Ethereum core developer Tim Beiko took to Twitter on April 12 to announce that the number two crypto network had entered the “final chapter of [proof-of-work].”

If you’re not already up to date on this event, called “the merge,” here’s the scoop: Ethereum is transitioning to a different consensus mechanism called proof of stake (PoS).

Instead of building and maintaining massive farms of computers in the Siberian tundra to maintain your crypto network, PoS-based networks leverage economic incentives.

To join, you simply need to purchase and stake the network’s native cryptocurrency. By staking and performing your validating duties correctly, you’re rewarded with a yield. But if you process fraudulent transactions or fail to accurately validate blocks on the network, you can lose some of the money you have staked (this is called “slashing,” by the way).

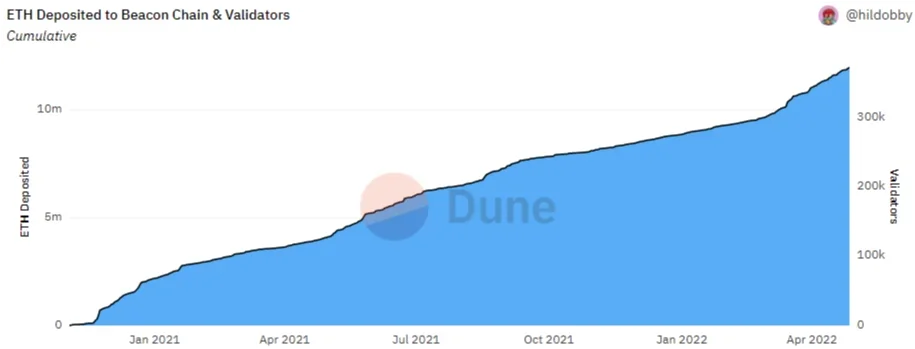

And though Ethereum hasn’t made the transition, the ability to stake ETH has been possible since December 2020.

According to data from Dune Analytics wizard hildobby, there has been nearly 12 million Ethereum staked (roughly $34 billion at today’s prices).

This currently makes up little more than 10% of the entire Ethereum supply.

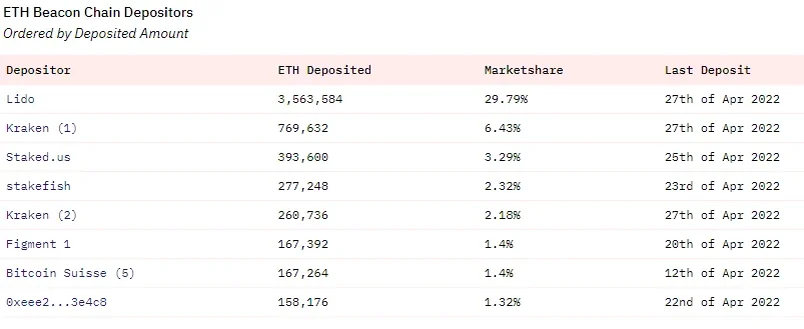

Understanding the types of stakers also reveals insight into how decentralized this next iteration of Ethereum will be.

These types include solo stakers—essentially someone setting up a computer at home and staking Ethereum manually—staking providers, and pooled staking.

Here’s how it breaks down.

Lido is a pooled staking protocol. Kraken is, well, the crypto exchange. Staked.us is a staking-as-service firm, offering services across all PoS networks. Bitcoin Suisse and Stakefish offer a similar service.

Then there’s address 0xeEE27662c2B8EBa3CD936A23F039F3189633e4C8. Given the sheer amount of Ethereum staked by this address, it may simply be an unidentified address related to another crypto firm.

But it’s currently holding more than $450 million in Ethereum. This is a ton of money for a solo staker running a validator out of their apartment.

Anyway, another standout figure among these stats is the massive market share that the pooled staking service Lido enjoys. The reason for this is simple though.

On other platforms, you typically need to deposit 32 Ethereum to participate in staking. This is obviously quite a lot for the average enthusiast. Kraken, for example, lets folks deposit any amount. The same is true for Lido and Stakefish.

Unlike other staking services, though, Lido gives you a token in return called Staked ETH (or just stETH). And because this is an ERC-20 token, it can be plugged back into various DeFi protocols.

This means that Lido users can earn a nice yield for staking, but can continue stacking percentage points to that yield by depositing their stETH in various other DeFi protocols.

Decrypting DeFi is our DeFi newsletter, led by this essay. Subscribers to our emails get to read the essay first, before it goes on the site. Subscribe here.

The best of Decrypt straight to your inbox.

Get the top stories curated daily, weekly roundups & deep dives straight to your inbox.