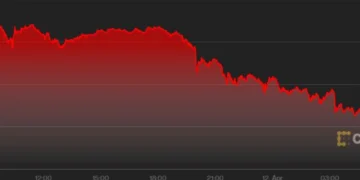

Crypto investors were lulled into a false sense of security after a steady three weeks, but now cryptocurrency has plunged again.

A major cryptocurrency crash has wiped away the gains made in the last three weeks, sending the values of the digital tokens plummeting to dangerously low levels.

Crypto prices tanked on Monday night, with the most popular ones falling by as much 13 per cent.

In total, cryptocurrency’s market cap dropped by eight per cent, from US$2 trillion (A$2.7t) to U$1.84 trillion (A$2.5t).

That represents an eye-watering loss of US$160 billion. (A$215b).

Terra’s LUNA coin slid the most out of the top 10 crypto tokens, plunging 13 per cent in the past 24 hours, and 28 per cent over the past week.

Avalanche fell by 12.6 per cent, Solana by 13 per cent and Cardano by 12 per cent.

Bitcoin and ethereum, the two most valuable crypto tokens, also took a serious battering.

Ethereum was down 9.7 per cent, worth just US$2,989.

Bitcoin has also massively declined, down eight per cent with a 24-hour low of US$39,275.80.

At time of writing both coins are still down trending.

For the past three weeks, cryptocurrency has held steady, particularly bitcoin, so the latest drop has sent shockwaves around the industry.

BTC’s price peaked for the year at $48,200 on March 28 but now, just a few weeks later, it is once again tragic.

Analysts believe crypto investors are spooked as markets around the world lose their steam.

In Asia, the Hang Seng closed down three per cent on the day in Hong Kong, while the Shanghai Composite Index finished 2.6 per cent lower.

Germany’s DAX traded 0.77 per cent in the red at the time of writing, as did London’s stock market.

Australia’s ASX is expected to dip when it opens this morning.

Tony Sycamore, senior market analyst at City Index, said in a note to news.com.au: “Bitcoin has cratered to be trading at $39,446 (-6.36 per cent) in line with the sharp fall in US equities.

“As we continue to note, Bitcoin is a risk asset, tightly linked to the performance of US equities and, in particular, the Nasdaq.

“Both have benefitted from an extended period of ultra-easy monetary policy and excessive liquidity, which is now being hastily removed.”

Another explanation for the drop could be new bans imposed on cryptocurrency as Russia continues to try to evade economic sanctions amid its illegal invasion of Ukraine.

Just before the weekend, the European Union banned the use of cryptocurrency services to Russia.

The new rule blocks deposits to Russian crypto wallets — including popular cryptocurrencies like bitcoin, ethereum, BNB, XRP, cardano, solana and luna.

It came after the European Central Bank president Christine Lagarde warned that cryptocurrencies posed a “threat” to efforts to curb Russia’s economy.

The EU will put “a prohibition on providing high-value crypto-asset services to Russia,” the European Commission announced.

They added: “this will contribute to closing potential loopholes.”

India’s cryptocurrency industry could also be dragging down the overall market.

Crypto research firm Crebaco found trade volumes had dropped massively in the country ever since a new tax rule was introduced on April 1.

India now requires a 30 per cent tax on any profits generated from cryptocurrency transactions and doesn’t allow offsetting gains with losses, according to CoinDesk.