<!–

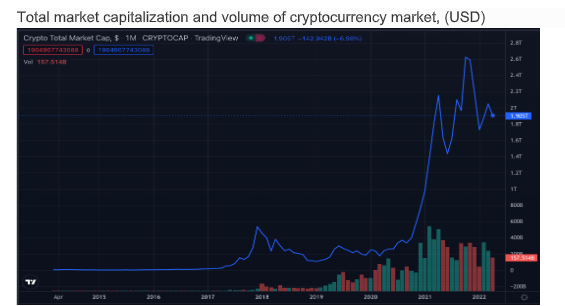

Recent years have seen a significant performance for crypto currencies in terms of its market capitalisation, trading volume, user base, people awareness, and publications across main stream media as well as research journals. According to a rough estimate these parameters have risen by nearly 10 times over last 3 to 4 years. As per one of the largest listed crypto exchanges Coinbase, the institutional volume comprises nearly 70% of Crypto turnover.

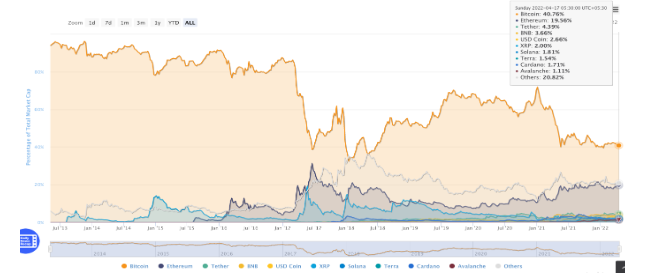

The rising popularity of bitcoin also led to the flood of other crypto currencies to test the market. The dominance, which is measured in terms of its share in total market capitalisation, of bitcoin remained very prominent during early years of crypto currency adoptions. The dominance of bitcoin started reducing over last 4-5 years, especially with the rise of alternate crypto currencies like Ethereum, Tether, etc. The graph depicts the individual proportions of the largest ten cryptoassets relative to the total market capitalization of all assets.

Major Cryptoassets By Percentage of Total Market Capitalization

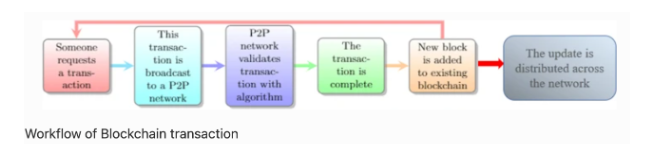

The growth in crypto currency market also led to the growth of blockchain and various other innovative technologies that resulted in expansion of use cases that covers almost every sectors of the economy including financials, healthcare, insurance, legal, administration, etc. a typical workflow of a Blockchain transaction is depicted with the below diagram.

According to a survey by the financial innovation, the top six services included Crypto plus Trading / Trading system/ Prediction / Trading strategy / Risk Management / Portfolio. It indicates the interest of existing and potential crypto market participants. The and hence the crypto market has not only expanded in terms of retail and institutional investors but also witnessed increasing number of exchanges, blockchain, cryptocurrencies and NFT platforms.

With the increasing capital market size, both in terms of quantum and coverage, debates about safeguarding this market from the possible frauds and market malpractices have resulted in adopting various global best practises. The evolving market is struggling to keep a fine balance of full KYC, Pseudonymity, and anonymity amidst the proponent of centralise system and decentralise system of public utility. Crypto exchanges on one hand trying to implement transparent KYC system while the block chains are moving towards Pseudonymity – a state where individual personal details like name etc are not seen but their activity details are transparently visible. Crypto exchanges are regularly trying to establish themselves in a well-regulated jurisdiction in order to win the trust of retail as well as institutional investors and participants.

A major challenge faced by the crypto industry is the gateway or interface between Fiat and crypto currencies. Countries across the world are diverged but slowly moving towards the facilitation of crypto-fiat conversion. People involved in crypto related policy-making are gradually getting equipped with required knowledge. Their enhanced education and awareness resulting in adaptive approach for this new asset class. Emerge the divorce process of crypto adoption amongst countries the interesting similarities in their tax structure and advertising standard or indicative of better time in coming years.

Crypto is often criticised for higher risk and volatility compare with other established asset classes. Volatility is the outcome of information asymmetry for any asset class. This asset class is no different than others in terms of volatility coming down as market evolves. The recent average daily volatility of this market as measured on IC15, India’s first index of crypto currency, is nearly 3.5%.

The broad crypto market barometer IC15, since its base date of 01 April 2018, has shown that the risk and the volatility associated with the crypto market is continuously coming down. That indicates market is slowly measuring up. Decentralisation and the public control, being the very basic ideology of this crypto market, have influenced people to come up with the innovative services and information being made available free or at a very minimal cost. One interesting feature of this market is the almost abolition of market intermediaries as most of the transactions are carried on peer-to-peer basis.

Although “trust” is established through the complex computer algorithm (consensus mechanism and reward system) by automatically ejecting the mal-intentioned entities, the possibility of fraud and associated risk cannot be ignored and hence this market needs to be safeguarded, especially from possible anti-social end uses. G7, G20, World Bank, IMF etc are putting efforts to have a coordinated framework for market evolution keeping its’s inherent characteristics intact while safeguarding from terror funding or illegal activities.

What more can be done to make industry better: the continuing education is the backbone for market growth and the pace of educating the market needs to be accelerated.

CryptoWire, CryptoTv and Crypto University are investing large resources and their plans on education, knowledge sharing, Price, and News and information dissemination. The countries taking a leap forward in facilitating this market also provides crucial learnings for other countries in order to formalise their policies. Some regulatory regime which provides industry specific regulation so that the regulation is shaped according to industry and not the industry is made to shape itself to regulation. Policies have to be oriented from the context of global market best practices rather than other asset class policy. Possibly the creation of SRO would get industry on same page for facilitation of digital and transparent clients support function. Surely agencies like IOSCO will start conceiving some global best practices for end user protection and awareness and industry standards. Since most trades are p2p, many risks of intermediation are eliminated in this market. Those residual risks which are exchange specific or coin specific can be redressed through education or the SRO finding best practices to grow the market and also ensure client protection and transparency. Coins and Projects are now being rated also to bring greater confidence in the market. Institutional investment is also increasing the confidence of the market in these assets.

Disclaimer

Views expressed above are the author’s own.

<!–

Disclaimer

Views expressed above are the author’s own.

–>

END OF ARTICLE