A closely followed trader says that he’s investing in one Solana-based (SOL) move-to-earn project with the expectation that the token will spark a series of massive rallies.

The pseudonymous crypto trader known as Capo tells his 551,000 Twitter followers that he thinks the crypto markets will pick a direction early next month once the Federal Reserve confirms another interest rate hike.

According to Capo, Bitcoin (BTC) will lead a crypto market correction after the Fed announces either a 75 or 100 basis points rise in rates.

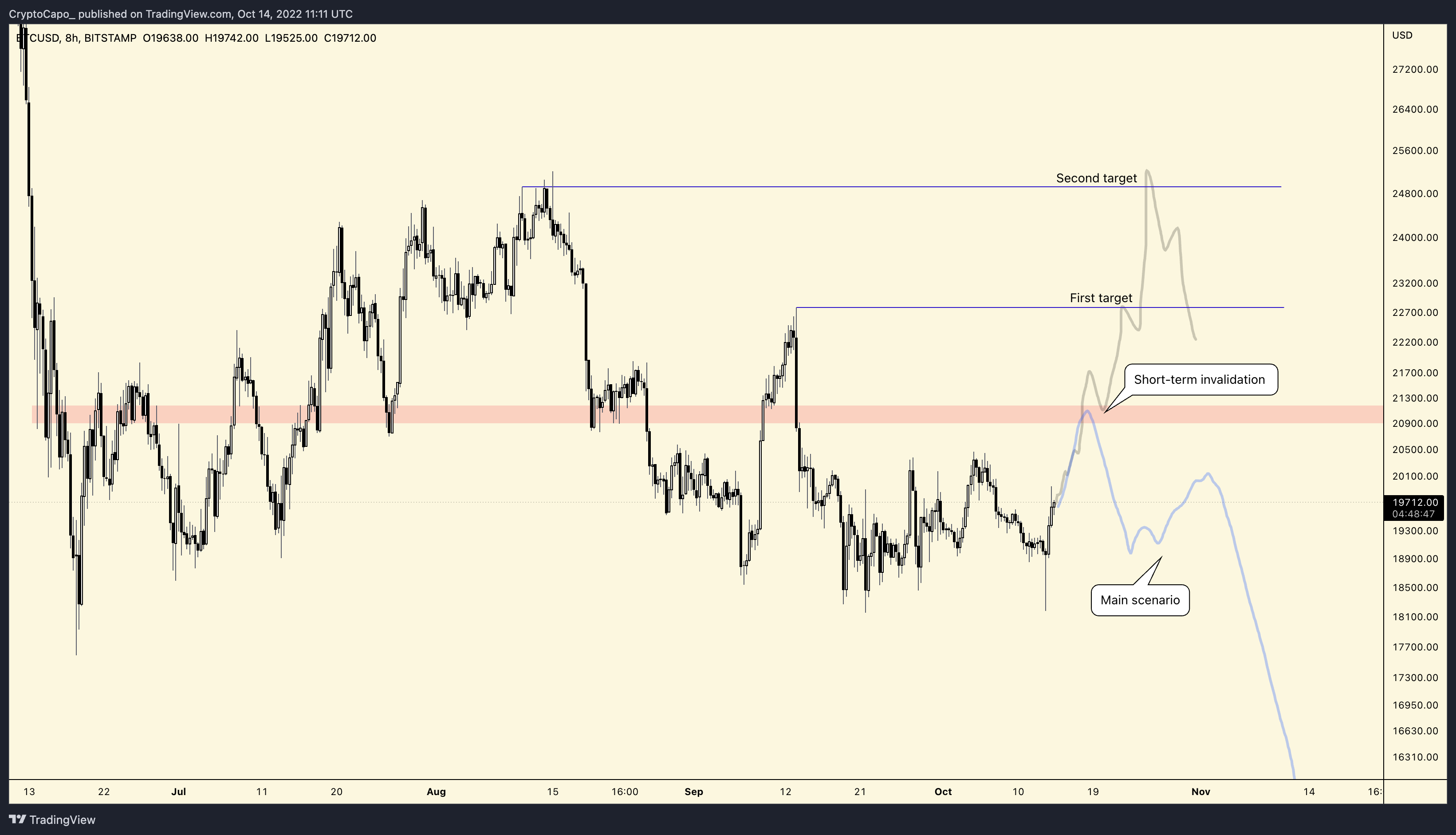

“BTC potential roadmap.”

Capo says that BTC is currently above the $19,000 mark because yesterday’s dip lower was more of a deviation than a direct price impulse downward. He says a rally to $21,000 or more is still likely before a dramatic correction to the $14,000 level.

“Right now price is back above $19,000 so the move below this level is considered as a deviation (bullish).

Demand coming in confirms this. There’s fuel to keep going up.

Short squeeze is not over and $21,000 is very likely. Then I will turn full bearish again and wait for new lows.”

While $21,000 is the trader’s base case, he’s still staying prepared for a potential break through of that resistance level to other targets in the mid $20,000s.

“From what I see now, $21,000 should act as resistance. It could go to $21,100, $21,200… as long as it doesn’t break that level on a HTF [higher time frame] close.

Example on chart.”

Looking at the altcoin market, Capo says he just grabbed a bag of STEPN (GMT), the popular move-to-earn project built on the Solana blockchain.

According to the trader, GMT is gearing up for a hefty 42% rally from its current price of $0.58 up to the $0.84 range.

Based on Capo’s chart, he also foresees a subsequent 60% dip from the $0.84 level all the way down to $0.33 before igniting a powerful 248% bull run to the $1.15 area.

“Just bought a bag of GMT.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.