A leading digital asset analytics firm says one reliable technical indicator is suggesting that weak hands have already left the crypto markets.

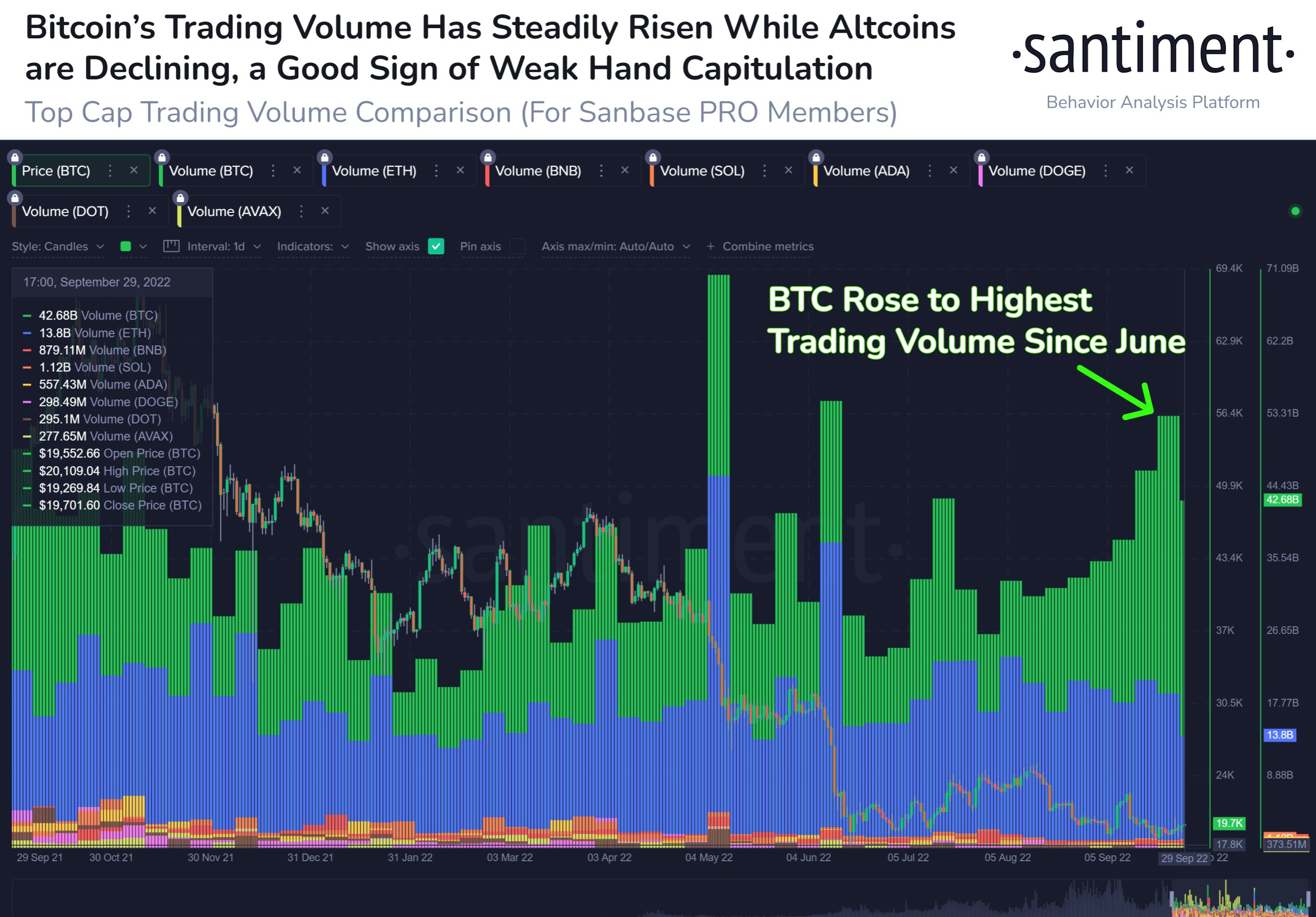

Santiment says it’s keeping a close watch on Bitcoin’s (BTC) volume, which the firm says has been in an uptrend since June when the king crypto printed its current bear market low.

According to the analytics firm, the surge in Bitcoin’s volume at the expense of trading activity in altcoins indicates that crypto tourists have been rinsed out of the markets.

“Bitcoin’s trading volume has steadily risen since mid-June, while other top cap assets are declining. Trader interests are beginning to return to relative safe-haven assets like BTC, while the rest of the markets have less trading interest.”

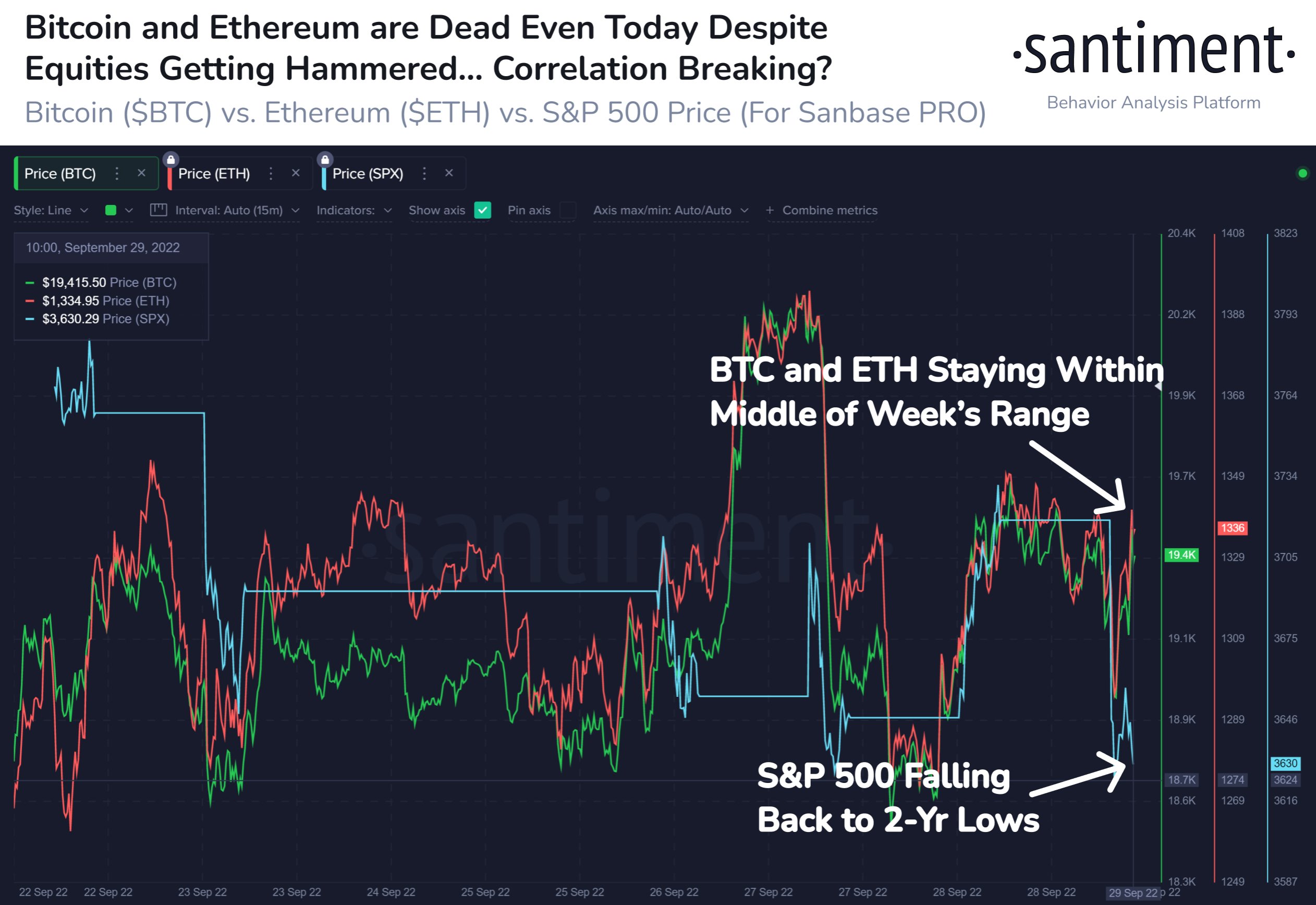

Santiment also highlights that BTC’s rising volume comes as Bitcoin continues to show strength in the face of heavy selling in the stock market.

“Bitcoin has stuck around $19,000 and Ethereum at $1,340 today. But the story is the fact that they are doing so without the support of the S&P 500, which is down 2.4%. If the correlation is easing between crypto and equities, this is very encouraging.”

Popular crypto strategist Rager is also noticing the difference in the short-term price action of Bitcoin and the S&P 500 (SPX). Rager predicts Bitcoin will rally once the stock market shows signs of life.

“If you want to be encouraged just compare the SPX and BTC charts.

Since the 22nd of Sept, equities index downtrend while Bitcoin, while choppy, has maintained a relatively sideways.

You better believe Bitcoin will have a strong reaction when the stock market reverses up.”

At time of writing, BTC is changing hands for $19,333, up over 4% in the last seven days, while the S&P 500 is down more than 2% over the same timeframe.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/vvaldmann/Andy Chipus