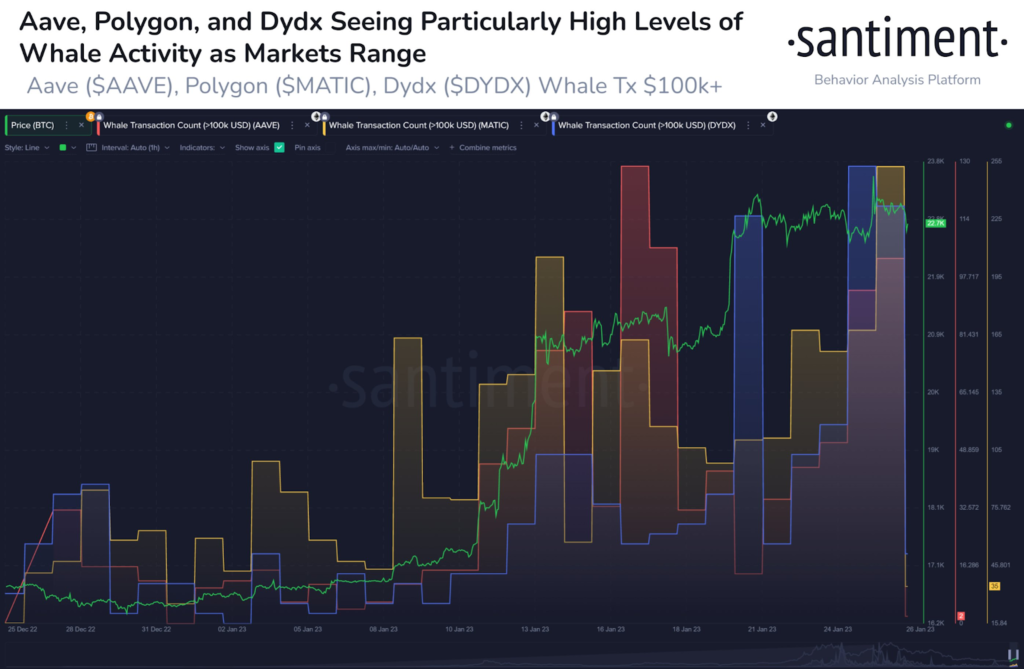

- As per the on-chain analytics company Santiment, Polygon, Aave and DyDx have all been reassembled with high whale activity recently.

- The pertinent sign here is the “whale transaction count” which computes the total number of transfers that whales are doing currently.

In connection with these altcoins, the state for a transaction to estimate as one coming from whales is that it must include a circulation of coins valuing a minimum of $100,000.

When the worth of this metric is inflated for any coin, it means whales are creating a huge number of transactions of that specific crypto at that time. This trend says these immense holders are trading the particular coin at the given duration with huge activeness.

From that time, whale transactions include the circulation of large scales of capital, a vital number of them altogether can sometimes remarkably influence the market. As a consequence, the whale transaction count is of substantial worth and can lead to surged volatility in the value of the crypto under consideration.

The chart

Now, the given chart here represents the trend in the whale transaction count for these altcoins namely Polygon, Aave, and DyDx in the last month:

As represented in the graph, Polygon, Aave, and Dydx have all witnessed some pleasing high whale activity over the last month. In the given duration, these altcoins have also represented some crucial reassembling. As per the data, AAVE has jumped 56%, MATIC 35%, and DYDX 94%.

Ironically, the most crucial stakes in the transaction count of whales for these coins emerged when the market was fluctuating between January 13 and January 18. Going through this exceptional burst of activity, the rally recommenced its pitch and altcoins significantly shot in their worth.

In the past few days, the worth of the indicator has again been at the same levels as witnessed at the time of mentioned upraised whale activity period at the start of this month.

At the same time, high whale transaction counts can be declining or optimistic for the worth of these coins, the fact that the recent pattern is as same as that prior one in the month when high activity from his unit was in real optimistic, could suggest the odds may be on the side of these altcoins.

In any which case, as Santiment says, “the hyped large address interest in these assets should be analyzed with care.”