Silicon Valley payments processor PayPal recently announced that it would allow BTC, BCH, ETH, and LTC withdrawals to users’ external wallets. The move comes after the payments giant listed these coins for trading in October 2020.

The news was widely celebrated by digital currency pundits and media outlets who, as usual, focused only on the potential for fiat gains and missed the true implications of the story.

BREAKING: PayPal now supports the transfer of crypto between PayPal and external wallets

— Blockworks (@Blockworks_) June 7, 2022

This is the opposite of digital currency adoption

PayPal is renowned for taking things slowly, and for now, it will only allow users based in the United States to withdraw digital currencies to external wallets. Something similar happened when it listed the coins for trading; it rolled out slowly, testing the waters in the U.S. and some other countries before rolling it out elsewhere.

Yet, the move was hailed by BTC maximalists and others as yet more evidence for the ‘adoption’ of digital currencies. It’s a sad reflection on just how far Bitcoin has fallen; the technology that was supposed to challenge incumbents and render companies like PayPal obsolete now has fanboys celebrating that a universally-loathed payments company is allowing them to withdraw their digital currencies.

PayPal’s decision shows that listed digital currencies are no threat

PayPal is a publicly listed corporation, and as such, it operates with one principle in mind: shareholder profit.

What can we conclude from this? The fact that PayPal is allowing users to withdraw BTC, BCH, ETH, and LTC, where they could potentially use the coins to transact on their respective blockchains, means the firm’s strategists have concluded that these digital currencies are no threat to its core payment business which generates the vast bulk of its billions in annual profits.

Think about it. Why would a payments company enable users to buy and potentially use digital currencies that could allow them to transact outside of its platform and chip away at its user base? It wouldn’t, and that’s because BTC Core, BCH, Ethereum, and Litecoin have no real utility and will never challenge PayPal in any meaningful way.

- BTC Core has a capacity of seven transactions per second (maximum) and fees of several dollars, ruling it out as a payment option for most people in the world. Supposed solutions like the Lightning Network are too complicated for everyday users and are renowned for losing funds.

- BCH has a 1MB block (maximum) despite having low fees. That’s because nobody uses it, and no business will ever adopt a digital currency run by anarchists hell-bent on poking authority in the eye at every opportunity.

- Ethereum has gas fees of anything between $3 and $1,500, depending on the day. It’s inherently unpredictable and has so far failed to roll out anything like a workable scaling solution despite promising to do so for years.

- Litecoin could potentially be a threat to PayPal, but with 100k transactions daily on average, nobody uses it in any significant way. With the activation of MimbleWimble, PayPal knows it won’t be long before Litecoin is banned by most regulated exchanges and ruled out of any legitimate business use case

In short, PayPal is happy to make fees from users buying and selling these coins, and after a period of monitoring, observing, and scrutinizing them, it couldn’t care less if users withdraw them.

What happened to Satoshi’s vision?

Digital currency enthusiasts who entered the space post-2017 may not be aware that it was never supposed to be this way. Thanks to an endless stream of propaganda by Blockstream, BTC Core, and hucksters like Vitalik Buterin and Charlie Lee, there’s a good chance that if you entered the space anytime after 2016, you don’t even know that Bitcoin was supposed to be a peer-to-peer electronic cash system that would seriously challenge, if not kill, companies like PayPal.

Before the ‘digital gold‘ and ‘digital assets’ narratives took hold, Bitcoiners, and Bitcoin’s inventor, dreamed of a world of peer-to-peer transactions with virtually no fees, enabling the poorest people in the world to transact with anyone on the globe and setting us free from the shackles of big-tech and banker dominance.

Somewhere along the way, the incumbents recognized the threat and hijacked the Bitcoin project. You can read more about some of that here. Yet, Satoshi’s vision lives on as BSV, and with millions of daily transactions and growing for fractions of a cent, companies like PayPal will eventually be forced to capitulate.

Join us in the fight to save Bitcoin

It’s unfortunate when Bitcoiners are brown-nosing companies like PayPal to get them to ‘adopt’ Bitcoin. Yet, some of us still see that Bitcoin on PayPal was never the goal. PayPal on Bitcoin was and is.

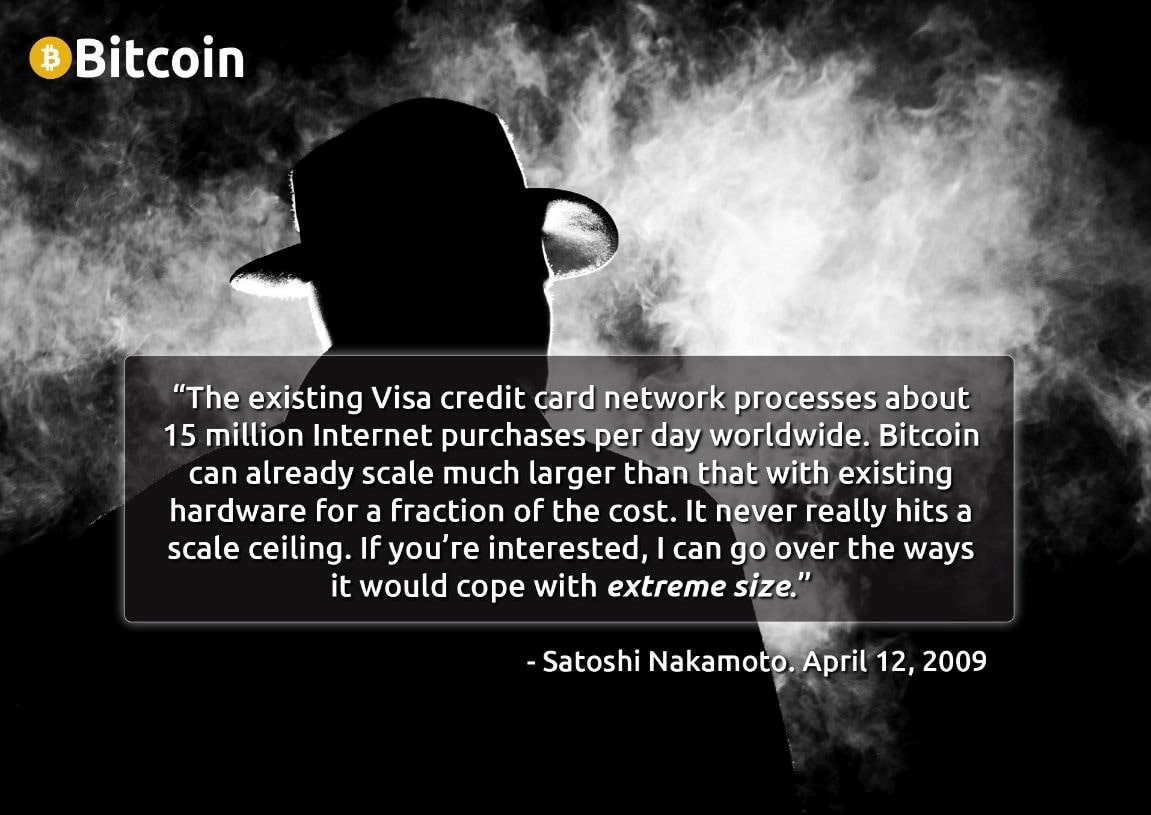

Reflect on the Satoshi Nakamoto quote above. Do these sound like the words of a person who invented ‘digital gold’ for Wall Street bankers and Silicon Valley VCs to trade and for companies like PayPal to sell for a fee?

If something smells funny, keep digging. I assure you it gets a whole lot weirder as you learn the true history of what happened to Bitcoin.

Watch: The BSV Global Blockchain Convention, The Future of Digital Asset Exchanges & Investment

New to Bitcoin? Check out CoinGeek’s Bitcoin for Beginners section, the ultimate resource guide to learn more about Bitcoin—as originally envisioned by Satoshi Nakamoto—and blockchain.