On November 25, Bitcoin, the leading cryptocurrency, failed to break above the $16,800 level and began to fall toward the 38.2% Fibonacci retracement level. Similarly, Ethereum, the second most valuable cryptocurrency, has followed Bitcoin’s lead and is currently trading bearishly toward $1,160.

The reason for the market’s risk-off sentiment could be related to recent Hodlnaut updates.

According to Bloomberg news, the Commercial Affairs Department, the Singapore police’s white-collar crime unit, is investigating Hodlnaut, a Singapore-based crypto lender that is currently under interim judicial management.

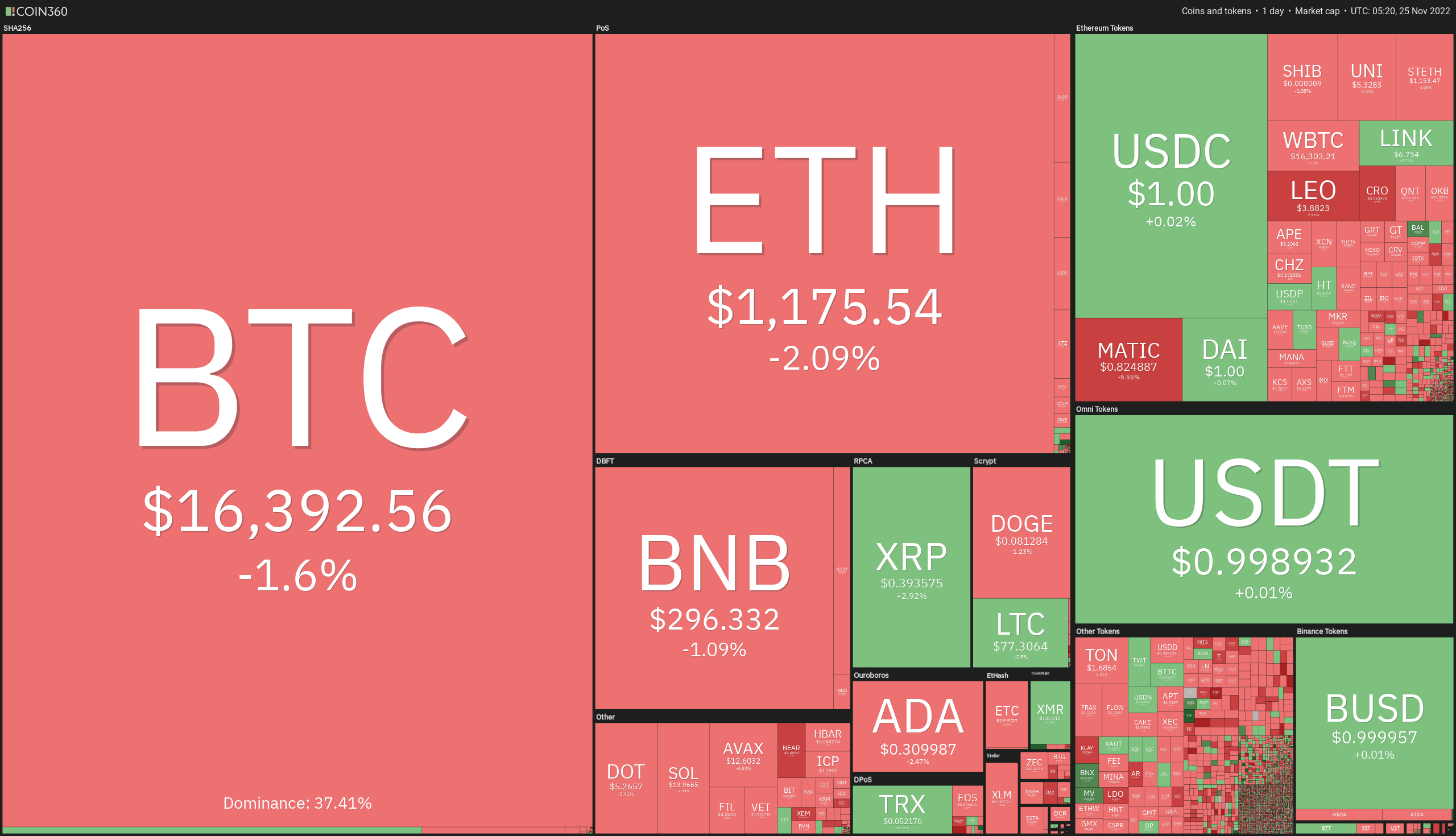

Crypto Market Cap Update

Major cryptocurrencies were trading unevenly early on November 25th, as the global crypto market cap fell 1% to $828.27 billion on the previous day. In contrast, the total crypto market volume fell 47% in the last 24 hours to $48.87 billion.

The overall volume in DeFi was $3.21 billion, accounting for 6% of the total 24-hour volume in the crypto market. The overall volume of all stablecoins was $44.98 billion, accounting for over 93% of the entire 24-hour volume of the crypto market.

Let’s take a look at the top 24-hour altcoin gainers and losers.

Top Altcoin Gainers and Losers

BinaryX (BNX), Huobi Token (HT), and Stacks (STX) are three of the top 100 coins that have gained value in the last 24 hours. The BNX price has soared by more than 7% to $169, the HT price has grown by more than 5% to $5.65, and the STX price has increased by nearly 1.5%.

UNUS SED LEO (LEO), Klaytn (KLAY), and Arweave (AR) are three of the top 100 coins that have lost value in the last 24 hours, where LEO and KLAY have lost over 7% to trade at $3.88 and $0.17, respectively. At the same time, AR’s price is down over 6% to trade at $8.95.

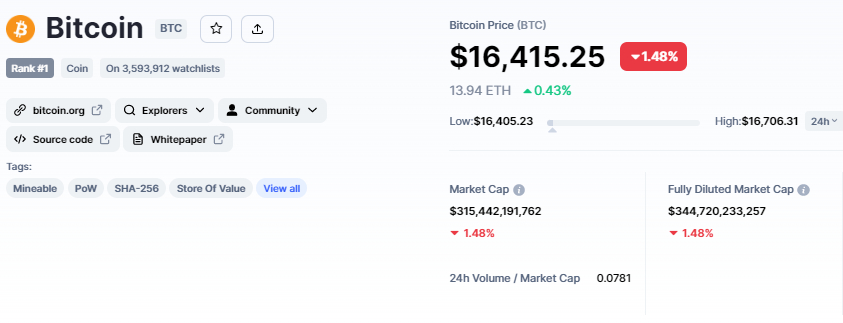

Bitcoin Price

The current Bitcoin price is $16,418 and the 24-hour trading volume is $24 billion. During the last 24 hours, the BTC/USD pair has dropped nearly 1.5%, while CoinMarketCap currently ranks first with a live market cap of $346 billion, down from $350 billion yesterday. It has a total supply of 21,000,000 BTC coins and a circulating supply of 19,216,412 BTC coins.

Looking at the technicals, Bitcoin has yet to break through the $16,785 barrier, despite dovish FOMC meeting minutes. Investors appear to be experiencing FUD as a result of FTX and now Hodlnaut news.

The BTC/USD pair is currently descending towards a 38.2% Fibonacci retracement level of $16,300. On the 4-hour timeframe, it has already crossed below the 50-day moving average line, indicating a selling bias.

Similarly, the leading technical indicators, such as the RSI and MACD, are very close to entering a selling zone, and if this occurs, BTC may break below the $16,300 mark and reach a support level of $16,000. The next level of support is set at $15,600.

A bullish breakout of the $16,785 level, on the other hand, could expose BTC to the $17,000 or $17,550 level.

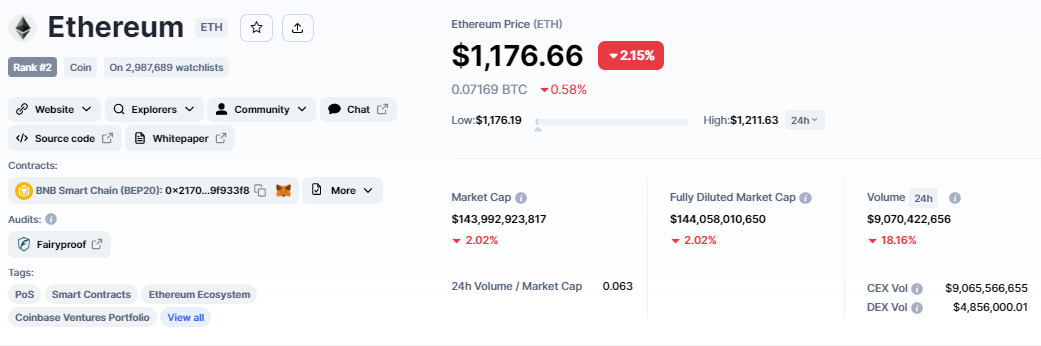

Ethereum Price

The current price of Ethereum is $1,177, with a 24-hour trading volume of $9 billion. In the last 24 hours, Ethereum has gained over 2%. CoinMarketCap currently ranks #2, with a live market cap of $144 billion. It has a circulating supply of 122,373,866 ETH coins.

On the 4-hour chart, Ethereum is trading bearish at $1,176 and has formed a bearish engulfing candle, indicating the possibility of a market bearish bias.

ETH is currently testing the 50-day moving average line at $1,175 and a bearish crossover below this level could lead to a 38.2% Fib level of $1,160.

A further break below this level could take ETH to $1,145 or $1,130 levels, which correspond to 50% and 61.8% Fibo levels, respectively.

On the upside, ETH’s major resistance remains at $1,216, and a break above this could take it to the $1,250 level. Later today, investors should keep an eye on the $1,160 level, as failure to break below this level could result in a bullish bounce or vice versa.

Litecoin Jumps 23%

The current price of Litecoin is $77, with a 24-hour trading volume of $1.1 billion. Litecoin has gained more than 1% in the last 24 hours, but its weekly gain is more than 23%. CoinMarketCap is currently ranked 13th, with a live market cap of $5.5 billion.

It has an 84,000,000 LTC coin maximum supply and a circulating supply of 71,687,456 LTC coins.

Some of the most well-known experts in the cryptocurrency market have commented on Litecoin’s recent price increase, predicting that the cryptocurrency will undergo a massive breakout following the “large accumulation” period that preceded its upcoming halving event.

Pseudonymous crypto analyst Kaleo recently told their over 500K Twitter followers that LTC’s recent surge appears to be the “real deal” because the cryptocurrency has been “long overdue for a solid pump.”

According to Kaleo, Litecoin’s price has long troughs during which it moves slowly downward, followed by rapid peaks.

After “a very substantial accumulation,” Smart Contracter, another well-known cryptocurrency expert, observed that LTC seems to be breaking out of its range.

Per the analyst, BTC tends to bottom approximately 500 days before its next halving event, and LTC’s breakthrough is happening fewer than 230 days ahead of its own halving.

Litecoin Price Prediction

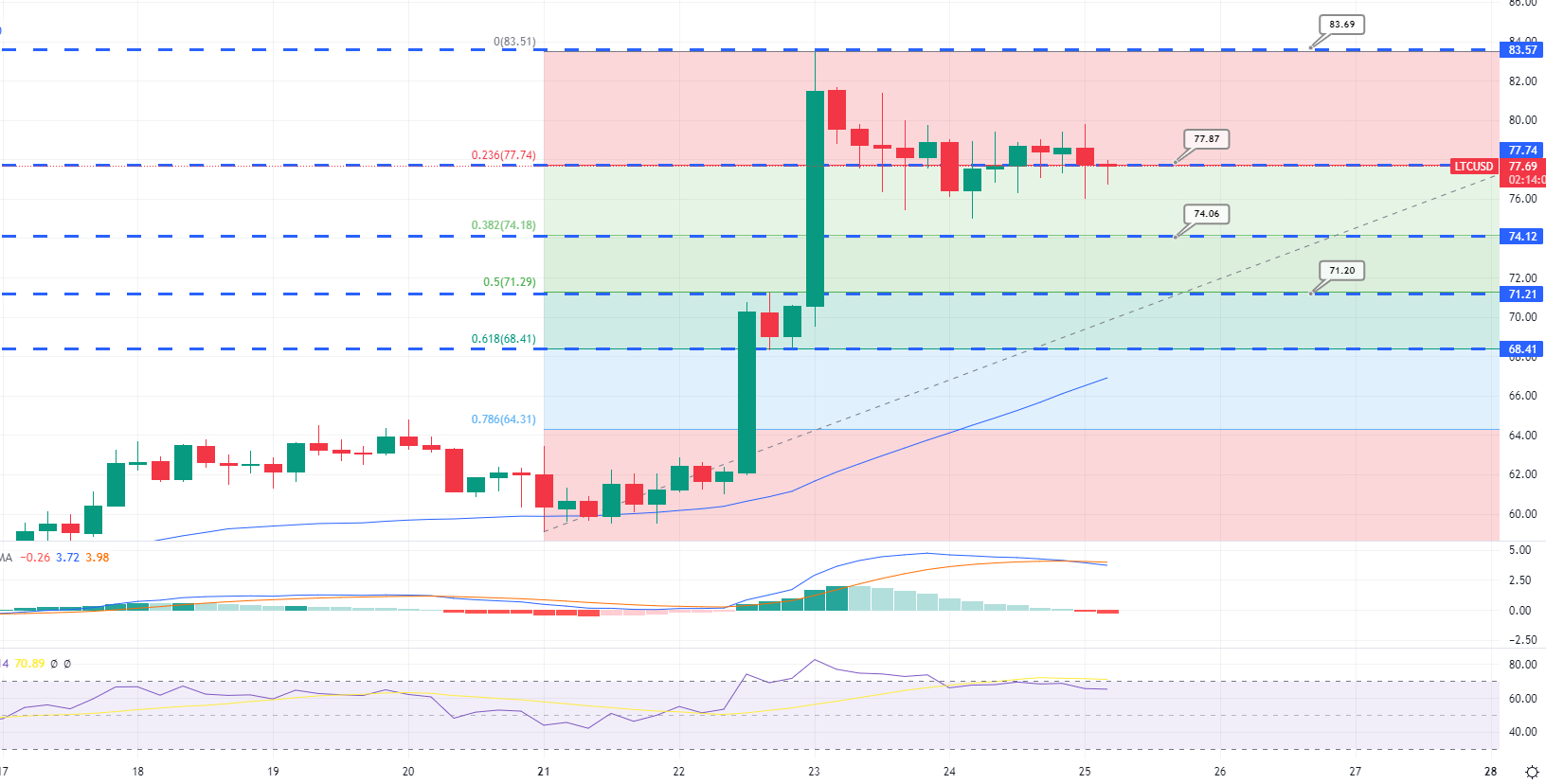

Litecoin was rejected below the $83.65 resistance level on the technical front, and candle closings below this level triggered a bearish correction.

Litecoin has already completed a 23.6% Fibonacci retracement and is now descending toward $74, which is extended by a 38.2% Fibonacci retracement. The LTC/USD pair is expected to reverse bullishly above the $74 or $68.75 (61.8% Fibo level) support levels.

Presale Cryptocurrency With Enormous Potential Gains

Dash 2 Trade (D2T)

Dash 2 Trade is an Ethereum-based trading intelligence platform that provides traders of all skill levels with real-time analytics and social data, allowing them to make more informed decisions.

D2T, developed by the Learn 2 Trade service, provides investors with market-driven insights, trading signals, and prediction services. Customers will be given enough information to make informed decisions, according to the cryptocurrency initiative.

D2T began selling tokens three weeks ago and has raised more than $6.9 million. Following the presale, D2T will be listed on LBank and BitMart, with a significant increase in asset price expected.

The current value of 1 D2T is 0.0513 USDT, but this is expected to rise to $0.0533 in the next stage of sales and $0.0662 in the final stage.

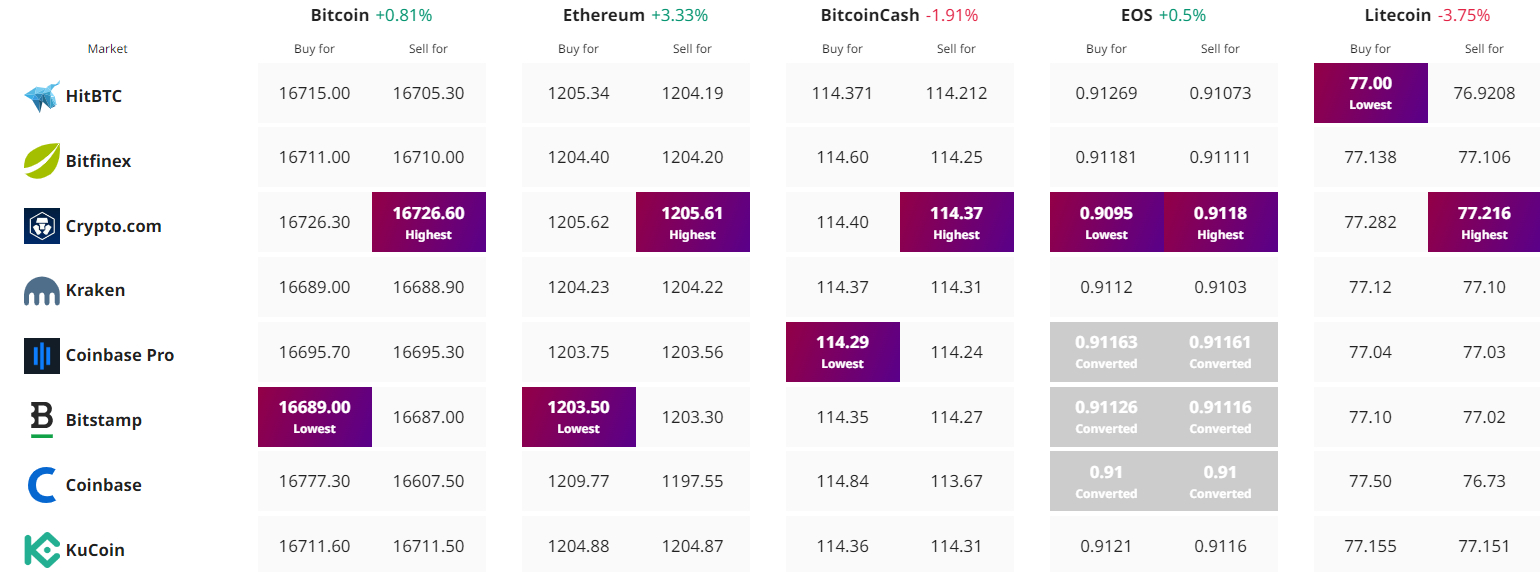

Find The Best Price to Buy/Sell Cryptocurrency