cemagraphics

After a steep decline in the first half of 2022, global investments in cryptocurrencies are expected to continue for the rest of the year, as they keep suffering from a raft of macroeconomic headwinds, KPMG contended in a recent report.

Crypto-related investments slumped to $14.2B in H1 from an all-time high of $32.1B in 2021 due Russia’s war in Ukraine, persistently high inflation and challenges experienced by May’s meltdown of the formerly prominent Terra ecosystem, according to the global audit and consulting firm. That’s on top of central bank tightening and mounting recession fears.

For the back half of 2022, KPMG has called for a “slowdown in crypto interest and investment, particularly retail firms offering coins, tokens and” non-fungible tokens. Fintech-focused blockchain infrastructure projects, meanwhile, could attract more investment, it said.

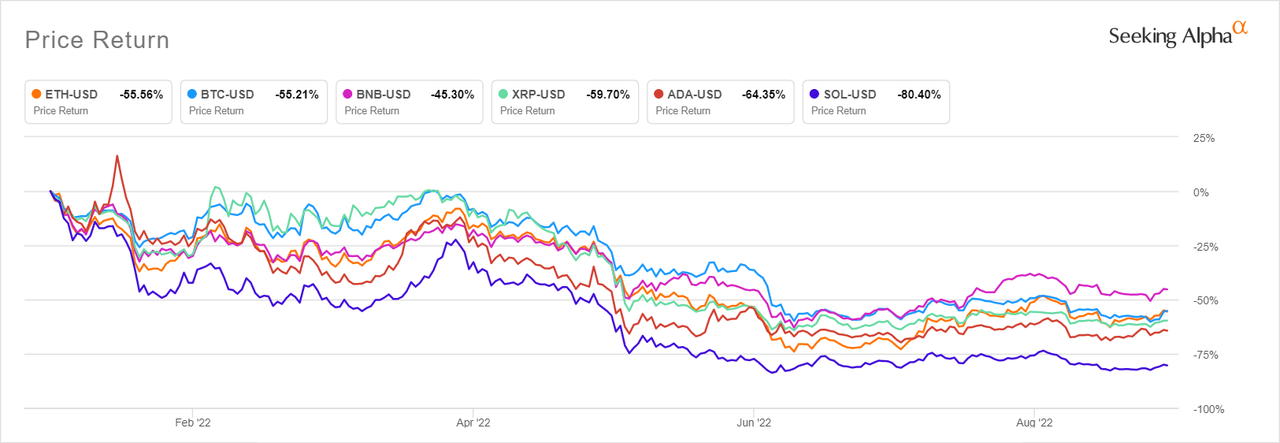

That would follow an already tough year for cryptos, with both bitcoin (BTC-USD) and ether (ETH-USD) down over 55% year-to-date. Take a look the chart below to see how the six-largest tokens by market cap have fared since the start of 2022, as of Friday afternoon.

SA contributor The Digital Trend gives bitcoin (BTC-USD) a Strong Buy rating, saying it “may have bottomed already, but isn’t ready to rally just yet” in the wake of an uncertain macro environment. The token has been trading rangebound since mid-June between $18.95K-23.85K.

While institution-driven crypto investments continue to fall, they remained well above all years prior to 2021 at mid-year, KPMG noted, highlighting “the growing maturity of the space and the breadth of technologies and solutions attracting investment.” For example, 2020’s crypto investments stood at just $5.7B, and $5.3B in 2019.

Going forward, though, “we are going to see some cryptos cutting their valuations and working to raise money because it’s their only option,” said Alexandre Stachtchenko, director of blockchain and crypto assets at KPMG France.

Crypto firms that are poorly managed and don’t have robust value propositions will probably die out in the ongoing market downturn, which “could actually be quite healthy from an ecosystem point of view because it’ll clear away some of the mess that was created in the euphoria of a bull market” in 2021, Stachtchenko added.

Previously, (Sep. 9) FTX’s Sam Bankman-Fried says the real pain in cryptos is likely over.