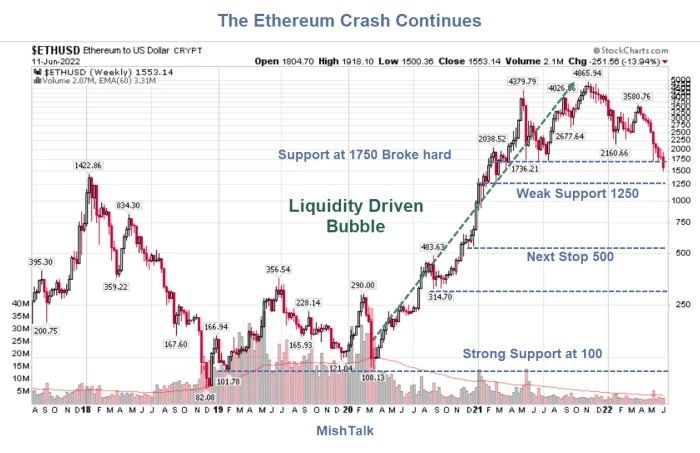

Ethereum crashed below support. Let’s discuss much of the crypto space including Bitcoin, Dogecoin, and coins allegedly staked 1:1 to Ethereum.

Ethereum chart courtesy of StockCharts.Com annotations by Mish

Liquidity Driven Bubble

The same forces that drove the stock market to insane levels are precisely the same forces that propelled the entire crypto space, even more so.

ARKK Innovation Fund

ARK Innovation Fund chart courtesy of StockCharts.Com annotations by Mish

Same Forces Driving Crypto as Stocks

- Three rounds of free money fiscal stimulus

- Eviction moratorium

- $9 trillion in QE driving interest rates to zero in 2020

- The Fed continuing QE all the way through March 2022

In short, the blowoff in the crypo space and the stock market was a liquidity driven event.

Tune Out the Fud

Here’s some friendly advice on how to tune out what I just stated.

Self-Reinforcing Feedback Loops

Duo Nine has a nice 13-chain Tweet Thread complete with self-reinforcing feedback loops so you only hear what you already believe in.

Following such advice is what drove LUNA to zero. But Duo Nine conveniently weeds out everything for you so you only pay attention to what he likes. And if you believe him, there are no lurking LUNAs is the gems he follows.

Ethereum Monthly Chart

Ethereum monthly chart courtesy of StockCharts.Com annotations by Mish

Please note that a crash to 333 would only take back a year-and-a-half worth of gains.

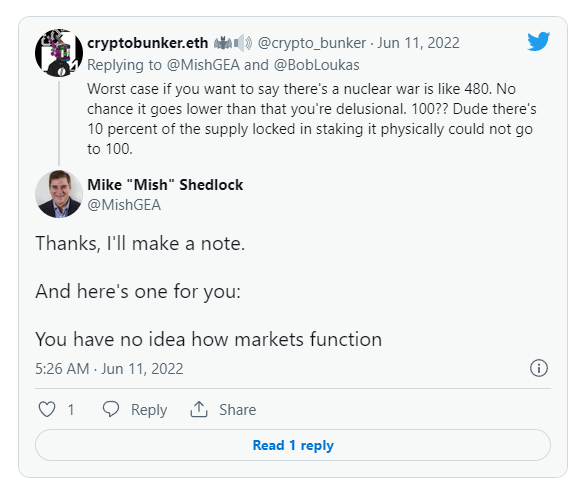

Worst Case 1000?!

Questioning 1000

Cannot Possibly Go to 100?!

How Markets Work

- Markets are driven by liquidity and sentiment more so than earnings

- We had a liquidity bubble.

- Just as in the DotCom bubble people believed in essentially what was tulips.

- Everyone was convinced their thing was immune.

- The tide of low interest rates and QE has reversed

- The true believers will go down with the ship

Facts of the Matter

- The entire crypto space, started by Bitcoin in 2009, has only known round after round of low interest rates and QE.

- The last round of QE propelled the Fed’s balance sheet to $9 trillion

- The last round of rate cuts drove the Fed Funds rate to Zero

- On top of Fed driven liquidity we had three rounds of free money from Congress

- The above items created massive bubble in stocks, housing, and the crypto space.

Bitcoin DeMark Counts

“Lowest weekly close of past 12mths for $BTC #Bitcoin. Not to worry bc BTC is little more than a figment of someone’s imagination, so price can be whatever one would like it to be. DeMark counts/levels are horribly bearish on daily & mthly, while supportive of a bounce on weekly.”

I asked for DeMark counts but did not get a reply.

Instead here are some charts by me.

Bitcoin Daily Chart

Bitcoin monthly chart courtesy of StockCharts.Com annotations by Mish

That’s an unusually tight range for Bitcoin. The question of the day is Distribution or Accumulation?

I will go with the latter because the entire crypto space is acting that way and the Fed is draining liquidity rapidly.

Bitcoin Monthly Chart

Bitcoin monthly chart courtesy of StockCharts.Com annotations by Mish

Technically speaking, there is no monthly support until the 1000 level. And that would just take off 1.5 years of gains.

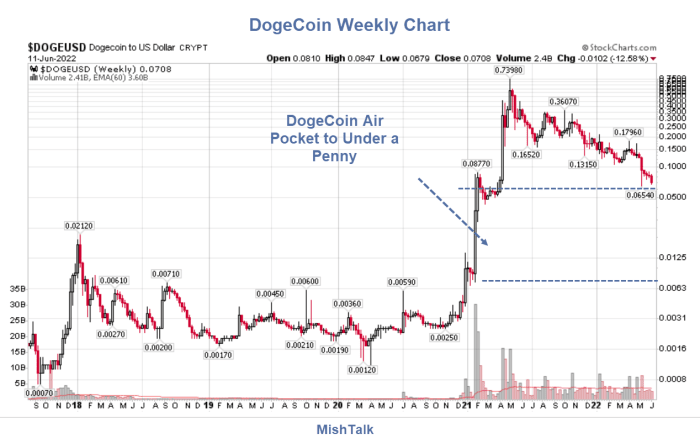

DogeCoin Weekly Chart

Dogecoin weekly chart courtesy of StockCharts.Com annotations by Mish

Dogecoin is right on support. And if it fell back to where it was at the beginning of 2021 it would trade for about a tenth of a penny or so.

Given that the coin was started as a joke and solves nothing, why should anyone expect anything less?

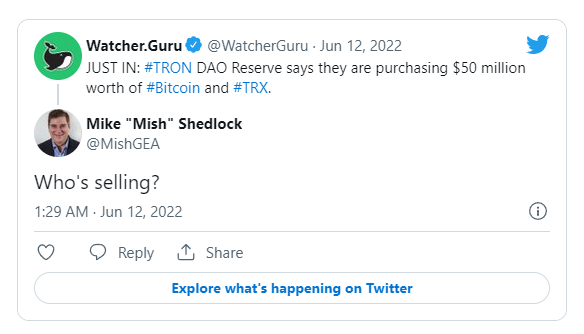

Who’s Selling?

Someone cannot buy unless someone else is dumping. Who is that?

Returning to Ethereum.

Staked Ethereum (stETH) Could Cause A Crypto Crash

Please consider Staked Ethereum (stETH) Could Cause A Crypto Crash, Here’s How

The token, which is supposed to trade at a 1:1 peg to ETH, is currently trading at $1,513.14 and has fallen 10% in the past 24 hours. By comparison, ETH is trading at $1,582.

stETH has been depegging since late-Thursday, with the first wave of losses stemming from a massive $1.5 billion dump by Alameda Capital– one of the largest holders of stETH. Alameda sold all of its holdings of the token.

stETH does not have a direct link to ETH prices. It can be redeemed for ETH only after the merge becomes effective- the date of which is currently unknown.

But the token’s main role as collateral on DeFi platforms such as AAVE and Lido could have dire implications for DeFi. Sharp losses in stETH are also causing panic selling in Ethereum.

Celsius, Lido could be caught in the crossfire

But even while stETH has minimal impact on ETH prices, its key role in leveraging with ETH on DeFi could burn those with high exposure.

Currently, DeFi platform Celsius has locked a lot of customer funds into stETH, which are liable to redemptions. If customers were to be spooked by the current stETH downturn, it could cause a bank run that would overload Celsius with redemptions, potentially causing a liquidity crisis.

DeFi majors AAVE and Lido, which have large holdings of the token, could also see a liquidity crunch if stETH selling intensifies.

Allegedly Stable

Here we go again. Another crypto is pegged to a second crypto that is allegedly “stable”.

In this case, we have Celsius, stETH, AAVE, Lido, and Ethereum in the mix.

I will let others attempt to explain how and why this is no worry, but anyone looking at any chart should be worried.

And that worry should be with or without a liquidity drain.

I have countless other Tweets all telling me why I am wrong and why whatever the hell they believe in is different.

Here’s a Tweet that makes sense.

“BTC is the ultimate indicator of what I would call the frivolous industry. The influencers, professional gamers, bloggers and bloggers anyone making money doing basically nothing productive. It thrives when interests rates are zero and the economy has ample supply of workers.“

Not to Worry

Everyone “knows” what I just describe cannot possibly happen. I have it on great authority that it would take a nuclear war for cryptos to give back 1.5 years of gains.

It just cannot happen. Meanwhile, back in the real world, let’s discuss inflation.

Why Did Economists Blow the CPI Forecast So Badly This Month?

Assuming you have gotten this far, implying you are not a cryptohead, please consider Why Did Economists Blow the CPI Forecast So Badly This Month?

Then consider what that might mean to overall liquidity.