- XRP was in a mildly weak market structure.

- Bears could push the price to $0.3327 or lower.

- Continued accumulation by whales could negate the bearish forecast.

Ripple (XRP) has been on a downtrend since the start of December 2022. With its lawsuit with SEC on a homestretch, recent rumors of the possible settlement pushed XRP’s price downwards.

Read Ripple’s [XRP] Price Prediction 2023-24

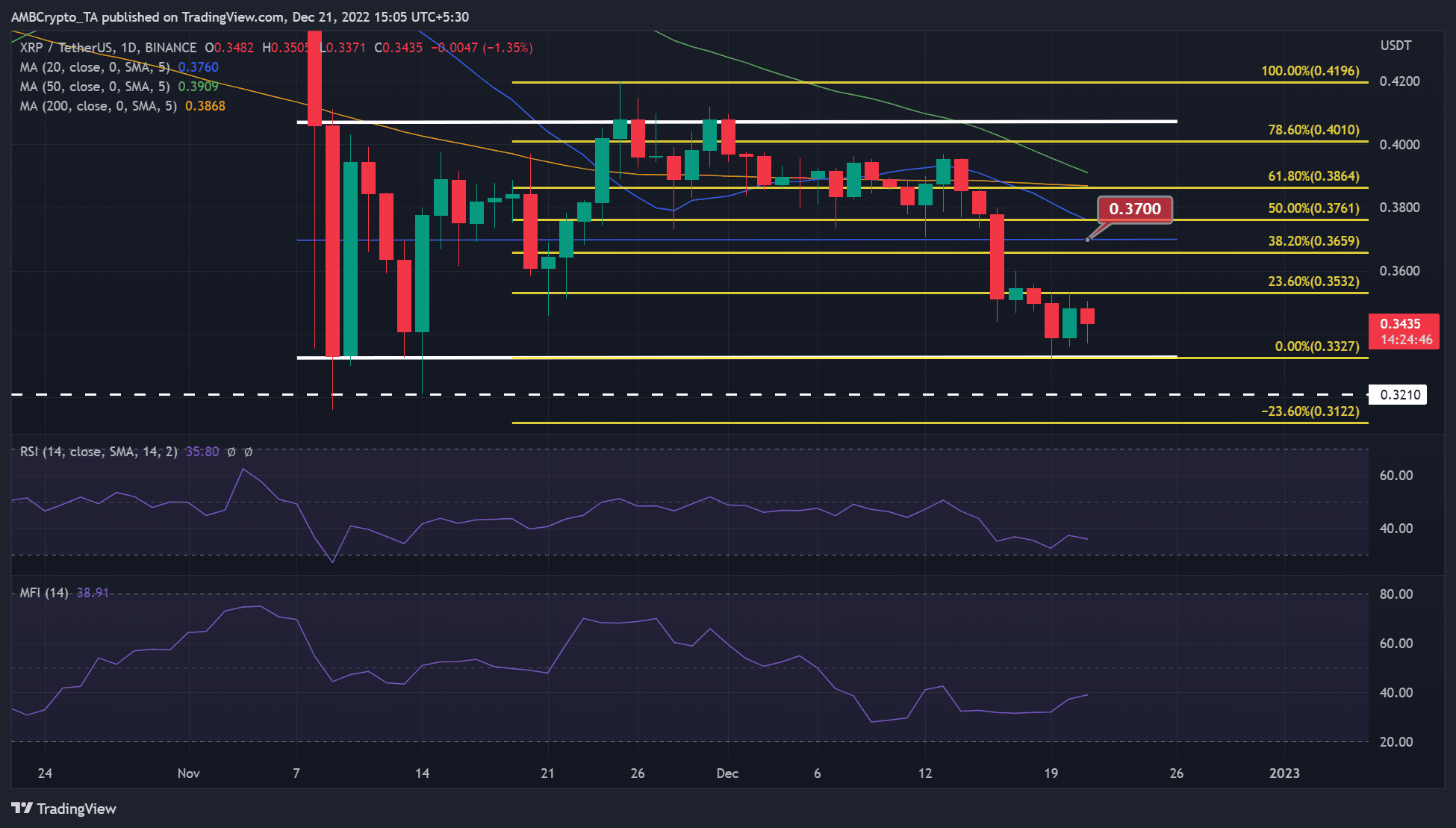

At press time, XRP was trading at $0.3435 as bulls and bears faced off for leverage. If bears take control, XRP could break below its current parallel channel pattern.

Will XRP break from the parallel channel?

Since November’s market crash, XRP formed a parallel channel pattern. At the time of publication, XRP’s price movement was close to the channel’s lower boundary. But was a breach of the boundary ($0.3327) possible?

The Relative Strength Index (RSI) had a slight uptick, followed by a downtick in the lower range. It was at 35, way below the 50-neutral mark. This showed a recent uptick in buying pressure, but intense selling pressure blocked the uptrend.

Put differently, sellers still have leverage in the market. As such, bears could push the price down to $0.3327 or $0.3210, which can act as short-selling targets.

However, a massive accumulation was underway as XRP’s discounted prices attracted demand. Notably, the Money Flow Index (MFI) sharply increased, showing buyers had accumulated XRP. If the accumulation continues, XRP could break above the current resistance at $0.3532, invalidating the above bearish forecast.

Such an upward move could set XRP to deal with a couple of obstacles ahead, including the channel’s mid-point at $0.3700.

How many XRPs can you get for $1?

XRP recorded demand in the derivatives market and massive accumulation by whales

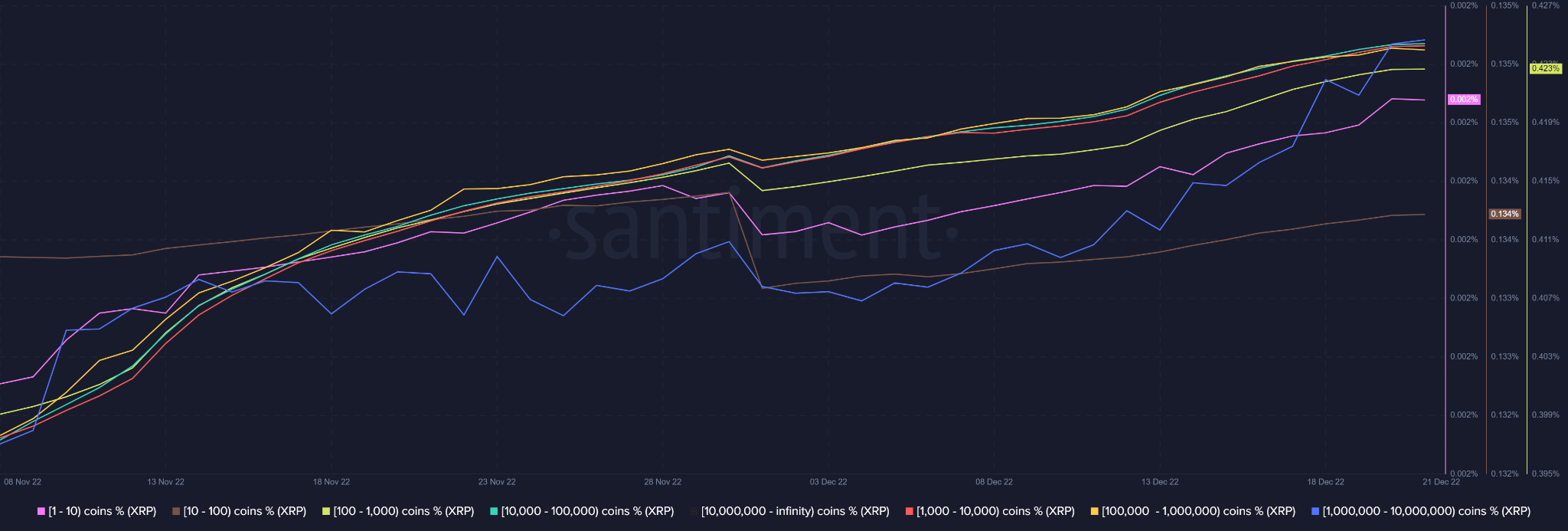

Based on the above supply distribution data, whales with 1 million-10 million XRP coins dumped significantly on 19 December (shown by the trough on the blue line) as everyone else was accumulating. Thus, the group caused selling pressure on the said day single-handledly.

However, by the time of publication, every group was accumulating, as every line showed a smooth rise.

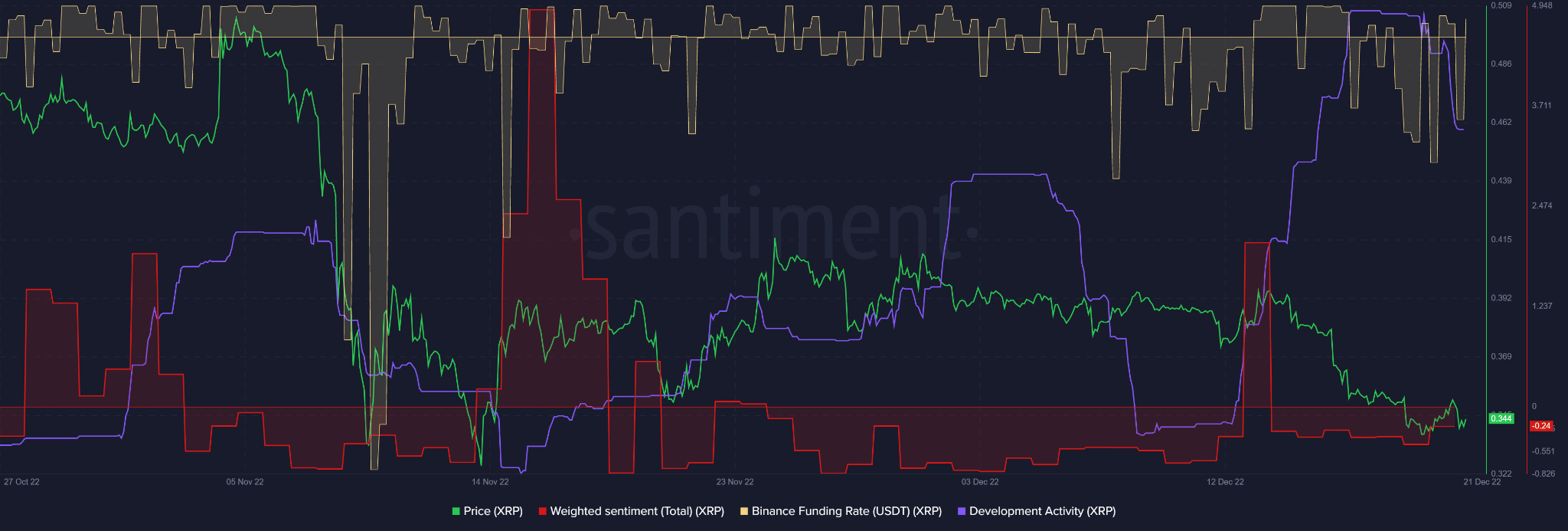

In addition, XRP saw increased demand in the derivatives market for the XRP/USDT pair. Notably, the Binance Funding Rate for the pair retreated massively from the negative to the positive area by press time.

Similarly, XRP’s recent negative weighted sentiment significantly improved as it moved closer to the neutral line. All these conditions could imply an imminent price reversal for XRP.

Nonetheless, XRP’s development activity also declined sharply. Can the drop in development activity change investors’ confidence and block the price reversal?

![Ripple [XRP]: Traders could profit from short-selling at $0.332, but…](http://egrowonline.com/wp-content/uploads/2022/12/jonathan-cosens-photography-TNTx5XKzcjg-unsplash-1000x600-360x180.jpg)