A widely followed crypto strategist believes that Bitcoin (BTC) is gearing up for a massive rally next year.

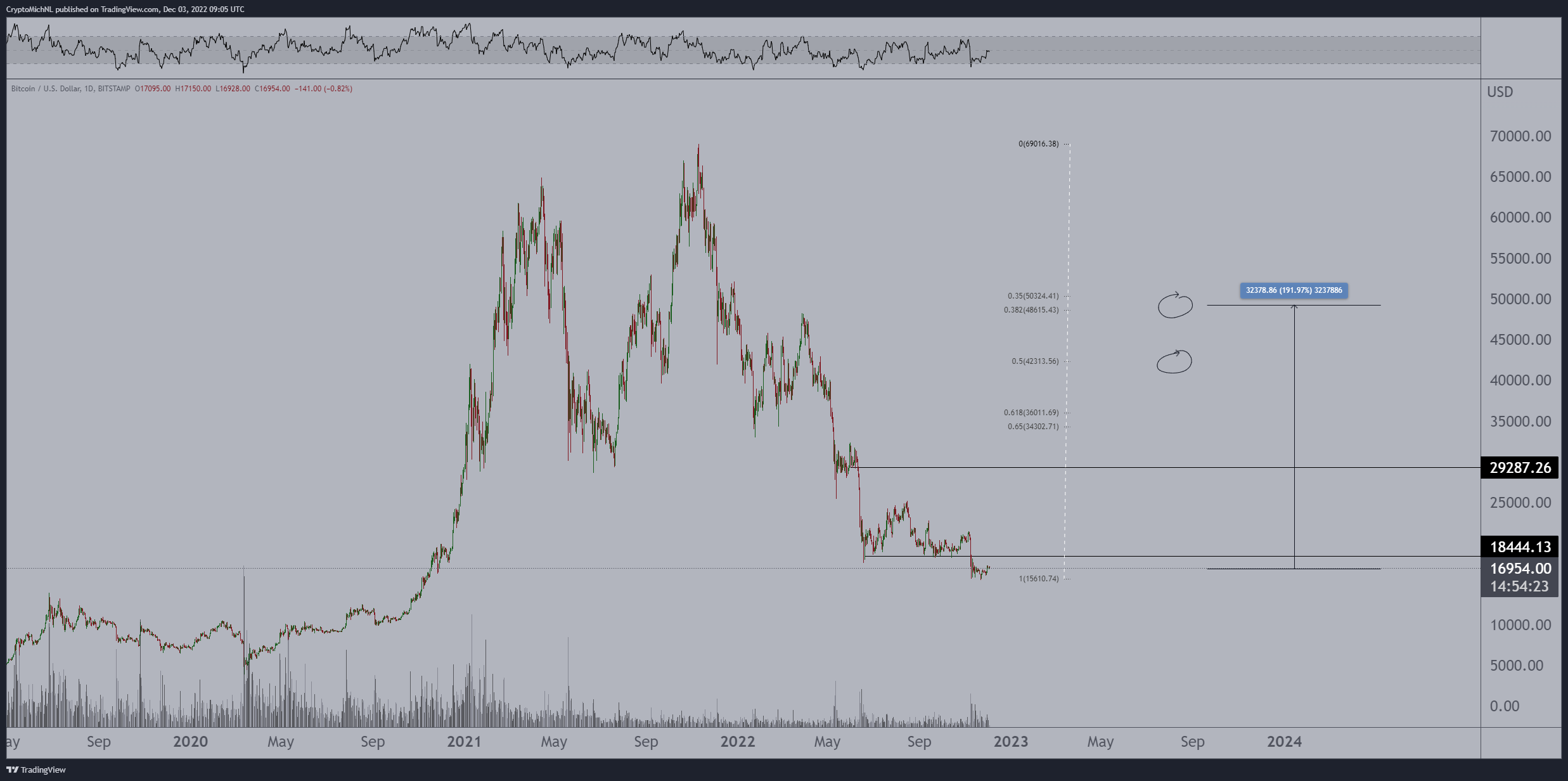

Analyst Michaël van de Poppe tells his 642,700 Twitter followers that he expects Bitcoin to ignite big rallies toward his targets of $42,313 and $50,324 by June 2023 based on key Fibonacci levels.

“Relief rally targets for Q2 2023 on Bitcoin.”

At time of writing, Bitcoin is switching hands for $17,321, a 1.63% increase on the day.

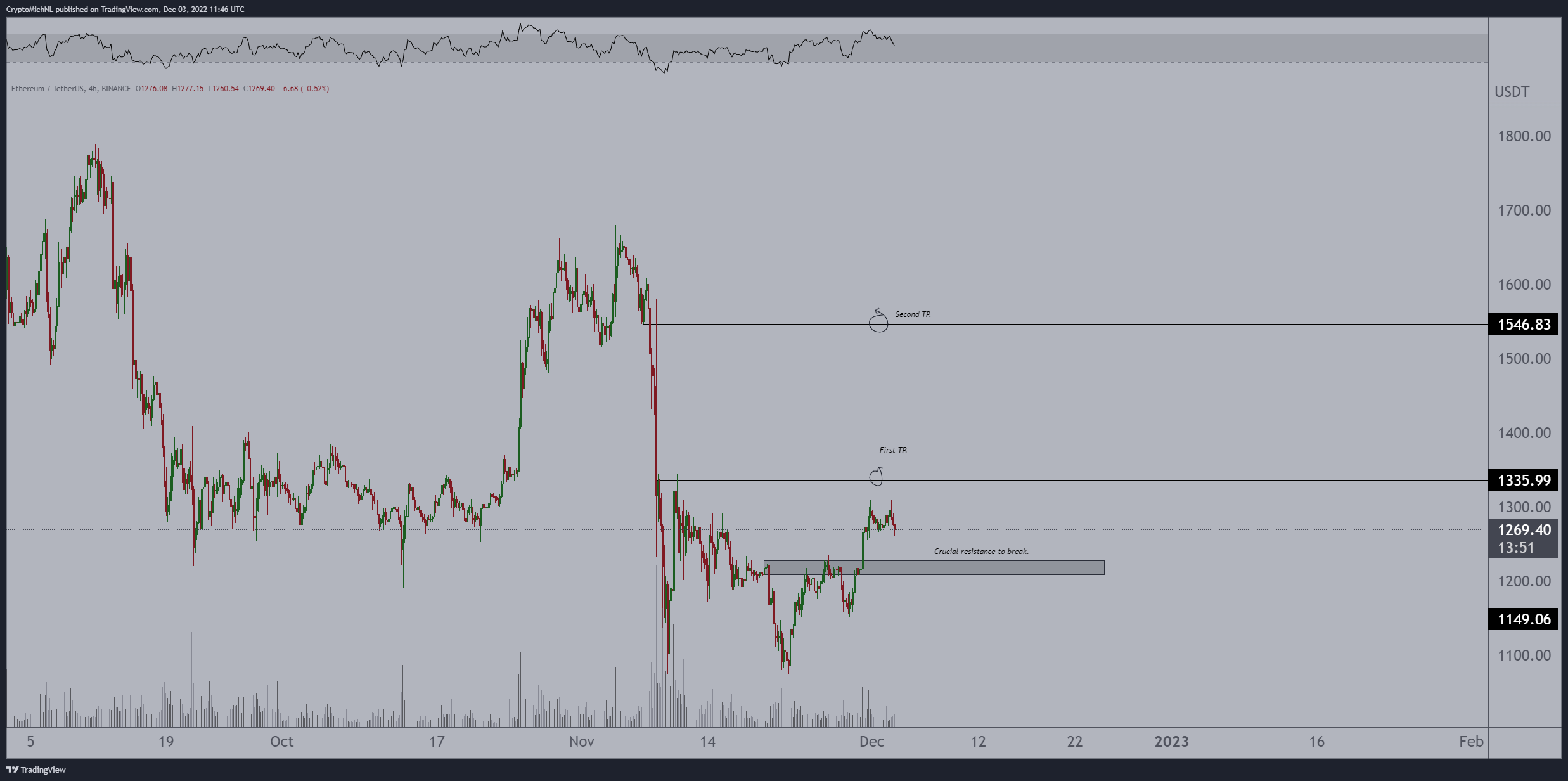

Van de Poppe is keeping a close watch on Ethereum (ETH), which he says is likely setting up for bullish continuation after taking out resistance at $1,200.

“Ethereum didn’t hit target price and, if I were looking for longs, didn’t reach optimal entry zone. Still waiting for continuation, which seems likely after this breakout.”

At time of writing, Ethereum is swapping hands for $1,290, up 2.45% in the last 24 hours.

Next up is Cosmos (ATOM), an ecosystem of blockchains designed to scale and communicate with each other. According to Van de Poppe, Cosmos also looks good for bullish continuation as long as it is trading above $10.

“This one looks a bit in the middle. Good resistance to support flip and reclaim of $9.40, but nothing strong further. Prefer to hold around $10 for continuation and then I’d be looking at $12.25 next.”

At time of writing, ATOM is changing hands for $10.41, up 3.38% on the day.

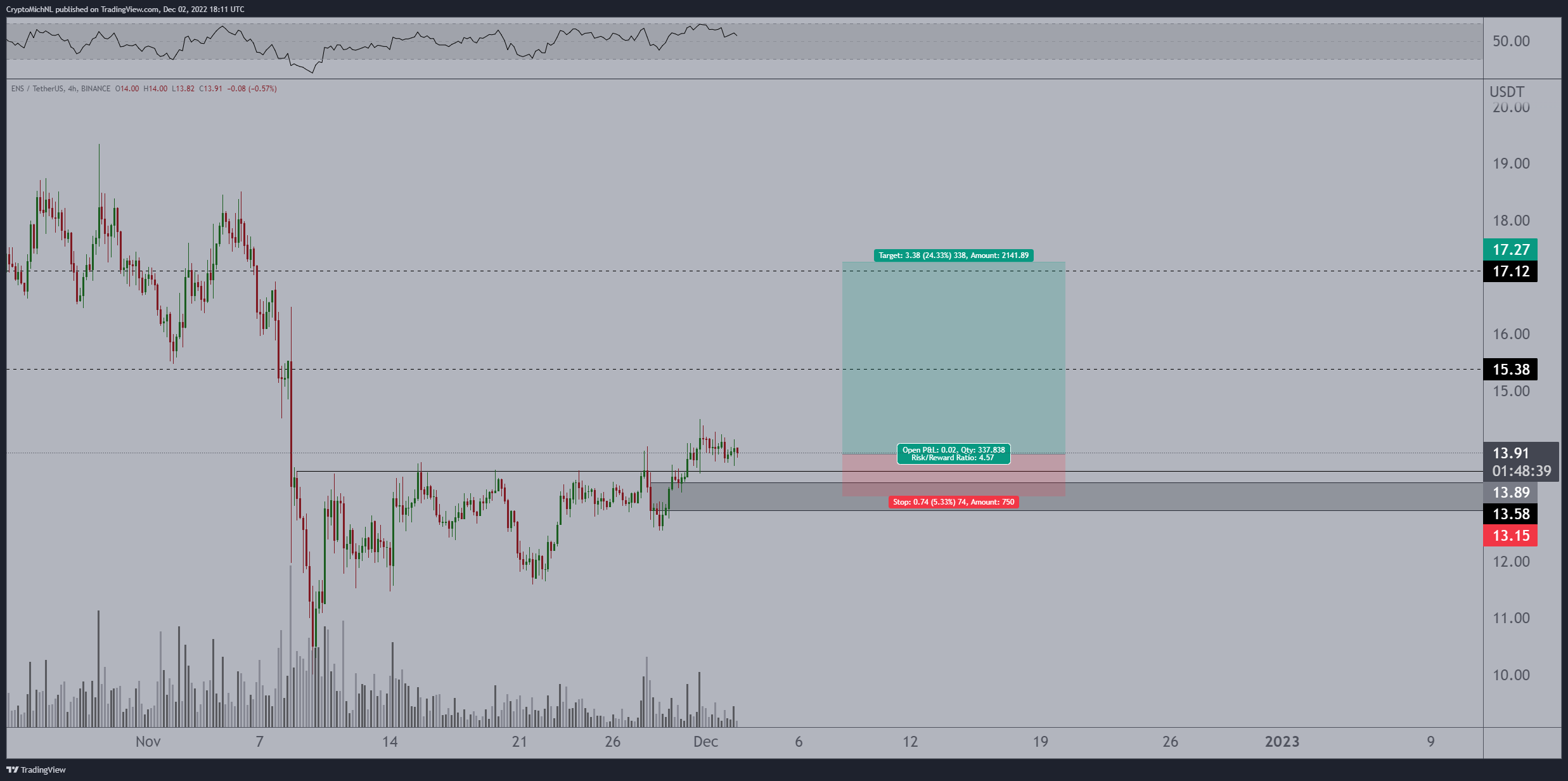

The last coin on the trader’s radar is Ethereum Name Service (ENS), a project that aims to allow users to create personalized domain names for their crypto address. According to Van de Poppe, ENS looks good for a rally after converting resistance around $13 into support.

“Breakout above $13 and now a resistance to support flip. Most likely leading towards continuation and then I’d be targeting $15.40 and $17.”

At time of writing, ENS is valued at $14.54, up 3% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/eliahinsomnia