bennymarty/iStock via Getty Images

Introduction

We’re currently on the hunt for alpha in the Bitcoin mining sector. Since May 2021, we’ve been warning investors about a coming bear market that was depicted by Bitcoin’s (BTC-USD) decade-old cycle. More specifically, we discouraged investors from taking positions in Bitcoin mining companies as Bitcoin mining companies are more volatile than Bitcoin and possess additional risks such as insolvency. We’ve recently updated our outlook on Bitcoin and expect Bitcoin to end its bear market by end of 2022 before entering its recovery phase that spans another 1 to 2 years. Therefore, this will be a good time to seek alpha in the Bitcoin mining sector.

For instance, we found that Iris Energy (IREN) has hard assets in excess of total liability and is valued more than its market cap. This implies that investors are getting its Bitcoin mining business for free. We explained that this is because Bitcoin mining is a loss-making business given Bitcoin’s current price and that the market is expecting the losses to eat into IREN’s balance sheet. Other key insights that make IREN an appealing company to invest in are also discussed.

In this article, we’re going to examine how Soluna Holdings (NASDAQ:SLNH) is positioning itself in the Bitcoin mining sector and whether it offers investors with sufficient investment value proposition.

Soluna’s Business: Creating Economies In Wasted (Curtailed) Energy Subsector

Soluna’s business is a very straightforward one. It is to create an economy in the curtailed (wasted) renewable energy subsector. Soluna locates sites with curtailed energy (that meets its criteria such as site operating costs between $0.025 to $0.026 per kWh) and then build facilities around them to produce marketable products and services (Batchable Computing).

Cost Control Benchmark (Soluna)

Although Batchable Computing may include computing applications such as scientific computing, artificial intelligence, and cryptocurrency mining, 100% of Soluna’s revenue is still derived from Bitcoin mining. Moreover, Soluna’s 2023 guidance indicates that Soluna will not be pivoting to other batch computing applications yet as it is still focused on the capacity to mine Bitcoin. We speculate that Soluna started with Bitcoin mining because Bitcoin mining has a relatively lower barrier to entry. That being said, we highly value Soluna’s ability to pivot to other types of batchable computing applications. We’ve also mentioned this feature when examining IREN. This idea was inspired by Kevin O’Leary when he mentioned that he invested in hydropower facilities to mine Bitcoin but is open to pivoting to host data centers for Microsoft should Bitcoin mining become unprofitable.

Therefore, Soluna is currently creating an economy in the curtailed energy subsector by buying curtailed renewable energy to mine Bitcoin and then sell Bitcoin for cash. Providers of the curtailed renewable energy get to operate at scale and improve the visibility of earnings while Soluna gets to profit from the difference between the mining cost and Bitcoin’s price.

Soluna to hedge against BTC downturn (Soluna) Soluna emphasizing its actual targeted sectors during monthly presentations (Soluna)

Threat to Soluna’s Business Sustainability

As mentioned above, Soluna’s business model is built on acquiring curtailed renewable energy. But we find that the sustainability of this business model is under threat.

Curtailment of renewable energy refers to renewable energy generators not operating at 100% capacity. Curtailment happens for 2 main reasons, system-wide oversupply, and local transmission constraints. System-wide oversupply refers to the situation where the supply of renewable energy exceeds demand such that renewable energy generators are not required to operate at 100%. On the other hand, local transmission refers to the lack of infrastructure to deliver electricity from the location of production to the location of demand.

Understanding the reasons for curtailment is crucial because a large amount of effort has been invested to reduce the curtailment of renewable energy. As a result, the curtailment of renewable energy has shrunk by 5% in 2021.

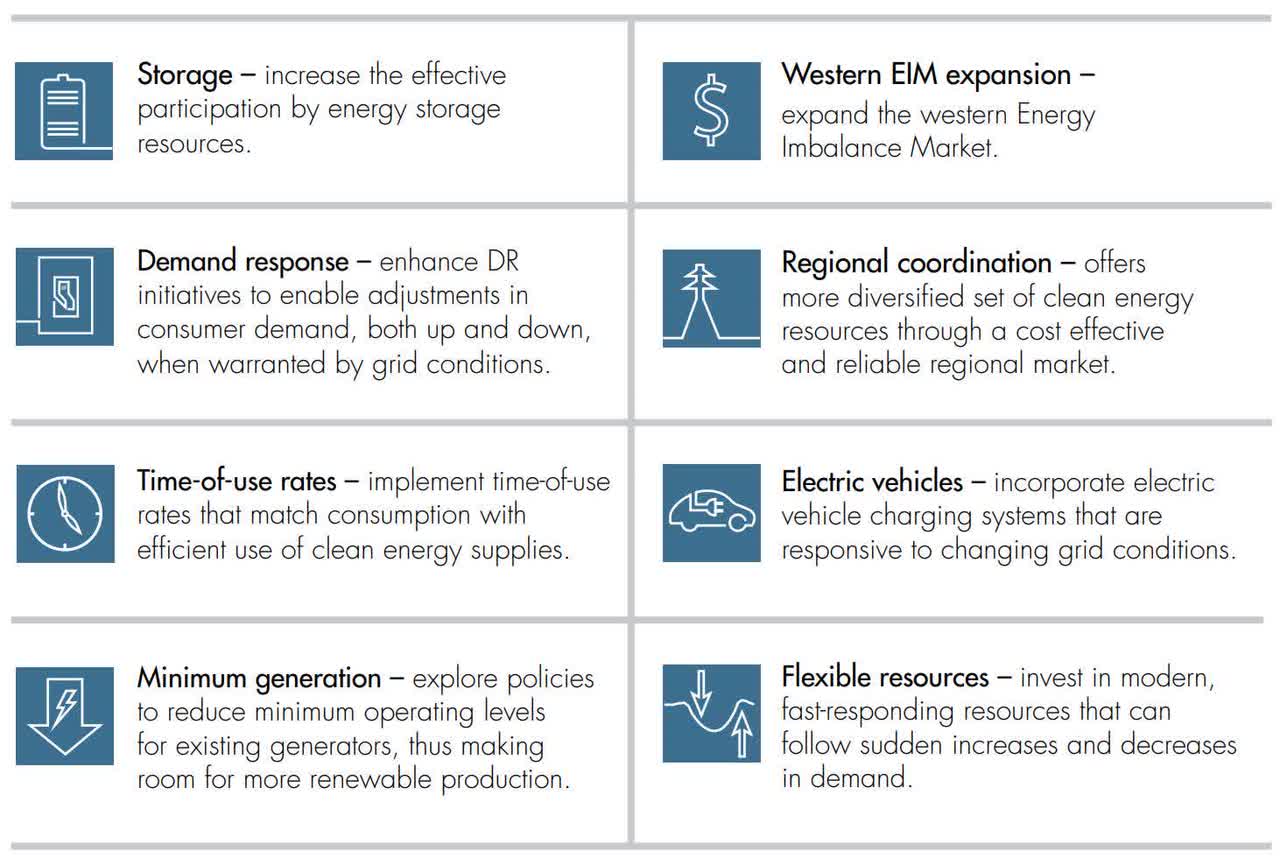

California Independent System Operator (CAISO) listed 8 ways to reduce the curtailment of renewable energy. For instance, the adoption of electric vehicles is expected to greatly reduce the curtailment of renewable energy. The US is currently targeting 50% of all new vehicles sold to be electric vehicles by 2030. Therefore, as more efforts are being invested to further reduce the curtailment of renewable energy, Soluna’s curtailed renewable energy business model will be under threat.

CAISO’s 8 Solutions to Curtailment (CAISO)

Other Unpleasantries

On top of the threats to the sustainability of Soluna’s business model, we do not find any competitive advantage when compared to other Bitcoin mining companies.

Soluna prides itself on low-cost energy. According to Soluna, sourcing energy from curtailed renewable energy can pass on energy cost savings to customers as much as a 75% cost reduction in computing when compared to AWS (Amazon’s (AMZN) cloud services). But upon inspection, we did not observe such material reduction in energy cost.

Soluna’s electricity cost per bitcoin mined stands at $14,115 in 2022Q1 and $12,657 in 2021Q4. During the 2 periods, Soluna (proprietary) mined 189.23 bitcoins and 111.95 bitcoins respectively while incurring a total electricity cost of $2.671mil and $1.417mil respectively. Soluna’s electricity cost increases further when the hosting segment is considered. By referring to Table 1, we can observe that sourcing curtailed renewable energy doesn’t provide a competitive advantage in terms of cost.

Table 1. 2022Q1 Electricity Cost Comparison Table

| Company | BTC Mined | Total Electricity Cost | Electricity Cost per bitcoin Mined |

| MARA | 1,259 | $7.86mil | $6,243 |

| RIOT | 1,355 | $19mil | $14,022 |

| IREN | 357 | $3mil |

$8,403 |

| SLNH |

189.23 (Prop) 36.43 (Host) |

$2.671mil (Prop) $1.156mil (Host) |

$14,115 (Prop) $31,732 (Host) |

When other operating and business costs are considered, we estimate Soluna’s total mining cost per bitcoin to be approximately $72K and $60K in 2022Q1 and 2021Q4 respectively. We estimate Soluna’s 2022Q1 total mining cash cost per bitcoin to be $41,624.

At $21,000 per BTC, Soluna would be operating at a loss of $50K or $20K cash loss per BTC. As of 2022Q1, Soluna only has approximately $3mil in cash. At this rate, Soluna will deplete its cash holdings and might need to resort to severe shareholder dilution.

Although total liability is only 24% of total assets, Soluna has $43mil of intangible assets which we believe is the Strategic Pipeline Contract or the letters of intent (LoIs) signed in 2021Q4. This figure wasn’t present in the 2021Q3 report.

This contract is valued at $45mil. However, we couldn’t determine its value for ourselves. If we do not consider this contract, Soluna’s liability is 35% of total liability, which is still okay. But the problem remains, that Soluna lacks liquidity.

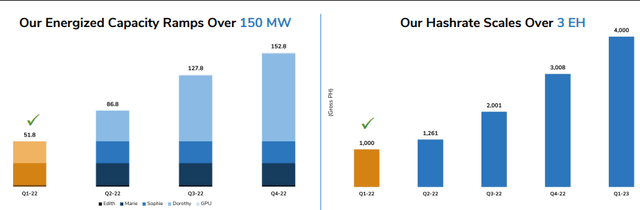

Moving on, Soluna is expected to achieve only 4 EH/s of mining capacity by 2023Q1. Comparatively, Marathon Digital Holdings (MARA), Riot Blockchain (RIOT), and Iris Energy are expected to achieve 23.3 EH/s, 12.8 EH/s, and 15 EH/s respectively within a similar timeframe. We can see that Soluna’s expected mining capacity severely trails other Bitcoin miners. Mining capacity is important because it determines how many bitcoins a miner is capable of mining.

Soluna’s Expected Bitcoin Mining Capacity (Soluna (April 2022 Presentation))

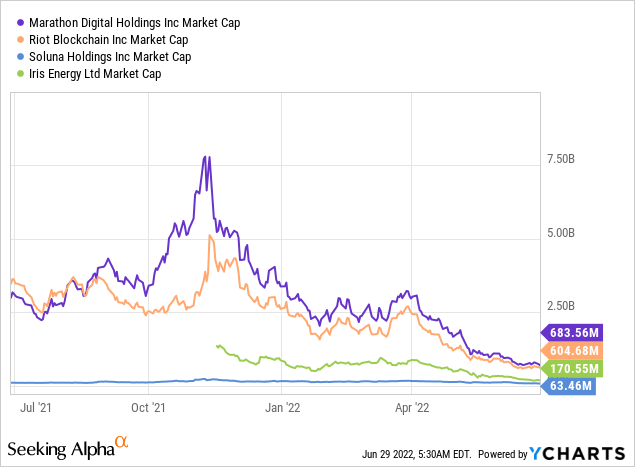

However, this shouldn’t be a problem if Soluna is priced accordingly. Soluna’s expected capacity is about 74% lower than IREN, hence it is also priced 63% lower. Soluna’s expected capacity is 83% lower than MARA and is priced 90% lower than MARA. Hence, we can say that Soluna is priced fairly relative to its expected capacity but its upside remains limited due to its low expected capacity.

At this moment, we should not price Soluna’s ability to pivot into other batchable computing applications because we have yet to observe actual implementations of such an initiative. Moreover, other Bitcoin miners also have a similar ability to pivot even though this feature isn’t explicitly stated in their annual reports. For instance, IREN owns at least 83% of the land and grid-connected power facilities to give it more stability and flexibility to host other data centers.

Verdict

Soluna has met our pre-requisite of being an investable Bitcoin mining company. Firstly, it is powered by renewable energy. Secondly, it can hedge itself against the Bitcoin downturn by pivoting to other batchable computing services.

However, what concerns us is the sustainability of Soluna’s business model. Soluna is in the business of converting (buying) curtailed energy into profits by providing energy-intensive services (batchable computing). But the curtailment of energy is expected to shrink (which is good for green initiatives but not for Soluna) as great efforts have been invested to solve the curtailment of renewable energy.

Furthermore, Soluna’s business model of sourcing curtailed renewable energy does not provide competitive advantages where Soluna’s energy cost is 2x and almost 2x more than MARA and IREN respectively in proprietary (self) mining or 5x and 4x more than MARA and IREN if hosting is also included.

Therefore, we cannot recommend Soluna to prospective investors for the time being and we need to monitor Soluna’s development further. That being said, we continue to encourage holding Bitcoin instead of Bitcoin mining companies as Bitcoin mining companies are more volatile than Bitcoin and are inherently riskier.