The overall crypto market cap has surpassed the $1 Trillion mark. The alts like ETH, DOGE, and TON have supported BTC’s contribution to the market cap.

According to CoinGecko, the global cryptocurrency market cap has surpassed the $1 Trillion mark. The top gainers on CoinGecko are Kompete, PointPay, and Illuvium. However, the large-cap and midcap rally contributes the most to the total market cap.

Bitcoin BTC price analysis

In a daily timeframe, Bitcoin has broken out of the double bottom pattern. As the price is significantly above the neckline at $20,367, it is highly likely to give a daily close above it today.

However, the price is battling immediate resistance of the 100-day Simple Moving Average (SMA) at $20,908, the 20-week SMA at $21,046, and the 100-day Exponential Moving Average (EMA) at $21,227. These resistances may slow down the rally of Bitcoin.

However, a daily close above all these resistance can easily send the price to over $23,000 levels.

The total crypto market cap price analysis

The total crypto market cap on TradingView calculates the total of just the top 125 coins. Hence there is a difference in the market cap reported by CoinGecko that considers over 13,260 coins.

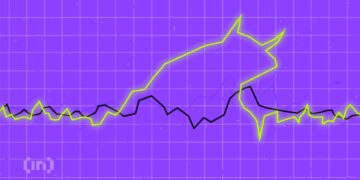

The total crypto market cap had a similar breakout to that of Bitcoin. It broke out from the neckline of the double bottom at 940.122bn with the support of volume. Although the price is trading over the 20-week SMA, it is battling the resistance of the 100-day SMA and the 100-day EMA.

If there is a close above these resistance levels, the price can visit the $1 Trillion area.

The $1 Trillion market cap is a massive milestone for crypto. The community is happy because the crypto market is showing bullish strength for the first time in weeks.

Got something to say about the market cap or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.