SrdjanPav/E+ via Getty Images

Voyager Digital (OTCQX:VYGVF) is a small-cap crypto growth stock that I’ve been watching for quite some time because I personally use their app.

This is my first time covering Voyager Digital on Seeking Alpha because I was worried about the risk of potential downside due to the current stage of the crypto market cycle.

My goal is to provide you with timely investment insights & research at the right moment so you can profit from market inefficiencies.

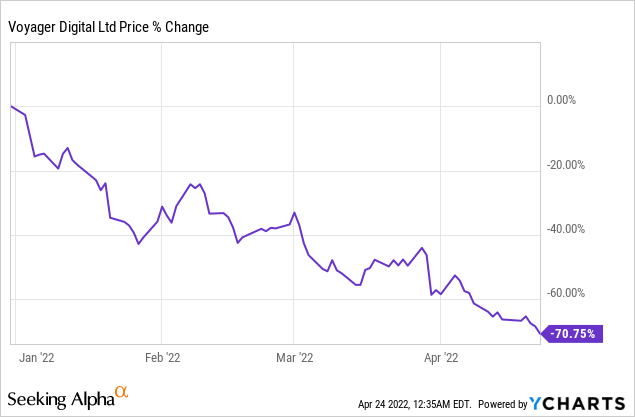

Several other Seeking Alpha writers previously placed strong buy ratings on VYGVF stock and now shares are trading down 70% YTD.

To be frank, VYGVF was grossly overvalued over the last few months but now is the time to get interested in picking up some shares.

That’s because Bitcoin has dipped below $40,000 and we are approximately 8 months away from what I believe to be the bottom of the crypto bear market in January 2023.

VYGVF stock trades below $4 and I think it’s time to give you guys a complete rundown because Voyager Digital will become an important player in the crypto market.

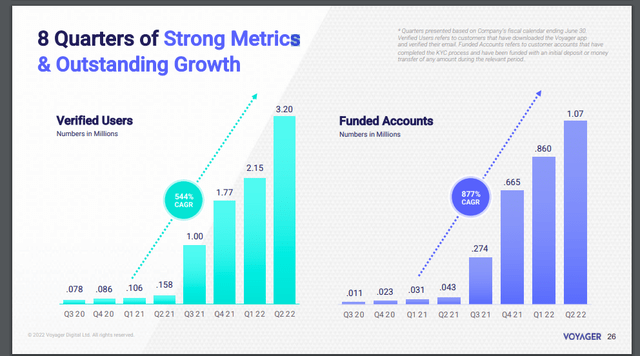

Voyager Digital Has a Large, Growing Verified Userbase

Voyager Digital is a commission-free cryptocurrency exchange that generates revenue from charging a spread on its crypto transactions.

The company has grown like crazy since 2020 and surpassed 3.2 million verified users during the period ending on December 31st, 2021.

Voyager Digital Verified User Growth (InvestVoyager.com)

Voyager Digital’s preliminary result ending on March 31st, 2022 shows that verified users increased to 3.5 million as well.

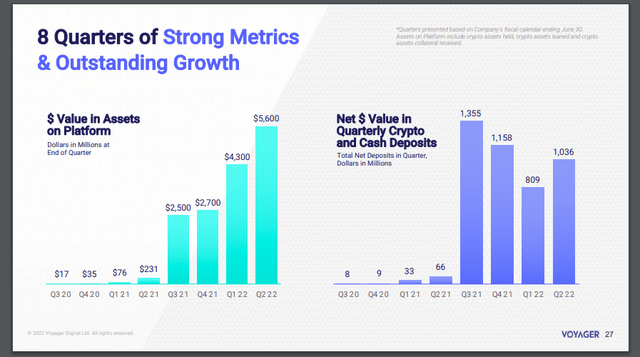

Value of assets on the Voyager Digital platform exceed $5.6 billion at the end of 2021 thanks to last year’s epic crypto bull run.

Voyager Digital Assets on Platform (InvestVoyager.com)

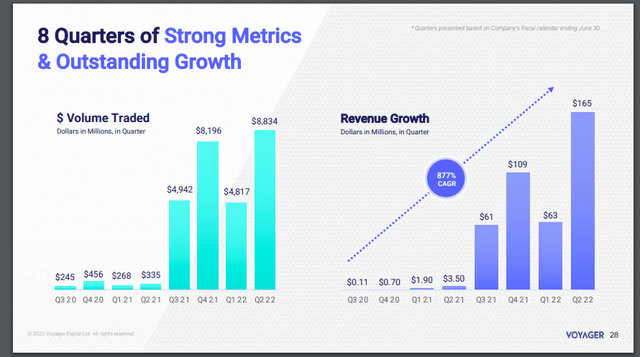

Volume traded and revenue are closely correlated as shown in the graph below and Voyager Digital earned $164 million during the 3 month period ending on December 31st, 2021 during the November crypto bearish selloff.

Voyager Digital Revenue and Volume (InvestVoyager.com)

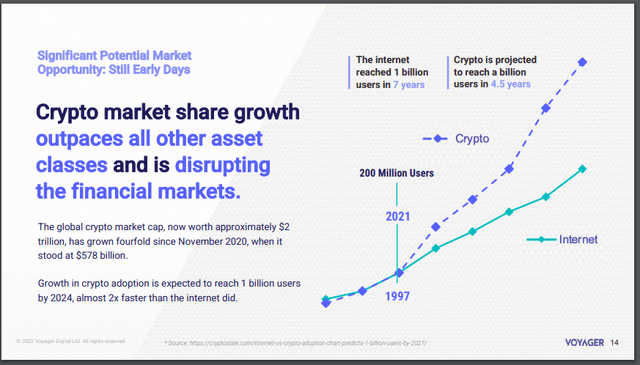

Cryptocurrency is still a brand new industry that is expected to grow faster than the internet did in the 1990’s. In layman’s terms, crypto is only being used by early adopters so investors should consider stocks like Voyager Digital as multi-year investments.

Understanding the Crypto Market Cycle Before Investing in VYGVF

I wrote extensively about the Bitcoin halving cycle previously and you need to understand how crypto market cycles operate before investing in crypto stocks.

Failing to understand these key components means you will pay a lot more for crypto stocks over the long run at less than ideal times.

Voyager Digital makes money when there is extreme volatility in the crypto markets. Massive bull runs or huge selloffs are when the company makes the most money. However, periods of low interest in crypto are when crypto prices fall and that’s when crypto stocks get crushed.

We are currently in that time period as of writing this article, which is exactly why my interest in VYGVF shares has increased.

Bullish Catalysts for Voyager Digital

Many crypto investors don’t like putting all their eggs in one basket and that means there is room for smaller companies like Voyager in an industry dominated by Coinbase (COIN), Binance (BNB-USD), and Crypto.com (CRO-USD).

First off, Voyager Digital is planning an expansion to Canada and France in 2022 to increase its verified userbase and boost revenue.

You’ll see a lot of crypto companies make huge moves through 2022 in preparation for the uptick in the crypto bull market during 2023.

The company also has plans for a cashback interest debit card, NFTs, and the addition of more tradable coins on its platform.

Crypto is projected to reach 1 billion users by 2024 so now is a wonderful time to pick up these beaten-down crypto stocks when no one else wants them.

Crypto Adoption Curve (InvestVoyager.com)

Be greedy when others are fearful works wonders if investors can control their emotions and buy quality companies when they are unpopular.

Risk Factors

Voyager Digital desperately needs to apply for a NASDAQ listing to make it easier for investors to purchase the stock. Even smaller crypto companies such as BTCS (BTCS), which I wrote about previously, are listed on the NASDAQ for maximum investor exposure.

VYGVF trades on the OTC markets and cannot be purchased on several popular stock trading apps such as Robinhood and Webull. There are millions of retail investors who cannot buy the stock, which really hurts its upside and creditability.

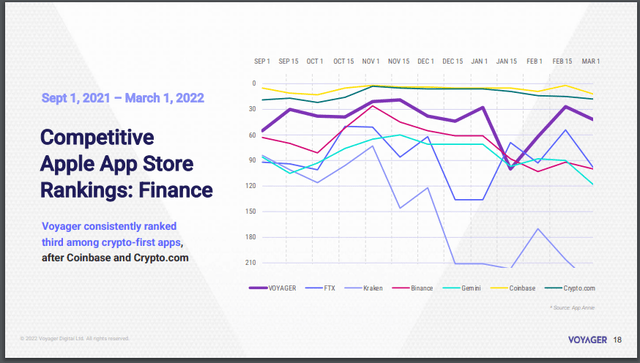

Competition is another issue but Voyager Digital continues to grow its userbase despite ongoing market share pressure from Coinbase, Binance, Kraken (KRAK-USD), FTX (FTX-USD), Crypto.com, and Gemini (GUSD-USD).

Voyager Digital Competitors (InvestVoyager.com)

I believe a rising tide lifts all boats and all of these companies will perform well because many crypto investors use multiple platforms to mitigate risk.

Lastly, Voyager Digital doesn’t have a desktop version at the moment but the company is working on a beta release at the moment. This aspect has hurt the company’s bottom line and could attract more crypto traders once the desktop launch is officially completed.

Conclusion

Voyager Digital looks cheap at these price levels but the crypto bear market isn’t over. I wouldn’t be surprised if VYGVF dips below $3 and heads back towards $2 over the next few months.

However, I do think it’s a good time to start building a position in preparation for the market flipping and bullish runup in early 2023.

My strategy is to take a portion of every paycheck and dollar cost average into my favorite crypto stocks at the moment. I’m loading up on both Bitcoin (BTC-USD) and crypto stocks through 2022 while no one else wants them.

Once the crypto market bottoms in early 2023, I believe VYGVF shares could 10x as we approach the next Bitcoin halving in 2024. That’s nearly 2 years from now but I believe investors who accumulate during bear markets will be handsomely rewarded once the masses jump back into the markets.

It will be difficult for Voyager Digital to maintain its impressive 50%+ CAGR user growth but I project them to have around 4 million verified users by the end of 2022.

VYGVF trades at a price to sales ratio of 1.5 and looks attractive at these levels. This is one of my favorite 10x crypto stocks that could soar during the next crypto bull run.