If you’re looking to buy cryptocurrencies in addition to just Bitcoin, you will need to have an account with a top altcoin exchange. Not only should your chosen exchange support your preferred altcoins, but it should offer low fees and a safe place to trade.

In this guide, we compare the best altcoin exchanges for 2022 through comprehensive reviews.

The Best Altcoin Exchanges for 2022

Below you will see a quick list of the best altcoin exchanges that are worth considering today.

- eToro – Overall Best Altcoin Exchange in the US for 2022

- Crypto.com – Great Altcoin Exchange for Earning Interest

- Binance – Popular Altcoin Exchange With Low Commissions

- Coinbase – Good Altcoin Exchange for Beginners

- Huobi – Top Altcoin Exchange for Diversification

- Webull – Invest in Crypto From Just $1 With This Altcoin Exchange

- ByBit – Altcoin Exchange Offering Derivative Markets

- Luno – User-Friendly Altcoin Exchange App

- Kraken – Trade Altcoins With Leverage

- Gemini – Safe and Regulated Altcoin Exchange Based in the US

You will find comprehensive reviews of the best altcoin trading platforms listed above in the sections below.

The Top 5 Altcoin Exchanges Reviewed

When searching for the best altcoin exchange in the market, we looked at the following factors:

- Regulation and trust

- Supported altcoin markets

- Availability of leverage and margin

- Fees and commissions

- Trading tools and features

- Minimum deposit requirements

- And more

We focus on the above factors in our reviews below – which cover the five best altcoin exchanges for 2022.

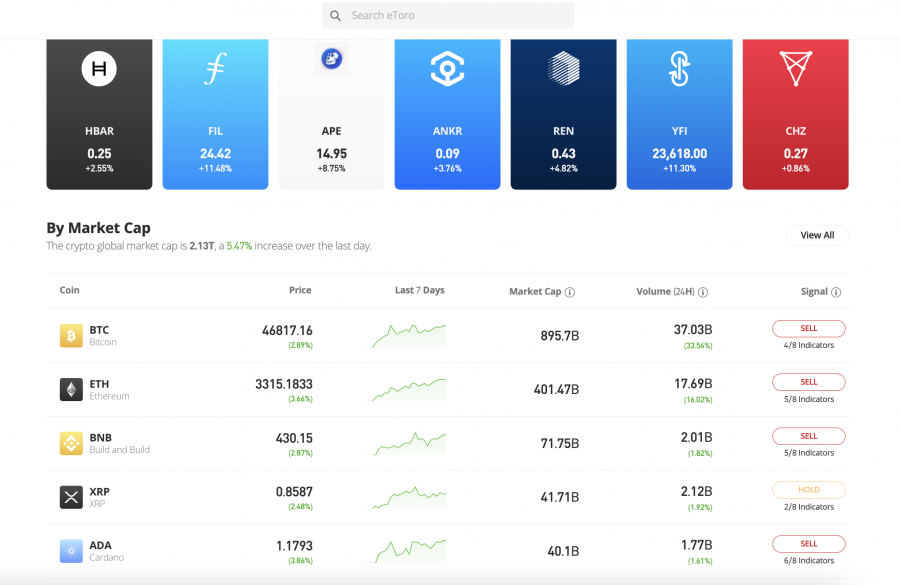

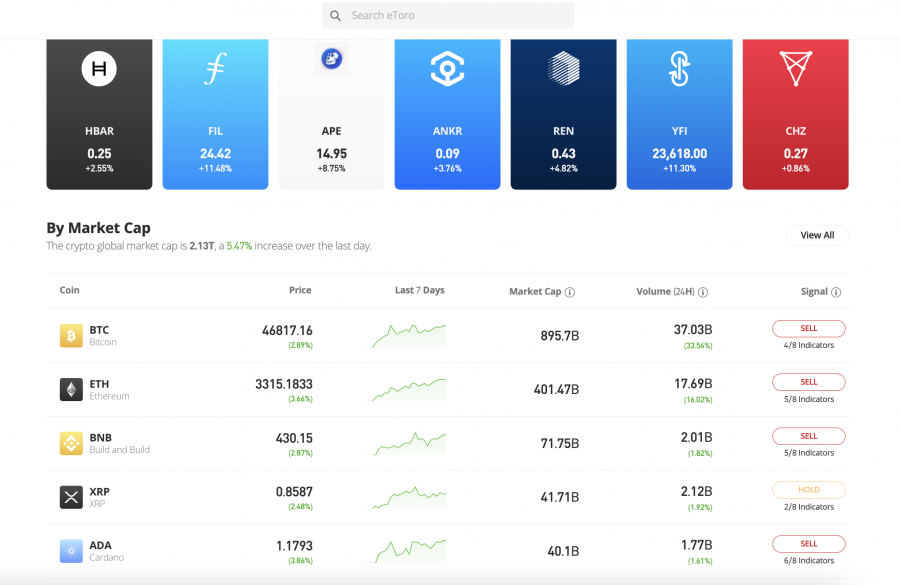

1. eToro – Overall Best Altcoin Exchange for 2022

To get started with the overall best altcoin exchange in the market right now – look no further than eToro. This platform is home to dozens of altcoins – all of which can be bought and sold from just $10 in a safe and secure way. Moreover, fees are super low here – especially when it comes to funding your account.

For instance, while many crypto exchanges charge in excess of 3% to deposit funds via a debit or credit card, US clients can use this payment method fee-free. Moreover, fee-free deposits are also available via Paypal, Skrill, ACH, domestic bank wires, and more. We also like that you only need to deposit $10 to open an account.

At eToro, some of the best altcoins to buy include Ethereum, BNB, Cardano, EOS, Dash, and Monero. You can also invest in DeFi coins like Decentraland, AAVE, Cosmos, and SushiSwap. Another way that you can buy cryptocurrency at eToro is via a smart portfolio. These are professionally managed by eToro, so you can invest in a basket of digital tokens passively.

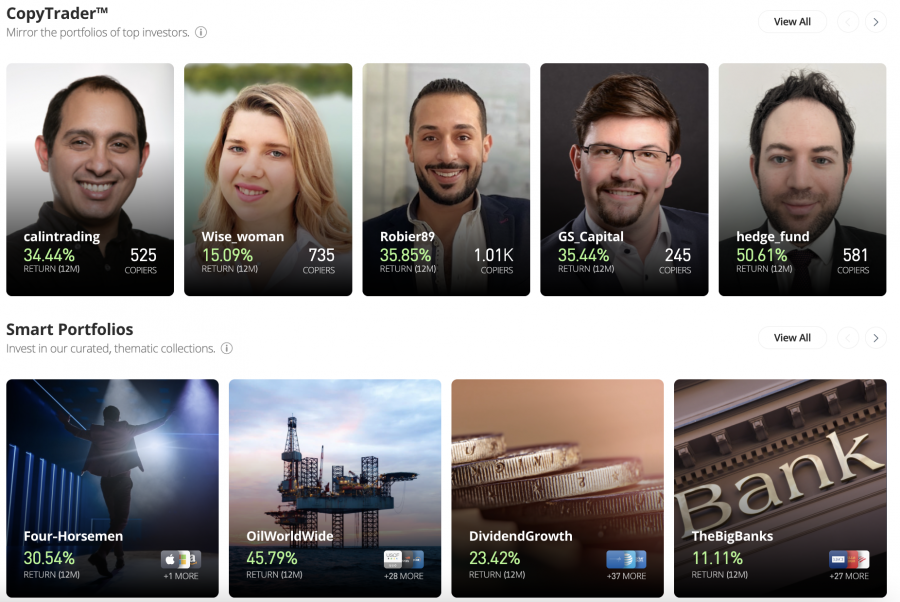

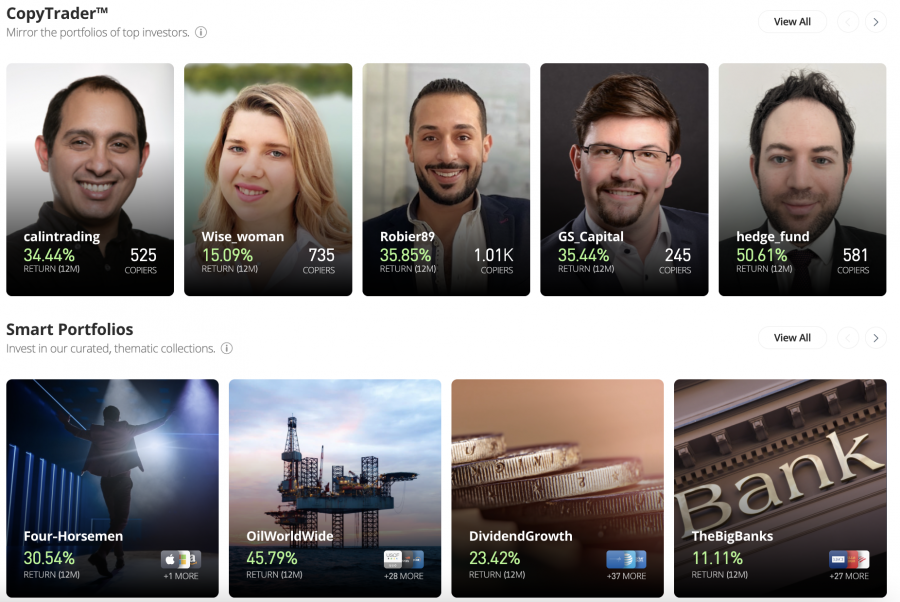

eToro is also one of the best copy trading platforms in the crypto space. For those unaware, this tool enables you to copy a seasoned crypto trader like-for-like, meaning – you can actively buy and sell digital currencies in a passive manner. In addition to crypto, eToro is also home to stocks and ETFs, as well as forex, commodities, and indices.

When it comes to security, eToro offers an in-house crypto wallet – so you don’t need to worry about your private keys being hacked. eToro also offers a mobile crypto wallet via an iOS and Android app. This connects to your main eToro account – so you can trade and store crypto in a seamless way.

However, perhaps the most important reason why we believe that eToro is the best altcoin trading platform in the market is that it is heavily regulated. Licensing at this exchange comes from the SEC, FCA, ASIC, and CySEC. eToro is also a member of FINRA. Ultimately, eToro’s regulated and low trading space is why more than 20 million people now use the platform to invest.

| Number of Altcoins | 58 |

| Debit Card Fee | FREE |

| Fee to Buy Ethereum | Spread + 1% |

| Minimum Deposit | $10 |

What We Like:

- Dozens of cryptocurrencies to trade

- Minimum deposit only $10

- Regulated by numerous top-tier entities

- Accepts credit/debit cards and PayPal deposits

- User-friendly trading app

- Very low fees

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Crypto.com – Great Altcoin Exchange for Earning Interest

Crypto.com is home to over 250+ altcoins – so if you’re looking to diversify with the best long term crypto investments, this exchange is well worth considering. We like the fact that accounts take just minutes to open and once you are verified – you can instantly buy crypto with a debit card. This will cost you a fee of 2.99% – although this is often waivered for new customers.

Crypto.com is home to over 250+ altcoins – so if you’re looking to diversify with the best long term crypto investments, this exchange is well worth considering. We like the fact that accounts take just minutes to open and once you are verified – you can instantly buy crypto with a debit card. This will cost you a fee of 2.99% – although this is often waivered for new customers.

Alternatively, you can reduce your costs by transferring funds via ACH or a domestic bank wire fee-free. When the funds arrive, you will then pay just 0.40% per slide. Crypto.com is also behind a popular altcoin – CRO, which gives you the opportunity to reduce your trading commissions.

We also found that Crypto.com is one of the best altcoin trading platforms for earning interest on your crypto holdings. Its crypto savings accounts support dozens of altcoins and yields are based on how long you lock the tokens away. This is a choice between one and three months or no lock-up period at all.

Moreover, the previously discussed CRO token allows you to increase your APY. Another popular feature offered by this top-rated altcoin exchange is its crypto loans. This allows you to raise funds at short notice without being forced to sell your crypto tokens. And finally, Crypto.com offers a secure mobile wallet app, as well as an NFT marketplace.

| Number of Altcoins | 250+ |

| Debit Card Fee | 2.99% (sometimes waivered for new customers) |

| Fee to Buy Ethereum | Up to 0.40% commission |

| Minimum Deposit | $20 when using ACH |

What We Like:

- Over 250+ crypto coins supported

- Accepts debit/credit cards and bank transfers

- Great reputation

- Offers crypto interest accounts and lending services

- Competitive fees

- Offers one of the best crypto credit cards on the market

Cryptoassets are a highly volatile unregulated investment product.

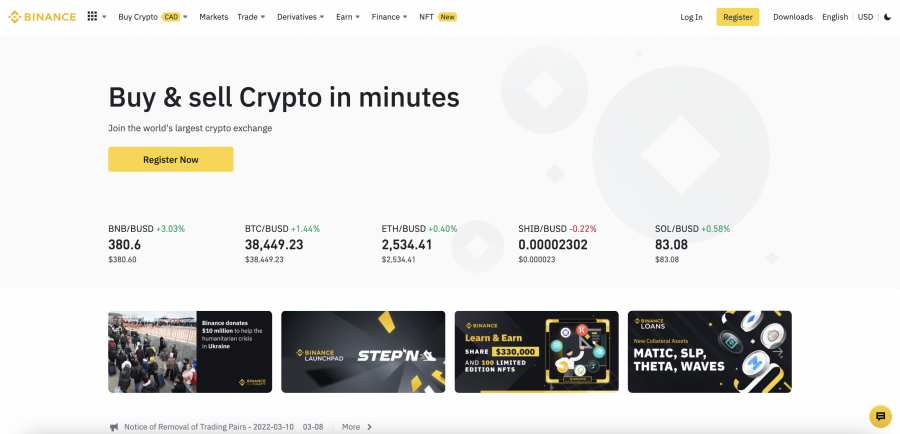

3. Binance – Popular Altcoin Exchange With Low Commissions

Binance is well known in the altcoin space, not least because the cryptocurrency exchange gives you access to hundreds of markets. Trading fees here are super-low too – as commissions start at just 0.1% per slide. In a similar nature to Huobi and Crypto.com, Binance offers reduced trading fees when you hold its native token – BNB. For more on how to buy Binance Coin you can read our guide here.

Binance is well known in the altcoin space, not least because the cryptocurrency exchange gives you access to hundreds of markets. Trading fees here are super-low too – as commissions start at just 0.1% per slide. In a similar nature to Huobi and Crypto.com, Binance offers reduced trading fees when you hold its native token – BNB. For more on how to buy Binance Coin you can read our guide here.

In terms of trading tools, Binance offers an advanced platform that allows you to perform in-depth technical analysis. Newbies can, however, buy altcoins via a simple interface with US dollars. Fees on deposits will depend on your chosen payment type. ACH and bank wires, for instance, are free of charge.

If you wish to use a debit or credit card, US clients will pay a fee of 4.5%. This is charged in addition to an instant buy fee of 0.5%. You can also deposit funds with Bitcoin – which typically takes 20 minutes to be credited to your Binance account. In terms of storage, Binance offers a decentralized wallet called Trust.

This also gives you access to DApps – such as Pancakeswap. Alternatively, beginners might prefer to keep their altcoins in their Binance web wallet. This is protected by two-factor authentication and IP address whitelisting. The latter means that if you try to log in from a new location, additional security checks are carried out.

| Number of Altcoins | 600+ (60 for US clients) |

| Debit Card Fee | 4.5% plus 0.5% buy fee |

| Fee to Buy Ethereum | Up to 0.10% commission |

| Minimum Deposit | Depends on payment method |

What We Like:

- Huge selection of markets

- Trading fees of just 0.10% per slide

- Supports debit cards

- Numerous wallet options

- Advanced trading tools

Cryptoassets are a highly volatile unregulated investment product.

4. Coinbase – Good Altcoin Exchange for Beginners

Next up on our list of the best altcoin exchanges for 2022 is Coinbase. This platform is arguably the best option for beginners. No prior experience is needed to buy altcoins here and you can easily open an account from the comfort of home. We also like that debit and credit cards are supported, although fees are expensive.

Although not quite as costly as Binance, debit/credit card payments are charged at 3.99%. This is also the case should you wish to buy altcoins with PayPal. With that said, ACH transfers are fee-free, so it’s only the standard commission of 1.49% that you will need to cover. Crypto deposits are supported too – so this is another payment method to consider.

In terms of supported altcoins, Coinbase typically focuses on medium and large-cap coins. Examples here include Ethereum, Shiba Inu, Dogecoin, Cardano, and USD Coin. Notable exceptions at Coinbase include XRP and BNB. Nevertheless, Coinbase is great for security too – as 98% of client tokens are kept offline in cold storage.

Two-factor authentication is mandatory at Coinbase, so that’s an extra layer of security on your funds. Once you have purchased your chosen altcoin tokens, you can store your digital assets in your Coinbase web wallet. You can also transfer them to the Coinbase non-custodial wallet, which is available as an iOS and Android app.

| Number of Altcoins | 50+ |

| Debit Card Fee | 3.99% |

| Fee to Buy Ethereum | 1.49% commission |

| Minimum Deposit | Depends on payment method |

What We Like:

- Great for beginners

- Support for debit/credit cards and Paypal

- Good selection of altcoins

- Top-rated security features

Cryptoassets are a highly volatile unregulated investment product.

5. Huobi – Top Altcoin Exchange for Diversification

![]()

![]() Huobi is one of the best altcoin exchanges to consider if you are looking to diversify across the best DeFi coins. At this exchange, you will find hundreds of altcoins across a variety of trading markets. For instance, most investors at Huobi will look to access spot trading markets.

Huobi is one of the best altcoin exchanges to consider if you are looking to diversify across the best DeFi coins. At this exchange, you will find hundreds of altcoins across a variety of trading markets. For instance, most investors at Huobi will look to access spot trading markets.

This typically consists of altcoins paired with USDT. You can, however, also trade altcoins against other digital currencies. If you have a higher appetite for risk, you can also trade altcoins with leverage. Experienced investors at this top-rated altcoin exchange will perhaps consider trading crypto derivatives. This covers a range of futures markets – all of which can be accessed on margin.

When it comes to fees, Huobi charges an entry-level commission of 0.20% per slide – which is very cost-effective. You can reduce your trading commissions when you hold the Huobi Token (HT). For example, holding more than 10 HT will amount to a reduction of 10%, while over 100 HT reduces your fees by 20%.

Huobi is also popular with investors that wish to earn interest on their altcoin investments. In fact, you’ll have access to industry-leading APYs, with many altcoins yielding hundreds of percent in interest per year. Lock-up terms typically average 7-14 days. Finally, Huobi does allow you to buy altcoins with a debit/credit card – but this will cost you up to 3.9% in fees.

| Number of Altcoins | 400+ |

| Debit Card Fee | Up to 3.9% |

| Fee to Buy Ethereum | Up to 0.20% commission |

| Minimum Deposit | Depends on payment method |

What We Like:

- Low trading fees

- Numerous derivatives markets offered

- Huge range of cryptos to trade

- Crypto savings accounts offered

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

The Best Altcoin Exchanges Compared

Our key findings of the best altcoin exchanges for 2022 can be found in the comparison table below.

| Altcoin Exchange | Debit Card Fee | Fee to Buy Ethereum | Minimum Deposit | |

| eToro | 58 | FREE | 1% plus market spread | $10 |

| Huobi | 400+ | Up to 3.9% | Up to 0.20% |

Depends on payment method |

| Crypto.com | 250+ | 2.99% | Up to 0.40% | $20 with ACH |

| Binance | 600+ (60+ for US clients) | 4.5% + 0.5% | Up to 0.10% |

Depends on payment method |

| Coinbase | 50+ | 3.99% | 1.49% |

Depends on payment method |

What is an Altcoin Exchange?

An altcoin exchange gives you access to cryptocurrencies other than just Bitcoin. Although there are over 18,000 altcoin projects in circulation, top-rated exchanges in this space typically limit their offering to a few hundred. After all, many altcoins carry a tiny market capitalization and attract little interest from serious crypto investors.

The best altcoin exchanges that we reviewed today operate in a similar manner. This is because you will first be required to open an account and deposit some funds. If opting for a deposit in US dollars, then you also need to provide the altcoin exchange with some government-issued ID.

All altcoin trading exchanges – irrespective of the services offered, charge fees. This means that you will pay a commission on each buy and sell order that you place. In most cases – with eToro being the exception to the rule as per our market research, you will also need to pay deposit and withdrawal fees on USD payments.

How to Choose the Best Altcoin Trading Platform for You?

According to CoinMarketCap, there are just over 300 altcoin exchanges in the market. Naturally, this can make it challenging to know which exchange is a good fit for you.

In the sections below, we help clear the mist by discussing the most important considerations to make when choosing the best altcoin exchange for your goals.

Regulation

We mentioned above that there are now over 300 altcoin exchanges to choose from. However, the one thing that most altcoin exchanges have in common is that they are not regulated by a financial authority.

This means that you can never be sure that your funds are safe or that you are trading in fair market conditions. With that said, the good news is that there is a selection of altcoin trading exchanges that do things by the book – meaning that they have regulatory oversight.

For example, eToro is licensed by the SEC and registered with FINRA – as is Coinbase. You then have Gemini, which holds a license with the New York State Department of Financial Services.

Tradable Altcoins

It’s likely that you have a good idea of which altcoins you wish to actively trade. If so, you should head over to your chosen altcoin exchange to ensure that it supports your chosen tokens.

If you’re unsure which altcoin markets interest you – here’s the lowdown.

Altcoin-USD Pairs

When you use an exchange that is approved to offer crypto services to US clients, you will be able to trade altcoins against the US dollar.

For example, at eToro, you can trade the likes of Ethereum, EOS, Cardano, AAVE, Dogecoin, Shiba Inu, and dozens of other altcoins directly against the USD. This makes it far easier to determine how your altcoin portfolio is performing.

Altcoin-USDT Pairs

If you come across an exchange that isn’t adequately licensed, then you will likely notice that altcoins are traded against USDT – which is the ticker symbol for Tether.

For those unaware, Tether is a stablecoin backed by a centralized entity – meaning that it can and frequently does issue new tokens as and when it sees fit.

The general consensus is that although Tether claims that each and every USDT token is backed 1-for-1 by US dollars, this actually isn’t the case.

Altcoin-Cross Pairs Pairs

If you’re an experienced trader that craves higher levels of volatility, then you might also consider an exchange that offers altcoin- cross pairs.

In a nutshell, these are pairs that contain two altcoins, meaning you won’t be trading crypto against the US dollar. For example, the pair ALGO/BNB would see you trade the future value of Algorand against BNB.

Fees

The best altcoin exchanges that we reviewed today offer competitive fees across the board. However, fees can and will vary not only between exchanges – but depending on what services you require.

Payment Fees

You might have noticed from our altcoin exchange reviews that deposit fees will vary based on your chosen payment method. Almost always – the most expensive payment method is a debit/credit card.

At Coinbase, this costs 3.99% per transaction. At Binance, this is even more expensive at 4.5% – plus a 0.5% buy fee. eToro, on the other hand, charges nothing on debit/credit card deposits made in US dollars.

Many altcoin exchanges also allow you to deposit funds via ACH or domestic bank wire. In most cases, no fees are charged with traditional banking methods – but the payment might take a few days to arrive.

Crypto.com is the exception here – as the popular altcoin exchange permits instant and free ACH deposits.

Commission Fees

Commission fees are related to trading. That is to say, on each buy and sell order that you place – you will pay a commission to your chosen altcoin exchange.

For example:

- Crypto.com charges an entry-level commission of 0.40% per slide

- If you buy $2,000 worth of your preferred altcoin, you will pay just $8 in commission to enter the market

- If you cash out your altcoin investment when it is worth $3,000 – your commission amounts to just $12

In comparison, Coinbase charges a commission of 1.49%. This means that in the above example, your buy and sell order would result in a commission of $29.80 and $44.70 respectively.

Therefore, the importance of choosing an altcoin exchange that charges low commissions is imperative.

Transfer Fees

The best altcoin exchanges in the market allow you to withdraw your crypto tokens to a private wallet. If this is something that you are planning to do yourself, it is important to check what transfer fees are in place.

In the vast majority of cases, this will depend on the altcoin that you are looking to withdraw.

- For example, at Binance, you will pay a fee of 0.002 ETH to withdraw Ethereum to a private wallet.

- Based on Ethereum prices at the time of writing, this amounts to a withdrawal fee of approximately $6.60.

- This is actually quite expensive if you plan on withdrawing small quantities.

At eToro, however, the altcoin exchange charges a withdrawal fee of 0.5%. This works out much cheaper – especially on smaller withdrawals.

Wallet

All of the altcoin exchanges that we reviewed today offer a native crypto wallet. However, the wallet offered by each altcoin exchange varies in terms of security, fees, supported tokens, and device type.

For example, eToro offers the choice of two wallets. The first way of storing your altcoins is to leave them in your eToro web wallet – which is super convenient. Alternatively, you can transfer your tokens to the eToro wallet app.

Both Coinbase and Crypto.com offer similar options – as does Binance. The latter, however, also offers a decentralized wallet called Trust – which gives you access to altcoins trading on the Binance Smart Chain.

Liquidity

Don’t forget about liquidity when choosing the best altcoin trading platform for your goals. For those unaware, liquidity refers to the amount of capital available on a particular market at your chosen exchange.

If there isn’t enough liquidity available, then this means that you will be trading at unfavorable prices. This will be a major issue when it comes to cashing out, as you will need to sell your altcoins at a much lower price in order to find a seller.

All of the altcoin exchanges that we reviewed today are home to huge levels of liquidity – so you’ll never struggle to enter or exit a trade favorably.

Tools & Features

Another disparity that we came across when compiling our list of the best altcoin exchanges for 2022 was with regard to trading tools and features.

Notable tools and features to look for include the following:

Chart Analysis

If you’re thinking about trading altcoins on a short-term basis with the view of taking advantage of ever-changing pricing swings, you’ll need an exchange that offers chart analysis tools.

This might include technical indicators, real-time pricing data, and perhaps integration with TradingView.

Copy Trading

We like the copy trading tool offered by eToro – which allows you to actively trade altcoins passively. The main concept here is that after you have chosen a successful crypto trader to copy, all future positions will be mirrored in your own account.

The amount being staked will be proportionate to your investment into the copy trader – which requires a minimum capital outlay of just $200. You can stop copying your chosen investor at any given time and no additional fees apply.

Altcoin News and Market Insights

Top altcoin exchanges will provide up-to-date news and market insights on leading coins. This will allow you to keep tabs on any important developments regarding specific altcoins – such as new partnerships or endorsements.

For example, when Elon Musk announced that he personally owned Dogecoin tokens – the altcoin went on a rapid upward pricing swing.

Alerts

The altcoin markets move at a rapid pace – so it’s wise to choose an exchange that offers real-time alerts. For instance, you might want to be notified when Ethereum surpasses $4,000.

Pricing alerts are best obtained via a mobile app – as the notification will be sent straight to your smartphone.

Payment Methods

Unless you are looking to deposit Bitcoin, you will need to fund your altcoin investments with cash.

As mentioned earlier, all of the altcoin exchanges discussed on this page support debit/credit card payments and bank transfers. eToro and Coinbase go one step further by also accepting deposits via PayPal.

In addition to fees, check how long the altcoin exchange takes to credit deposits for your preferred payment method.

Customer Service

Top altcoin exchanges in 2022 offer a great level of customer support. Live chat is the preferable contact method here, as you will be able to receive a response in real-time.

Phone support is somewhat rare in this space, as altcoin exchanges accept customers from around the globe. We also prefer exchanges that offer customer support 24/7.

Mobile App

Finally, you should also check to see whether or not your chosen provider offers an altcoin exchange crypto app that is compatible with your smartphone device.

In most cases, altcoin exchange apps develop an application that is fully optimized for both iOS and Android.

In downloading the app offered by your selected exchange, you can buy and sell altcoins no matter where you are, and thus – you’ll never miss a trading opportunity.

How to Use an Altcoin Exchange

If you’ve never used an altcoin exchange before – we are going to walk you through the required steps with eToro.

You’ll learn how to:

- Open an account

- Verify your identity

- Deposit US dollars

- Buy an altcoin from just $10

All of the required steps can be completed in less than five minutes from start to finish.

Step 1: Open an eToro Crypto Account

You can open an account with eToro by providing the altcoin exchange with some personal information. You will also need to choose a username and password – which you will use to log into your account moving forward.

eToro will also ask you to enter your social security number alongside some brief information about your prior trading experience.

Step 2: Upload ID

To get your eToro account verified instantly, upload a copy of your driver’s license, state ID, or passport.

Moreover, for proof of residency, upload a document that contains that name and address. This can be a bank statement or an electricity bill, for example.

Step 3: Deposit Funds

Now you will need to make a deposit so that you can trade altcoins. The minimum deposit for new customers from the US is just $10.

You can choose from a variety of payment methods, albeit, most US clients opt for a debit/credit card. All payment methods are processed fee-free when the deposit is made in US dollars.

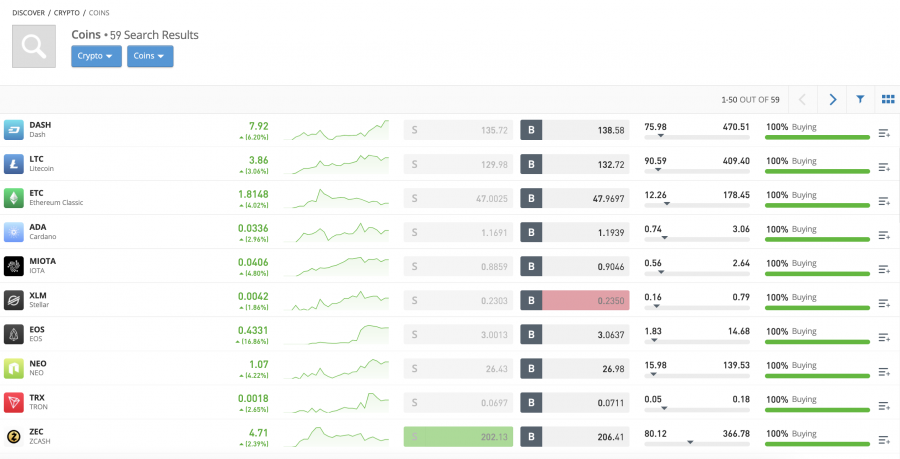

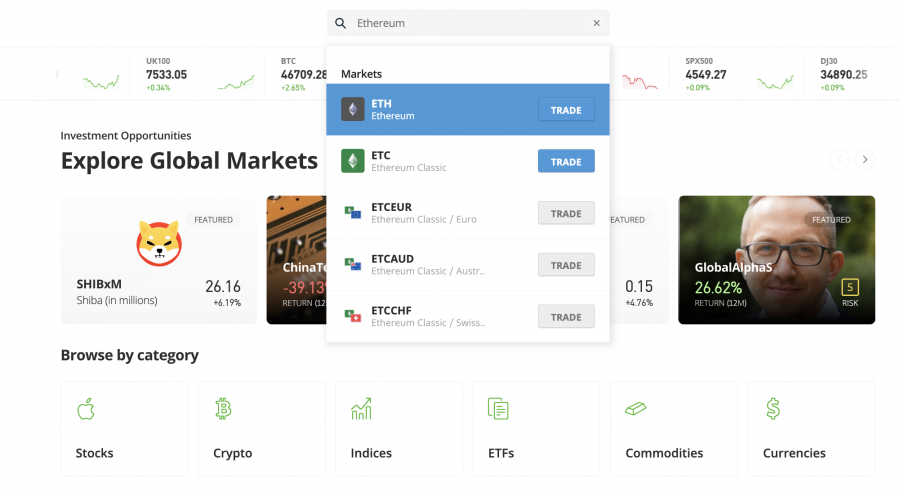

Step 4: Search for Altcoin

Now you have a funded eToro account, you click on the ‘Discover’ button followed by ‘Crypto’. This will then bring up the full list of altcoins that eToro supports.

If you already know which altcoin you want to add to your portfolio – you can type in the name of the token into the search box.

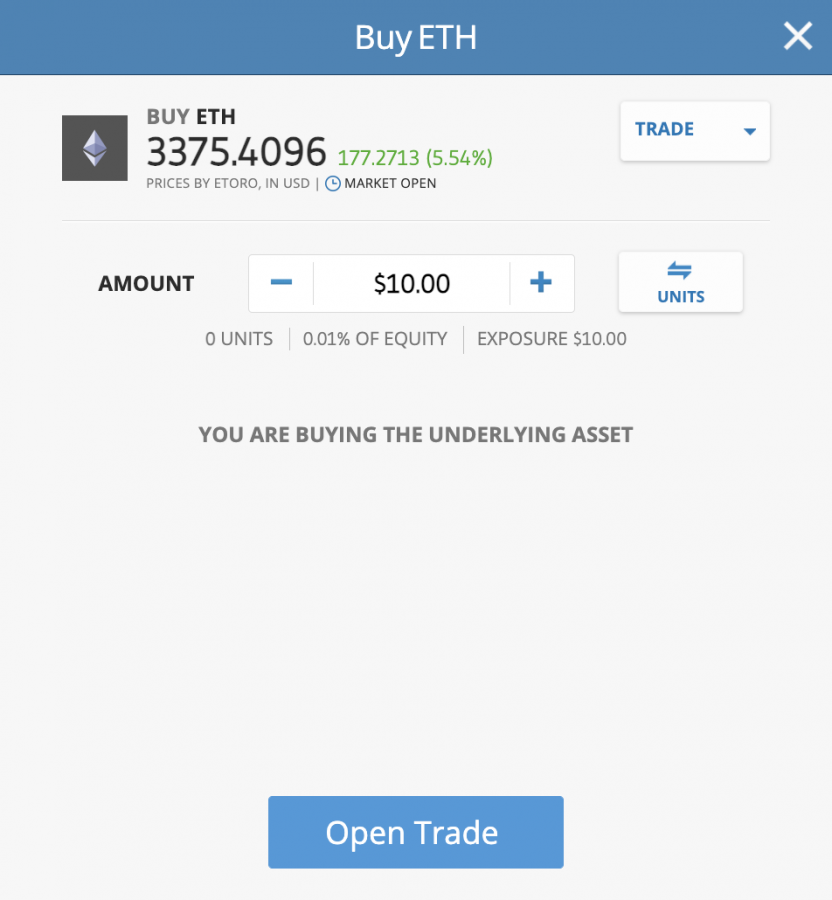

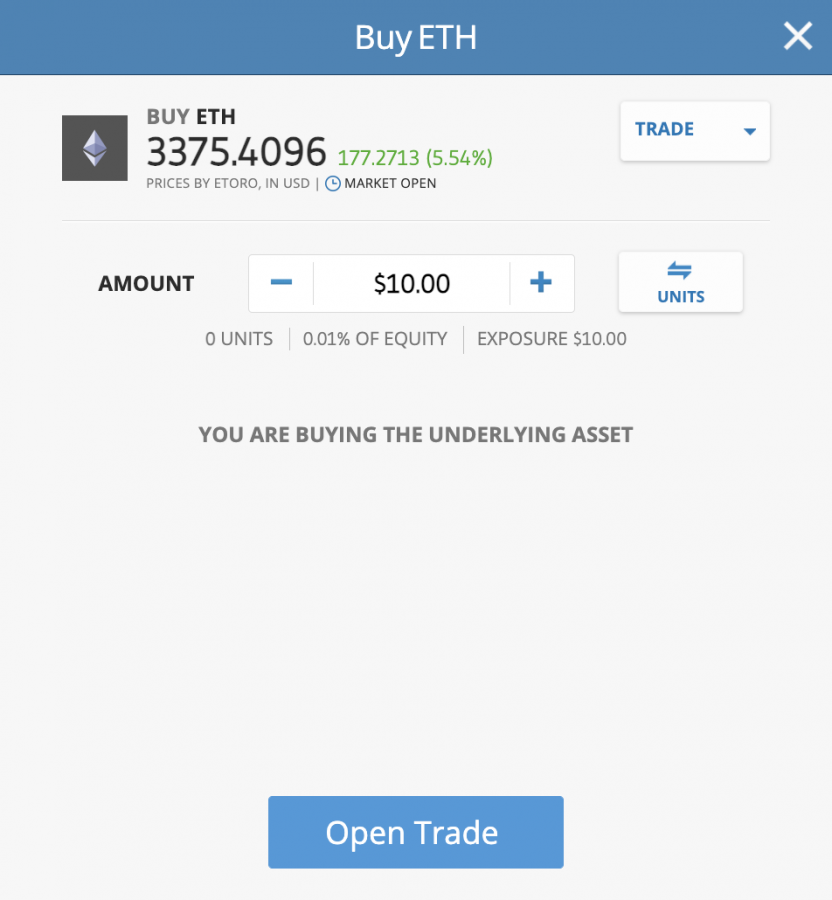

Step 5: Buy Altcoin

Now you will need to place a buy order on your chosen altcoin token. In the ‘Amount’ box, you will need to enter your stake.

The minimum at eToro is just $10 – which is especially useful for high-value altcoins like Ethereum. To complete your altcoin investment – press the ‘Open Trade’ button.

Conclusion

The best altcoin exchanges for 2022 have been reviewed on this page. We’ve focused on specific core metrics – such as safety, commissions, trading tools, customer service, and supported altcoin markets.

If you’re looking to trade altcoins right now – consider the eToro platform. Put simply, eToro enables you to deposit US dollars with a debit/credit card fee-free, which you can then use to trade altcoins in a user-friendly environment.

Cryptoassets are a highly volatile unregulated investment product.

Frequently Asked Questions on Altcoin Exchanges

What is an altcoin exchange?

An altcoin exchange is an online platform that allows you to buy cryptocurrencies other than just Bitcoin.

What is the best altcoin exchange for US traders?

Our research findings concluded that eToro is the overall best altcoin exchange USA. In a nutshell, the platform supports dozens of leading altcoins, the minimum deposit amounts to just $10, and you’ll benefit from fee-free debit/credit card payments.

Which exchange has the most altcoins?

Binance is likely home to the largest number of altcoins. The exchange offers 600+ different altcoins across over 1,000 markets. However, US clients only have access to 60+ altcoins at Binance.

What is a P2P altcoin exchange?

In using a P2P exchange, you will be trading altcoins directly with other market participants – as opposed to going through a centralized platform.