management activities

- Lending, borrowing, and leverage activities

- Safeguarding and/or custodial activities

- Validation and governance activities

Most interesting among the paper’s commentary on the government’s plans is that their starting point is that “crypto-backed tokens should be regulated in the same way as unbacked cryptoassets such as Bitcoin.”

Token issuance

The consultation will also look at how token issuance is regulated, with an initial proposal to treat digital asset issuance on the same or similar footing to traditional securities issuance. As a result, the government is proposing an issuance and disclosure regime. As such, the consultation will look at the following:

- the minimum standard of information that should be made available to investors and regulators before any issuance,

- appropriate liability and compensation for untrue or misleading statements,

- the level of due diligence conducted over the disclosure documents,

- investor protections with regard to marketing materials, and

- controls and procedures aimed at detecting fraud.

Exchanges

On exchanges, the paper remarks that “the proliferation of cryptoasset trading venues across the globe has heightened challenges around monitoring trading venue activity (e.g. for AML purposes) and protecting consumers. Lack of regulation to support market integrity and increased fragmentation of liquidity across venues and jurisdictions is also creating more opportunities for market manipulation.”

The consultation paper lists four intended outcomes with regard to exchanges:

- Orderly, open, and resilient conditions for digital asset trading on exchanges

- Exchanges should have transparent and fair access and operating rules

- Exchanges should have the people, processes, systems and controls to facilitate fair, orderly and efficient trading, while addressing conflicts of interest

- Exchanges should have systems and processes for ensuring accurate market data is available in real time

The government is proposing to bring exchanges in line with the current approach to traditional trading venues in order to do this. This would invoke several requirements that would apply to any exchange existing in or offering services to U.K. residents. These requirements include obtaining a license, minimum liquidity standards, robust governance arrangements, clear organizational structure, reporting requirements, and certain resiliency standards.

Custodians

Digital asset custodians will also be addressed in the consultation. According to the paper, the government is currently considering a proportionate approach to custodians and “may not impose full, uncapped liability on the custodian in the event of a malfunction or a hack that was not within the custodian’s control.”

The consultation hopes to achieve the following high-level regulatory outcomes for custodians:

- Custodians should ensure adequate arrangements to safeguard investors’ rights to their digital assets when it is responsible for them such that, if the custodian goes under, the assets are returned to the customers

- Custodians should have enough financial resources that they can fail without causing significant harm to customers and market participants

- They should have clear avenues for redress in the event that assets held in custody are lost

- They should have adequate systems, controls, and governance arrangements to minimize the risk of lost digital assets

- Regulators would have the ability to put in place more stringent reporting requirements in future

Market abuse

The government is also proposing a dedicated regime to detect and tackle market abuse in digital asset markets, noting that “a well functioning and efficient financial market requires market integrity.”

The regime would oblige participants to detect and take action against market abuse practices, would include a sanctions regime, and balance the need to maintain market integrity against the cost to market participants of complying with the obligations.

One of the key questions that the government is seeking consultation on is where the responsibility for preventing market abuse should primarily land: on regulators such as the FCA or the trading venues themselves. At the outset, the government is proposing to place the onus on the venues to detect, prevent and disrupt market abuse. This may include the obligation to establish information-sharing regimes with other venues and the ability to blacklist offenders.

Lending platforms

The consultation will also examine how digital asset lending platforms should be regulated.

The topic has become a hot one in the U.S., with the Securities and Exchange Commission (SEC) clamping down on lending programs as illegal unregistered securities.

It comments that lending programs:

- Should have adequate risk warnings for consumers

- Have adequate liquidity and wind-down arrangements to carry out their business

- Have clear contractual terms for ownership and, if applicable, ringfence retail funds in the event of insolvency

Government wants more submissions on DeFi and sustainability

The paper also calls for submissions on how the government should approach so-called decentralized finance (DeFi) arrangements. At this stage, the Treasury makes its current position clear:

“HM Treasury is of the view that the regulatory outcomes and objectives described in the preceding chapters should apply to cryptoasset activities regardless of the underlying technology, infrastructure, or governance mechanisms.”

However, they note that the unique characteristics of DeFi organizations will mean that the best way of regulating them may take longer to clarify.

The paper also outlines the government’s desire to consider the sustainability of digital assets. It advocates for reporting requirements in line with ESG mandates that apply to traditional asset issuers.

Roadmap

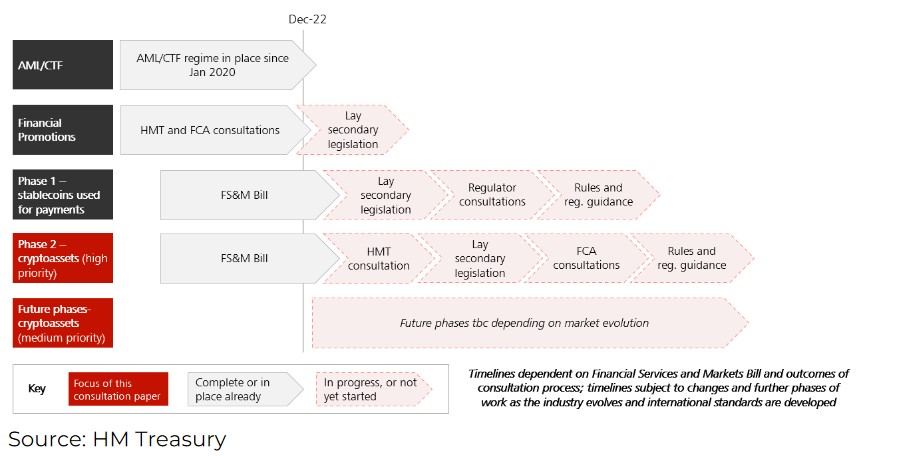

The paper also provides a roadmap for the various current and planned regulatory developments in the industry:

Watch: Regulatory compliance for blockchain & digital assets

width=”560″ height=”315″ frameborder=”0″ allowfullscreen=”allowfullscreen”>

New to Bitcoin? Check out CoinGeek’s Bitcoin for Beginners section, the ultimate resource guide to learn more about Bitcoin—as originally envisioned by Satoshi Nakamoto—and blockchain.