The current turmoil in the crypto market will leave more specialized firms with stronger governance and risk management, and institutions increasingly looking to work with firms they trust with a track record of prudent governance according to Coalition Greenwich.

The consultancy said in its report,Top Market Structure Trends to Watch in 2023, that crypto is in the middle of its dot com moment and the washout will leave fewer vertically integrated firms. and more specialized firms with stronger governance and risk management in a flight to quality.

“These will be overseen by more stringent regulations that will take the whole market segment forward,” said Coalition Greenwich.

2022 was a year of both transition & preparation: transition away from a decade’s long low-rate environment, equity bull market &COVID lockdowns; preparation for market structure changes on the back of the March 2020 liquidity crunch & the meme stock craze https://t.co/SOV5FeBLQS

— Coalition Greenwich (a division of CRISIL) (@CoalitionGrnwch) January 3, 2023

In addition, institutions will increasingly look to brands and institutions with a real track record of prudent governance and putting clients first.

“And with these changes, we’ll likely see an increase in institutional allocations to crypto and maybe even … a spot Bitcoin ETF,” added the report.

Colleen Sullivan and Peter Johnson, co-head of venture at Brevan Howard Digital said in a blog that, in their personal opinions, they have never been more excited about crypto.

“We’ve seen multiple crypto market cycles and know that it is when the hype dies down that builders build, non-speculative use cases accelerate, and great investments are made,” added Brevan Howard Digital. “It’s also when the industry refocuses on how the fundamental web3 innovations of digital ownership and open-network value transfer can positively impact the world.”

Custody

Brevan Howard Digital predicted that custody and settlement will start to separate from centralized exchanges. Crypto exchanges can have a vertically integrated structure operating a brokerage, a custodian, and a clearing/settlement provider. However, the alleged fraud and failure of exchange FTX will finally change this paradigm .

This custody/trading model has long been desired by traders and has gained some limited traction, but has failed to gain widespread adoption due to exchange pushback. FTX debacle changes this.

Good for custodians @PolySignInc @BitGo @mikebelshe @FireblocksHQ @CopperHQ etc.

— Peter Johnson (@TheChicagoVC) January 4, 2023

Coalition Greenwich said in a report last year that fully regulated custody of digital assets is important or extremely important to the majority of both sell side and buy side. The survey, Providing Digital Asset Services: An Institutional Infrastructure Roadmap, found that 71% of the sell side and 62% of the buy side believe that fully regulated custody is important/extremely important.

Trading

Brevan Howard Digital also said the bankruptcy of FTX and the collapse of other centralized/custodial platforms will drive overdue changes to crypto trading market structure. They expect trading volumes will shift to decentralized crypto exchanges (DEX) from centralized exchanges (CEX), which have their own order books and infrastructure. In contrast, a DEX acts as a decentralized application on a blockchain.

2) @Uniswap overtakes @coinbase volumes as DEX trading market share reaches new ATH.

The failure of FTX and other centralized platforms will drive overdue changes to crypto trading market structure, including increased usage of non-custodial wallets and non-custodial exchanges.

— Peter Johnson (@TheChicagoVC) January 4, 2023

@Uniswap will decisively overtake @coinbase in trading volumes. We consider this a major symbolic shift in the industry as the most well-known DEX surpasses the most well-known centralized exchange in the US (although not globally). pic.twitter.com/ohVYc1pOPP

— Peter Johnson (@TheChicagoVC) January 4, 2023

CryptoCompare, an FCA authorised benchmark administrator and digital asset data provider, said in its review of 2022 that it was one of the most impactful years for centralized crypto exchanges since the collapse of Mt. Gox in 2014.

“Following the fall of FTX, the main takeaway from 2022 is the increased importance that security and transparency will play in the CEX sector in 2023,” added CryptoCompare. “We hypothesise that exchanges with superior transparency policies, for example, releasing clear and audited Proof of Reserves (PoR), will be those that succeed, particularly in a year which we believe will have sustained lower volumes.”

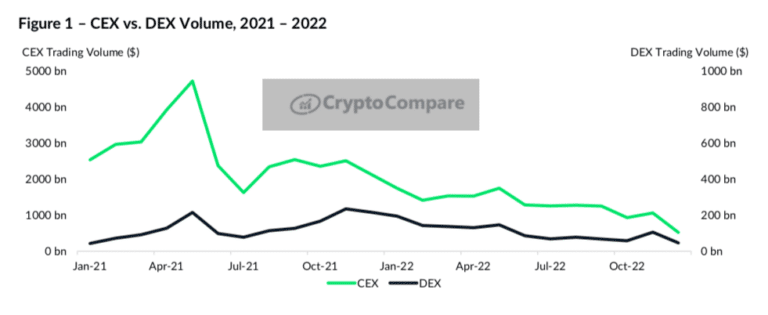

Trading volumes across CEXs remained well above their decentralised counterparts according to CryptoCompare, despite declining 46.2% in 2022.

CryptoCompare predicted that continued contagion from the collapse of FTX will lead to sustained low trading volumes relative to the records in 2021; consolidation of market share amongst exchanges; and higher regulatory scrutiny.

“Exchanges will have to adhere to more stringent regulatory requirements, although it will likely take several years before a sufficiently robust framework is employed by regulators,” said CryptoCompare. “Regulated exchanges could be the long-term winners of the FTX collapse.”

CME Group

Regulated derivatives exchange CME Group reported on 4 January that average daily volume for its cryptocurrency contracts increased 82% in 2022 from the previous year. In addition, CME reached a record micro ether futures average daily volume of 19,582 contracts.

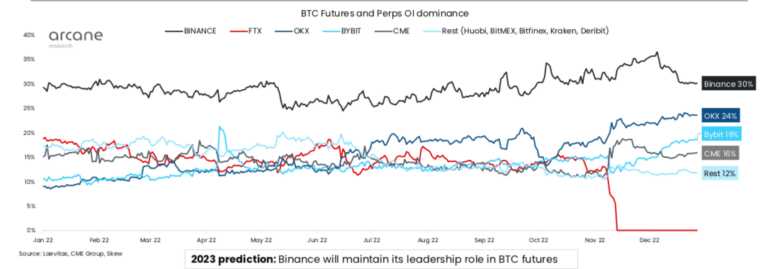

Arcane Research said in its review of 2022 that CME’s was fairly stable at 10% to 15% of the crypto derivatives market throughout 2022, but saw a short-lived sharp uptick after FTX collapsed in November. CME only represents 4% of the trading volume in the market according to the Norwegian research-led digital assets brokerage.

“It’s somewhat unfair to compare CME to offshore derivatives due to substantially fewer trading days, but it’s still obvious that most of the trading activity of bitcoin derivatives originates on offshore derivatives exchanges,” added Arcane Research. “Nonetheless, this has been the case ever since CME launched bitcoin futures, and several price discovery analyses point towards CME being an influential venue in bitcoin’s price discovery, despite the comparably low trading volumes.”

(function (d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s);

js.id = id;

js.src = “//connect.facebook.net/en_US/sdk.js#xfbml=1&version=v2.7&appId=305424549515394”;

fjs.parentNode.insertBefore(js, fjs);

}(document, ‘script’, ‘facebook-jssdk’));

Source link