Bitcoin’s value has fallen sharply, and no one knows what will happen to it next, bringing previously ignored risks into focus.

Have you ever been at a football match when your team is losing, you question something that happened, and the fans of the winning teams start to gleefully chant “SCOREBOARD!”? They point up at the numbers that show their victory is assured and laugh at your pitiful complaints.

That’s how it has felt over the last few years talking about possible problems in bitcoin. If you tried to raise a question about bitcoin it was drowned out by the exultations of the fans and the revving of their Lamborghinis.

They were on their foredeck of their private yachts, quaffing a cocktail as the crew polished the platinum helipad. Anyone sitting in a rental property, sipping tap water and trying to ask sceptical questions looked like an idiot for missing out.

Bitcoin is very hard to compare to other assets that we have long known and agreed are valuable. So the best argument for bitcoin has usually been its price.

“Yes, sure, it seems weird that this completely man-made thing that has no clear function would have any value, but look: people are buying it for $A80,000! That tells you something!” – bitcoin fans.

That argument works! Or at least it worked when bitcoin was worth over $A80,000, as it was a few months ago. But now bitcoin is worth under $A30,000, and the questions a person might ask about it look, suddenly, a tiny bit less silly.

Nobody knows where bitcoin is going from here. Could be up or down. So let’s take the chance to lay a few of those questions out.

Bitcoin is argued to be a great “store of value”. It is referred to by some people as “digital gold”. But is it a great store of value? We could ask the people who put their money in six months ago that question, and they’d tell you half their value is gone.

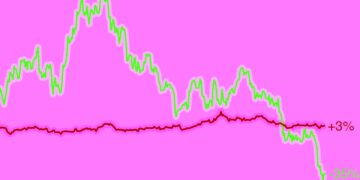

Look at the red line in the chart below: it soared as bitcoin doubled; then plunged as bitcoin fell by more than half. The blue line in the following chart shows changes in the gold price over the same period. Metal gold has been a lot less volatile than “digital gold”!

To be clear, I’m not a hater, just a doubter. I’ve owned bitcoin, ethereum and other cryptocurrencies. I’m excited by the idea and made a surprising amount of money on them (not all of them were good buys! I bought some crappy altcoins that went to zero). But even as I speculated and cashed in, I couldn’t dislodge my concerns about whether this made sense, whether it was more than a bubble.

Making something out of nothing

Can you just invent an asset out of nowhere, like the pseudonymous Satoshi Nakamoto did with bitcoin? Mostly what people value is scarce or very hard to make, like gold, diamonds and land. Bitcoin’s source code is public. You can replicate bitcoin this afternoon if you want (and people have, making copies and slight variations).

What makes the main version of bitcoin unique for now is the ecosystem built up around it – bitcoin miners, people who own bitcoin, systems set up to transfer bitcoin. They are highly motivated to improve the supporting systems and encourage people to buy bitcoin, increase adoption, maintain belief and keep the price high.

If you point out bitcoin depends on belief, bitcoin fans will say aha! national currencies are the perfect example of an asset invented out of nowhere that depends on belief!

And that is a good point. So, what makes a national currency valuable? The answer is: you can use it, and people believe the government will protect the value of that currency from eroding too quickly, and they believe the government itself is stable.

Where that doesn’t apply, you find black markets in other currencies. Venezuela, Argentina, Montenegro, Nauru: around the world people use foreign currencies because they don’t trust their own currency.

Bitcoin may indeed be more trustworthy than some governments! This is not necessarily a sufficient yardstick (for me) to trust it completely. So the point remains the same: bitcoin’s value depends on trust and belief. What affects that belief?

You use bitcoin?

Lol.

The original intent of bitcoin was to create a useful currency. The original white paper of bitcoin starts with the words “Commerce on the internet…”. But bitcoin is not much used for commerce on the internet. Cash is far more widely accepted.

Bitcoin transaction fees are still significant, speed is still slow, despite significant improvements. And bitcoin keeps changing in price wildly, discouraging people from accepting it as payment. Bitcoin’s core function is – for now – as an asset.

Whether you think it’s a good asset depends on when you bought in.

Let’s be very clear, since 2008, bitcoin’s value has gone far, far higher. If you bought way back when and didn’t sell too soon I applaud your foresight and resolve. The recent fall from over $A80,000 to under $A30,000 is puny by comparison – a fall of over 60 per cent. The rise since 2015 is over 9000 per cent. That means bitcoin is still over 90 times higher than seven years ago.

But bitcoin changes hands. Anyone who bought in the last 18 months has lost money. For them – and for people who might buy in the future – past gains are irrelevant. Past performance is no guarantee of future performance, as they say.

What does experience tell us?

Bitcoin was invented in 2008 and introduced to the world in 2009. Since then bitcoin has gone up and down but on average, performed impressively. Is this experience enough to conclude bitcoin is impervious to dramatic reversal?

I’d argue we should reserve judgment. This is the sort of situation described by Nassim Nicholas Taleb in his famous book The Black Swan: People tend to conclude that a system is safe based on a relatively small amount of data.

Taleb argues that kind of conclusion is sound so long as the risks are predictable. For example, people may measure the reach of the biggest wave at the highest tide and build their house out of reach of it.

But it doesn’t save them if there is a tsunami. Bitcoin is growing the body of evidence that it is durable, but it has not got anything like the track record of gold, land, diamonds or stocks. A tsunami – a metaphorical one – could yet harm it severely.

I don’t want to anyone to finish reading this believing bitcoin is dead. It is not, I’m not saying it is. What I am asking everyone to do is consider whether bitcoin is more likely to be immortal or mortal, godlike or fallible.

Possible tsunamis

The point of Black Swans is they aren’t predictable. But one issue for bitcoin that gets a lot of discussion is supply.

The maximum number of bitcoins that will ever be made is 21 million. So far a bit over 19 million have been made. This, some bitcoin fans think, is one reason why bitcoin is good. Unlike national currencies, which keep getting printed, bitcoin’s supply is capped. It’s genuinely scarce.

The remaining 2 million will be made over the next 120 years.

But production is not spread out evenly. One million will be made in the next four years or so, and then another million in the 116 years after that. Every four years or so, production halves.

That matters because the new bitcoins are used as rewards for the people that maintain the bitcoin ecosystem we talked about before.

Bitcoin “miners” are given bitcoins for confirming transactions are legitimate (that’s what mining is, they do some complicated maths using a lot of electricity to confirm the transactions and get paid for that in bitcoin).

This has been a clever system that has shown itself to be self-sustaining so far: bitcoin may not be fast or energy-efficient but it is reliable.

But the rewards for confirming transactions are legitimate are dwindling in number. Will there be enough incentive to “mine” bitcoin in future?

Bitcoin has proven itself so long as the reward for mining is high in BTC terms, and the price of bitcoin is rising. It is yet to prove itself when the reward for mining is low in BTC terms, if the price of bitcoin goes into a prolonged fall, or especially if both are true. A cryptocurrency that only works while its price is going up is not a safe one.

Maybe this issue will be decisively solved by the use of transaction fees to compensate miners, without making bitcoin expensive to trade. There are other issues:

– cryptographic – might quantum computers get smart enough to crack the bitcoin system and make it unsafe?

– Maybe bitcoin becomes legitimately useful for something and it becomes helpful to have lots of ecosystems with abundant cheap bitcoins instead of one ecosystem with few expensive bitcoins.

– There’s no barrier to creating better cryptocurrencies. Maybe bitcoin is the MySpace of crypto and one fine day the Facebook of cryptocurrency comes along and eats its lunch.

– But of course maybe bitcoin is designed well and everyone selling right now regrets it for the rest of their lives.

It’s hard to get anyone to think about risks when the price is rising. The point of this article is to use this lull in the whooping to remind people that bitcoin is still new, has thrived in really only one market cycle, and faces risks both known and unknown.

I urge you, even if you buy in, to buy no more than you can afford to lose and consider all claims sceptically.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology