- Immediate targets for long trades are at two Fib levels and $0.4465

- Improved sentiment and development activity propping up XRP price

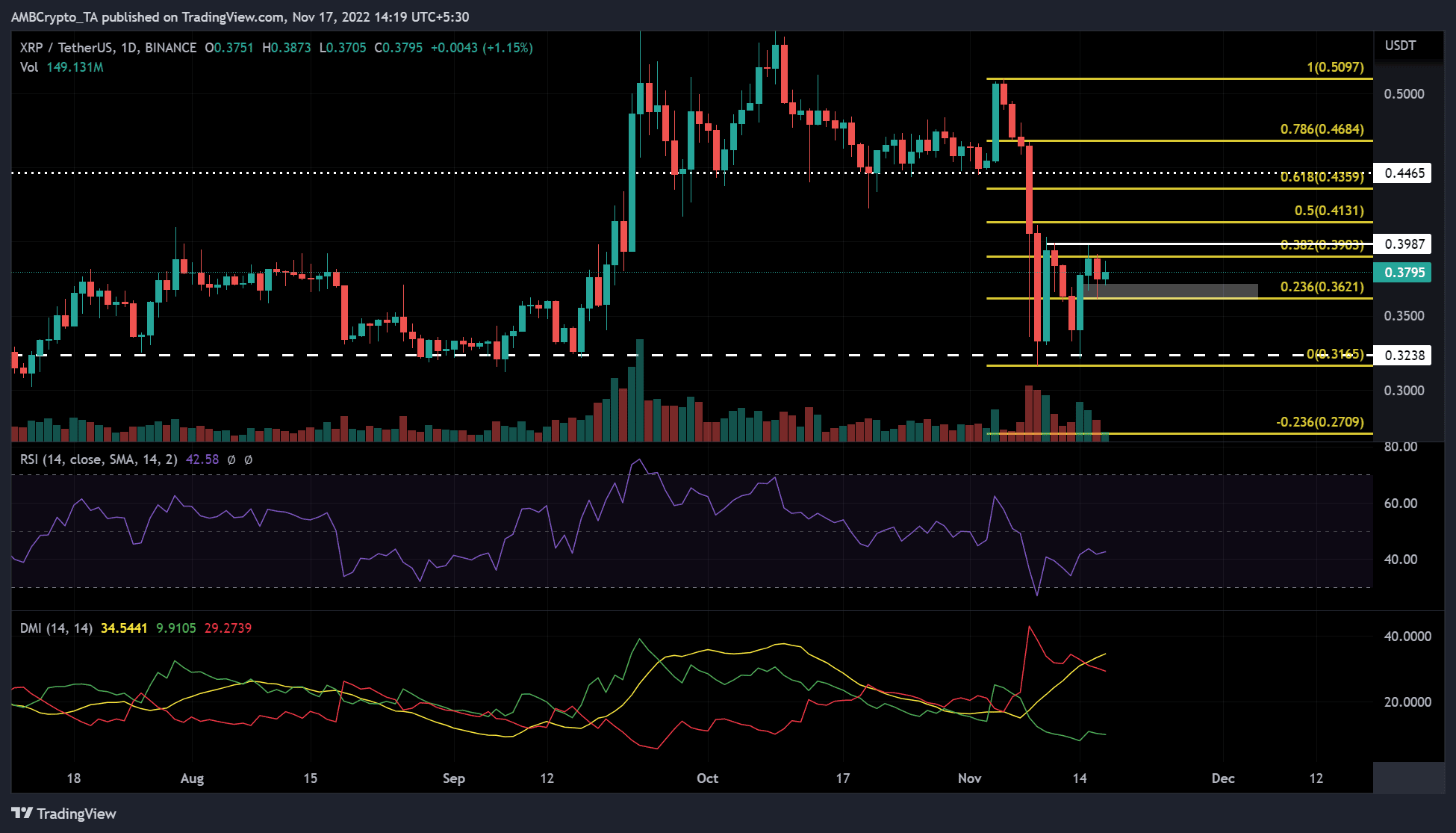

Ripple (XRP) has shown mild bullish momentum on the lower timeframe charts. On the daily chart, XRP is facing four resistance levels to reach its October levels. At press time, XRP was trading at $0.3795.

If the bulls build enough buying pressure and the range is above the 0.236 Fib level support zone, the following resistance levels can be targets for long trades.

Ripple (XRP) faced a bearish order block at the 0.382 Fib level ($0.3903) on November 16. On November 10, a similar bearish order block was recorded at $0.3987.

As the Relative Strength Index pulls back from oversold territory, sellers are losing momentum. This could give the bulls a chance to push XRP higher. If the bulls maintain their momentum, they could break through the two bearish order blocks and head for more resistance levels.

This would make $0.3903, $0.3987, the 0.5 Fib level, and $0.4465 targets for long trades. The $0.4465 was a critical support level in October that was tested four times before XRP broke through it and other lower supports as it headed lower.

A daily close below the current support zone at $0.3621 would invalidate the above bullish theory. The DMI shows that the red line is above the green, so sellers still have leverage. Therefore, sellers should keep an eye on $0.3238 and $3165 as possible new supports if XRP falls below the current support level.

Improved development activity and sentiment

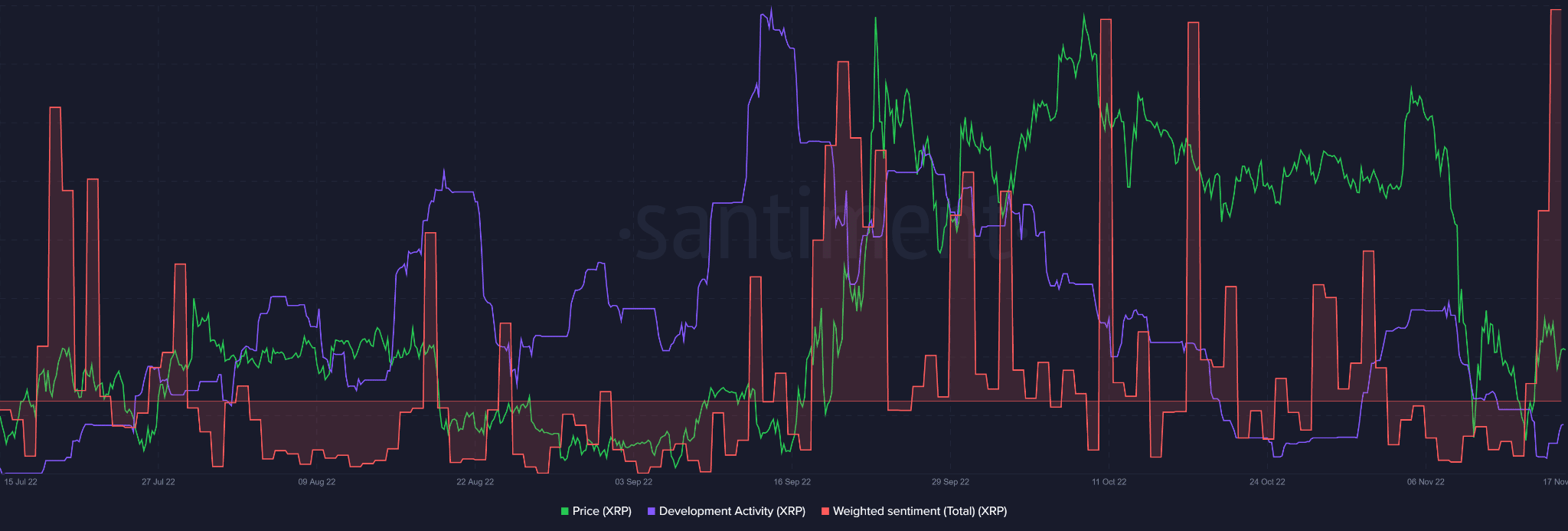

According to Santiment, XRP’s weighted sentiment has improved in positive territory. This indicates a bullish outlook for Ripple. In addition, at the time of writing, there has been an upswing in development activity.

These two positive metrics are a good sign for the XRP price. However, enough volume and buying pressure will be needed to break through the two order blocks.

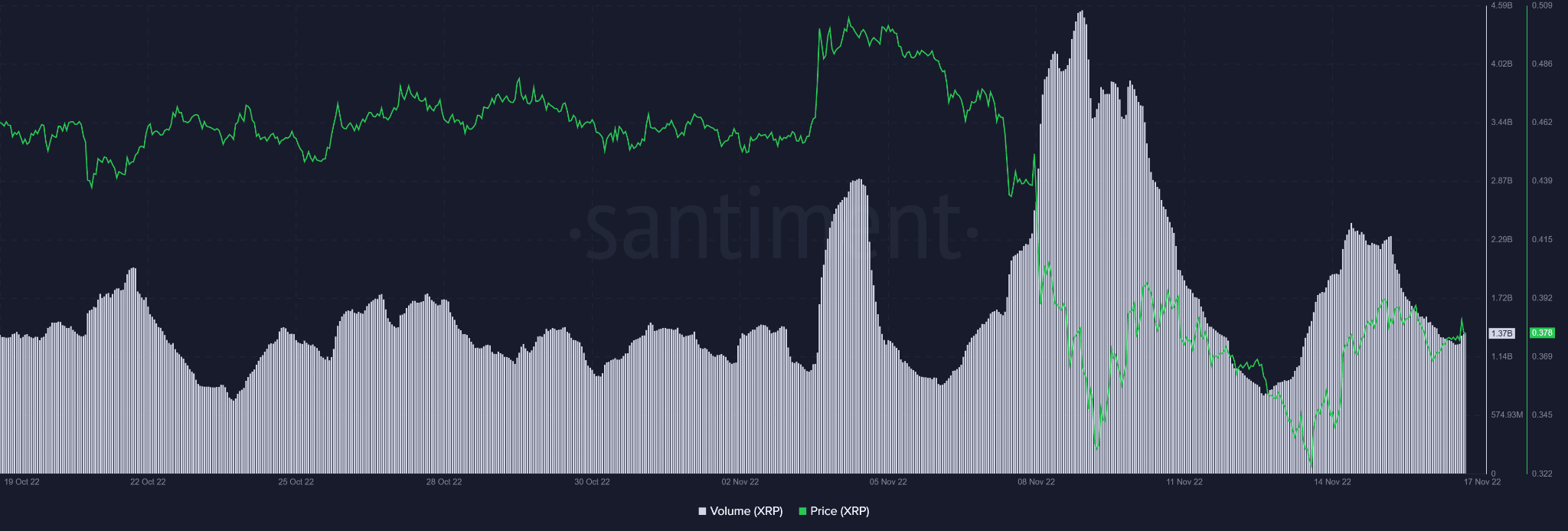

Santiment data showed that the price rally was not yet attracting high trading volumes, at the time of writing. Therefore, potential selling pressure could be imminent if the bulls do not muster enough volume.