Key Takeaways

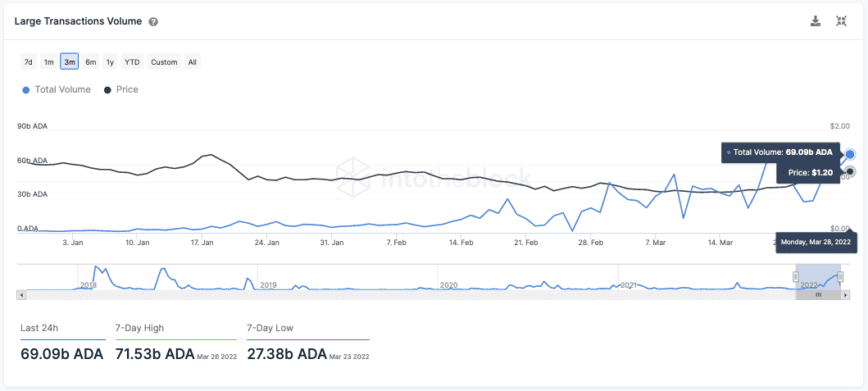

- A total of 69.09 billion ADA were transacted on Mar. 28.

- Such on-chain activity points to institutional demand.

- Further buying pressure could push Cardano to $2.

Share this article

On-chain data reveals that institutional players and whales have been adding significant amounts of ADA to their portfolios.

Cardano Whales Accumulate Heavily

Institutional interest in Cardano appears to be picking up after ADA reclaimed $1 as support.

IntoTheBlock has reported a significant increase in on-chain activity on the Cardano network. The blockchain and cryptocurrency market analysis platform affirmed that the number of large transactions with a value greater than $100,000 has risen by more than 5,000% since the beginning of the year.

A total of 69.09 billion ADA were transacted on Mar. 28 alone, representing 99% of the total on-chain volume. Such market behavior hints at institutional players’ and whales’ activity, pointing to how they may be investing and positioning themselves.

Santiment picked up on similar network activity. The behavioral analytics platform recorded a 1.7% increase in the number of whales on the Cardano network. Roughly 42 addresses holding 1,000,000 to 10,000,000 ADA were created since Mar. 21.

Such an uptick in the number of large investors behind Cardano may seem insignificant at first glance. But when considering that these whales hold between $1.2 million and $12 million in ADA, the sudden spike in buying pressure can translate into millions of dollars.

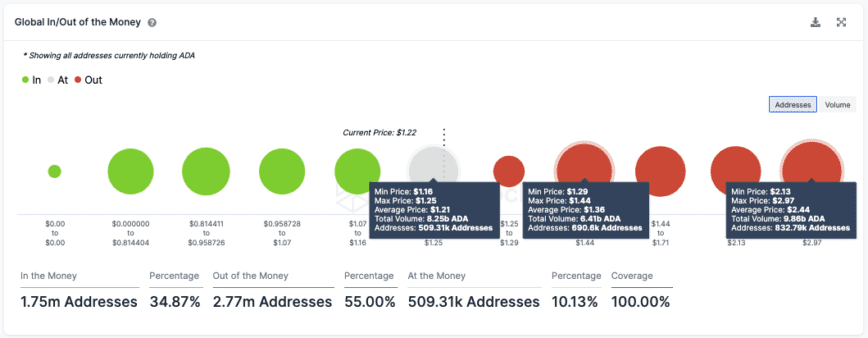

The rising interest in Cardano has helped prices reclaim the psychological $1 level as support. Now, transaction history shows that the next hurdle to overcome sits at $1.36, where more than 690,000 addresses had previously purchased over 6.41 billion ADA. Breaching this supply wall could help the so-called “Ethereum killer” surge toward $2.

It is worth noting that since whales have been increasing their holdings over the past few weeks, they have been able to build a formidable support floor at $1. Unless a black swan event happens, this demand barrier could prevent Cardano from incurring significant losses.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.